Crypto and the Kafkaesque | Opinion

06/04/2024 11:23

In this week’s #hearsay column, Dorian Batycka marks the 100-year anniversary of the Bohemian writer Franz Kafka’s death on June 3, 1924, taking you on a literary journey through the most “Kafkaesque” moments in all of crypto.

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

In this week’s #hearsay column, Dorian Batycka marks the 100-year anniversary of the Bohemian writer Franz Kafka’s death on June 3, 1924, taking you on a literary journey through the most “Kafkaesque” moments in all of crypto.

Imagine a world where you are ensnared in a web of bewildering and illogical situations, powerless against faceless bureaucracies that wield omnipotent and indifferent authority. This nightmarish distortion of reality is the essence of the term “Kafkaesque,” derived from the German-speaking Bohemian writer Franz Kafka. Through seminal works like “The Trial” (1914), “The Castle” (1922), and “The Metamorphosis” (1912), Kafka’s narratives have become foundational texts in modern literature, depicting protagonists trapped in existential anxiety and futility. Strikingly, these Kafkaesque themes find resonance in the chaotic and often dystopian world of cryptocurrency, where the promise of financial liberation is fortuitously often overshadowed by paradox and disillusionment.

Franz Kafka wrote “A Hunger Artist” in 1922 and published it in 1924, the same year he passed away from a brutal condition that made him die of starvation due to complications from laryngeal tuberculosis. Kafka’s final story centers on a professional hunger artist who fasts for extended periods as a form of art, attracting audiences fascinated by his self-imposed suffering. Despite such dedication, the hunger artist becomes increasingly marginalized and forgotten as public interest wanes, leading to his eventual demise.

