Ethereum exodus: Big ETH players gearing up for post-ETF rally?

06/05/2024 00:00

Ethereum [ETH] market performance has shown remarkable resilience in the face of recent fluctuations

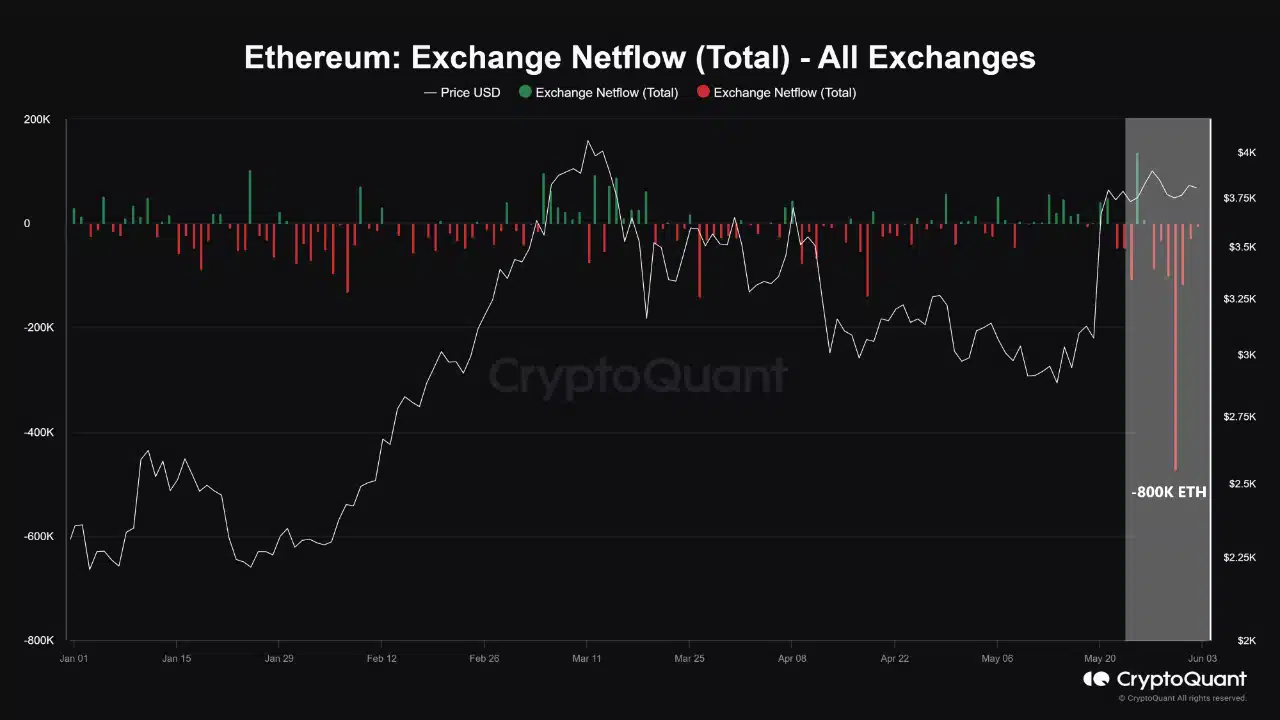

- 800,000 ETH (worth $3 billion) were withdrawn from exchanges post-ETF approval.

- Large investors and institutions may be positioning for a bullish future.

Ethereum’s [ETH] market performance has shown remarkable resilience in the face of recent fluctuations, maintaining a stable price level below the $4,000 mark despite slight volatility.

Over the past week, Ethereum’s value oscillated between $3,800 and $3,700, closing recently at approximately $3,768.

This relatively steady state, characterized by a modest 2.1% decline over the week and a 1.1% dip in the last 24 hours, might seem uneventful at first glance.

However, this could be indicative of a more profound dynamic at play within the crypto market.

The recent calm in Ethereum’s price coincides with significant developments in the regulatory landscape and market structure, particularly with the U.S. Securities and Exchange Commission’s (SEC) approval of the Ethereum Spot Exchange-Traded Fund (ETF).

This regulatory milestone has set off a notable reaction in the crypto exchanges, leading to a substantial shift in Ethereum holdings.

Whale movements and market impact

Post-ETF approval, Ethereum saw a dramatic increase in activity, with around 800,000 ETH, valued at nearly $3 billion, being withdrawn from exchanges within just eight days.

This mass exodus of Ethereum from exchanges mirrors a similar pattern observed previously with Bitcoin following its ETF approvals, suggesting a strategic positioning by investors in anticipation of heightened demand.

These withdrawals were highlighted by Cryptoquant’s analysis, which pointed to a possible orchestrated move by institutional players preparing to cater to their clients’ needs in the wake of the ETF launch.

The implications of such significant market movements are quite profound.

Crypto analyst Burak Kesmeci, reporting on the CryptoQuant QuickTake platform, speculated that either large-scale investors (“whales”) or institutions might be gearing up for a bullish future for Ethereum post-ETF.

The massive outflow, according to Kesmeci, is likely to positively impact Ethereum’s price in the medium term, as these large holdings reduce available market supply, potentially leading to price increases as demand continues to rise.

Investor appetite for ETH grows, but what do fundamentals say?

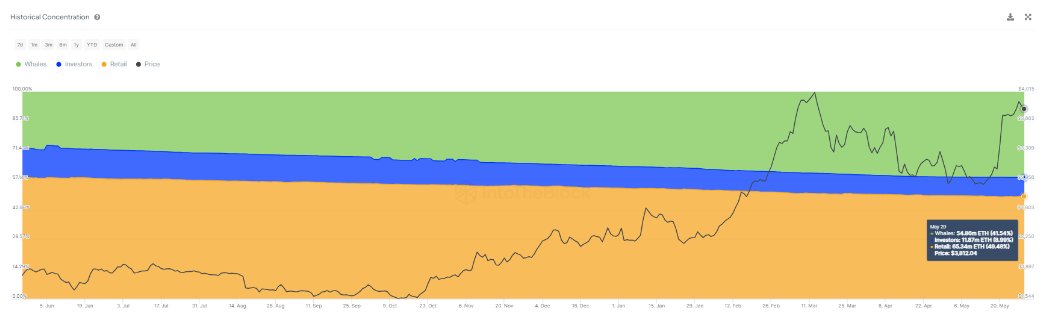

Supporting this analysis, data from IntoTheBlock revealed a growing concentration of Ethereum holdings among large investors.

As of 31st May, 2024, 41% of Ethereum wallets held more than 1% of total circulation, a significant increase from earlier in the year. This concentration suggests a growing confidence among significant stakeholders in Ethereum’s long-term value.