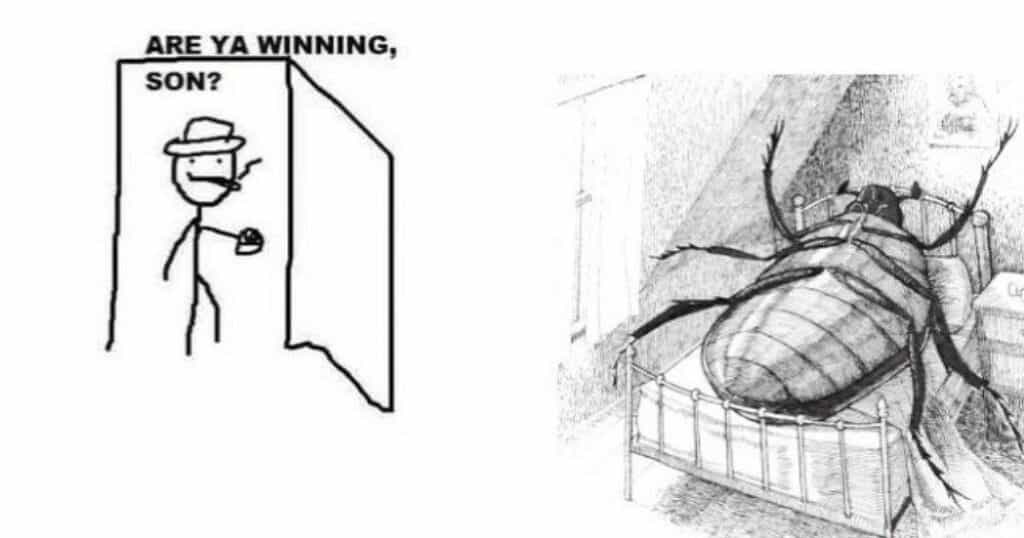

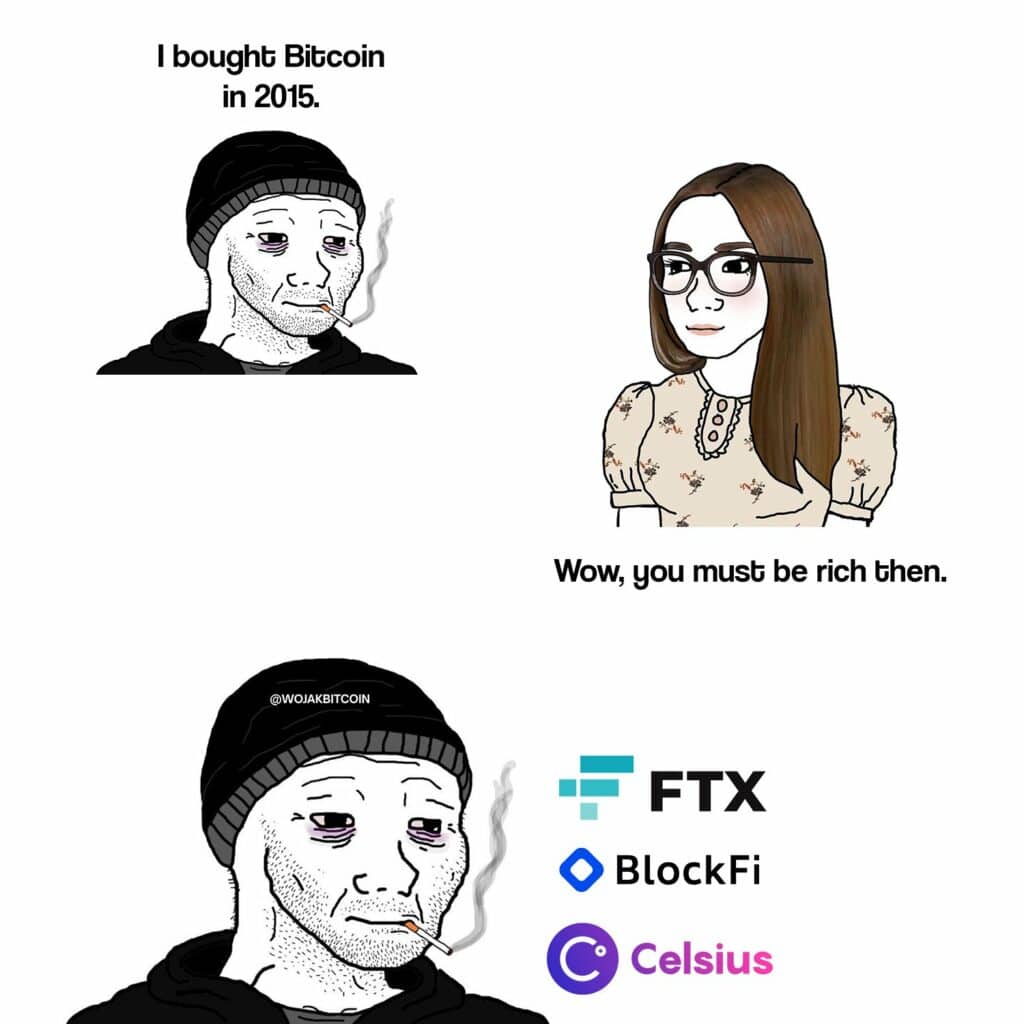

It’s a situation that mirrors the experience of crypto’s most titular figure: the wojak. The proverbial McDonald’s night manager whose incessant pursuit of quick wealth becomes an unhealthy obsession, akin to gambling. With wojak consumed by the volatile and often isolating and crippling failure of crypto trading and investment, he finds himself constantly in profound loss and disillusionment. What hunger was to Kafka’s artist, cheap packets of ramen noodles are to the toiling wage cuck hoping to get rich on a Solana meme coin. What could be more utterly Kafkaesque?

Satoshi Nakamoto as Joseph K.

Self-revelations aside, let’s shift gears to conjure the term “Kafkaesque” not with the wojak loser, but with the OG of crypto himself, Satoshi Nakamoto. In Kafka’s “The Castle” (1922), the protagonist K. struggles against an opaque and inaccessible bureaucratic authority; similar to Satoshi himself, Kafka speculates on the often duplicitous nature of governments, remarking: “You mustn’t believe everything that officials say,” adding, “I have my rights, and I shall get them.”

In “The Trial,” Kafka describes the arrest of the main character. “Someone must have been telling lies about Joseph K., he knew he had done nothing wrong but, one morning, he was arrested.” Again, one is here confronted with the brutal reality of a system bearing consequences on someone born to change it, i.e., Satoshi, or even CZ, for that matter. The lack of current regulatory clarity in crypto, from legislation being proposed in the EU, MiCA, has only created widespread confusion on the continent, through to the befuddling situation around legislation in the United States, where things have not fared much better, with both Joe Biden and Donald Trump also recently U-turning on the crypto bandwagon.

KafkaCrypto: towards a new theory of technology and doomer

Lastly, think about the idea of paradox itself, perhaps the pinnacle of all Kafkaesque situations. It’s based on a supposition that two seemingly different realities can be true at once. While cryptocurrency was designed to circumvent traditional financial systems and their regulatory frameworks, as the market has grown, so too has the demand for regulation to prevent fraud, protect consumers, and ensure market stability, often under the guise of anti-money laundering (AML) initiatives that exist in stark contrast to privacy-focused tools like Monero or Tornado Cash.

Yet, on top of this reality, a paradoxical situation has emerged: where the decentralized crypto world ethos has increasingly brushed up against the centralized systems that crypto purported to disrupt. Look no further than China’s or Russia’s recently stated that they would embrace central bank digital currencies (CBDCs). Together with omnipresent state surveillance and control, the paradoxical reality of having crypto in the hands of a tyrannical government, while at the same time allowing for encrypted financial freedom, is indeed peak Kafkaesque.

“It’s only because of their stupidity that they’re able to be so sure of themselves,” Kafka concluded in The Trial, perhaps his most seminal work on the illusory nature of justice. It is perhaps in some ways related to the notion of effective altruism prevalent in modern echelons of crypto theory, and famously core to the convinced fraudster Sam Bankman Fried’s worldview, i.e., scamming for the greater good theory of crypto capitalism.

At its heart, cryptocurrency advocates for financial autonomy and individual control over one’s economic identity. Yet, as we mark the centennial since Kafka’s death, it’s clear that the crypto industry has taken on many Kafkaesque qualities. From the mysterious figure of Satoshi Nakamoto to the lowly wojak, through to the unsettling reality of crypto scams and the paradox of decentralization and regulation, the illusory sense of autonomy stands as a remarkable bellweather to how deeply problematic crypto has and continues to be. As Kafka once wrote:

“Every revolution evaporates and leaves behind only the slime of a new bureaucracy.”