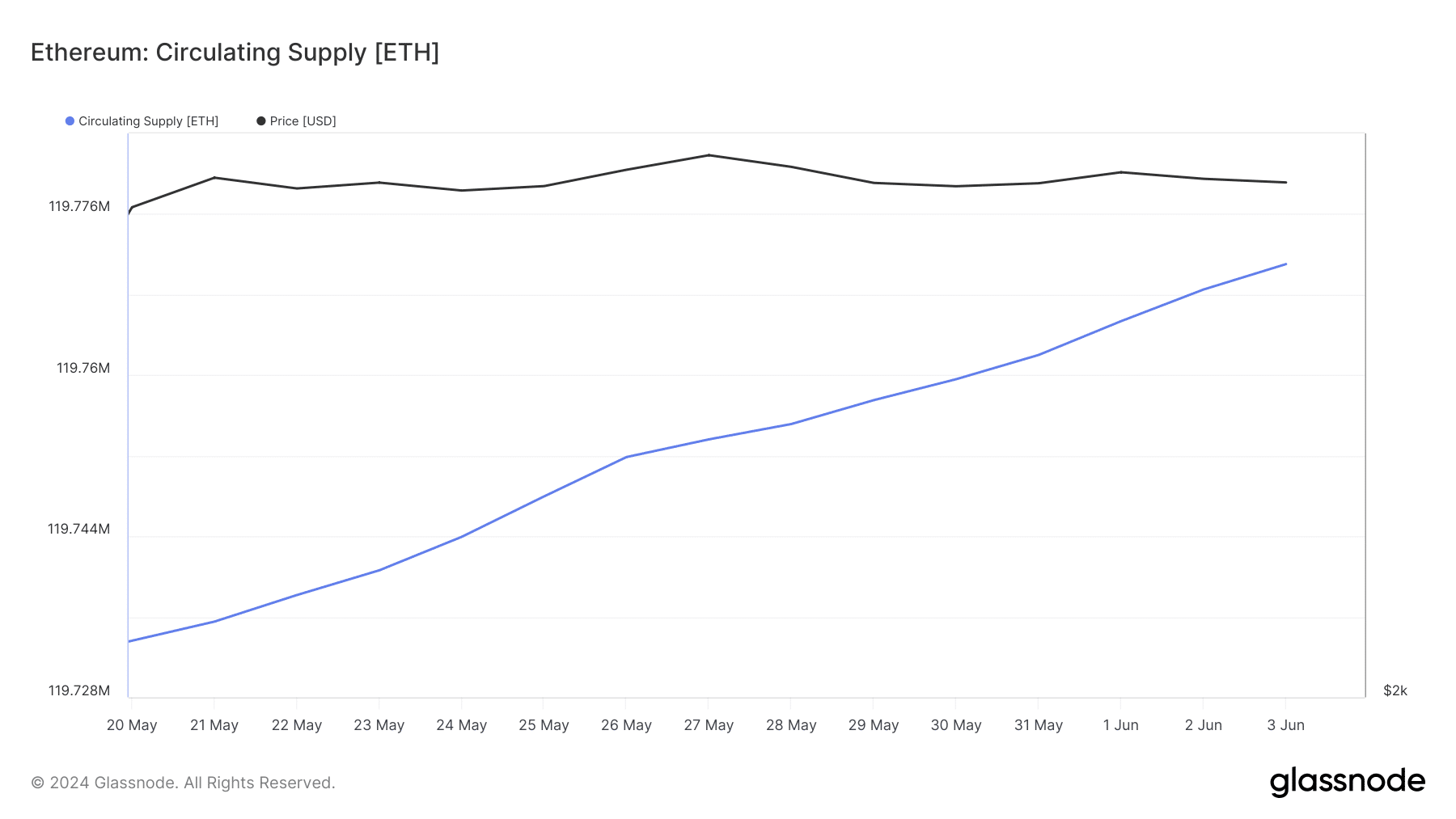

However, it’s essential to consider the broader market dynamics. Despite the potential for a supply squeeze, the overall circulating supply of Ethereum has continued to rise, indicating that not all large holders are in accumulation mode.

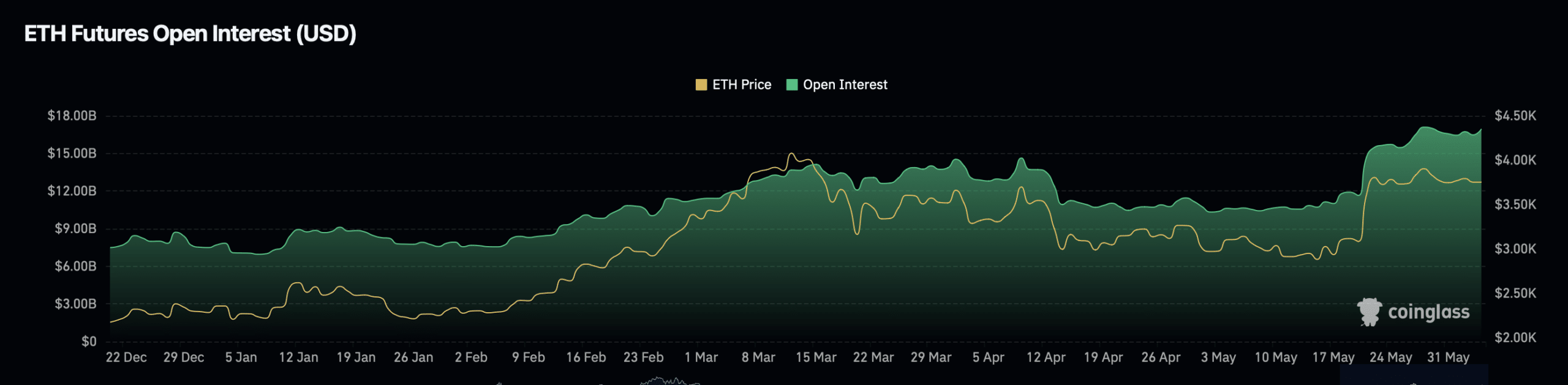

Furthermore, trading metrics such as open interest and trading volume on futures markets have shown substantial increases, suggesting a robust and active trading environment that could influence Ethereum’s price trajectory.

In the past 24 hours, Ethereum’s open interest has seen a significant uptick, rising by nearly 3% to a valuation of $17 billion. This surge has also boosted open interest volume, which has increased by approximately 15% to $21.40 billion.

Is your portfolio green? Check the Ethereum Profit Calculator

Meanwhile, an analysis of Santiment’s data by AMBCrypto reveals that holders of 0.01-10 ETH have reduced their overall ETH holdings, while addresses with more than 10 ETH have also sold off a portion of their assets.

This profit-taking behavior, observed among both retail investors and whales, has not been intense enough to negatively impact prices.