Bitwise: US Political Shift Could Be the Alpha for Crypto to Reach New All-Time Highs

06/05/2024 15:09

US political shifts and regulatory clarity could unlock trillions in crypto investments, according to Bitwise's Matt Hougan.

In recent weeks, the US political environment has shown signs of shifting its stance towards the crypto industry. Bitwise’s Chief Investment Officer (CIO), Matt Hougan, believes this evolving attitude could bring the crypto market to new all-time highs.

Despite the lack of widespread attention outside the crypto community, this political shift may present a significant opportunity, or “alpha,” for investors. Alpha is a term in the crypto market that refers to information that has the potential to give a trader an edge and outperform the market.

Bitwise: Regulatory Clarity Could Bring Crypto to $20 Trillion Markets

Hougan remarks that a shift started on May 8, when the House voted for H.J. Res. 109, repealing Staff Accounting Bulletin No. 121 (SAB 121). SAB 121 is the US Security and Exchange Commission (SEC) rule that prevents large banks from custodying crypto assets.

This bipartisan support extended to the Senate. Although President Joe Biden vetoed the bill, this passage marked the first positive legislative action for crypto in US history.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

On May 20, the House voted for the Financial Innovation and Technology for the 21st Century Act (FIT21) bill. This comprehensive crypto legislation grants primary oversight to the Commodity Futures Trading Commission (CFTC). However, both SEC Chair Gary Gensler and President Joe Biden expressed their opposition to the FIT21 bill.

This momentum continued with the SEC approving filings for spot Ethereum (ETH) exchange-traded funds (ETFs). The decision is surprising, given Gensler’s stance toward the FIT21 bill. The approval, however, came with the condition of removing staking aspects.

Hougan sees the overall positive shift in Washington’s attitude holds significant potential for growth. He thinks regulatory uncertainty has been a major barrier for financial advisors managing an estimated $20 trillion in wealth. According to Bitwise, 64% of advisors cited this uncertainty as the primary reason for limited crypto exposure in their portfolios.

“Imagine, then, how much of that $20 trillion will go into crypto when the biggest barrier gets lifted,” Hougan outlined.

Furthermore, Hougan uses major Wall Street banks, such as The Bank of New York, Nasdaq, and State Street Bank, as examples. He notes that these banks have been hesitant or slow to enter the crypto space due to regulatory concerns. However, with regulatory clarity, they could now fully embrace crypto, which would significantly boost the market.

Crypto is a Bipartisan Issue

Experts believe the upcoming election heavily influences the Biden administration’s changing stance towards the crypto industry. BeInCrypto reported that several key industry figures have urged the community to support pro-crypto candidates.

Major entities, including Ripple and Coinbase, have shown their support by donating significantly to Fairshake, a digital assets-friendly Super Political Action Committee (PAC). With such movements increasing, the crypto community has a unique opportunity to influence the political environment.

Moreover, former President Donald Trump, who is also running in the presidential election, has strategically targeted crypto-focused campaigns. Trump expressed his comfort with crypto and accepted donations in cryptocurrencies.

He also pledged a more welcoming approach to the industry, criticizing current US regulatory measures as hostile. Ultimately, he urged those who favor crypto to vote for him.

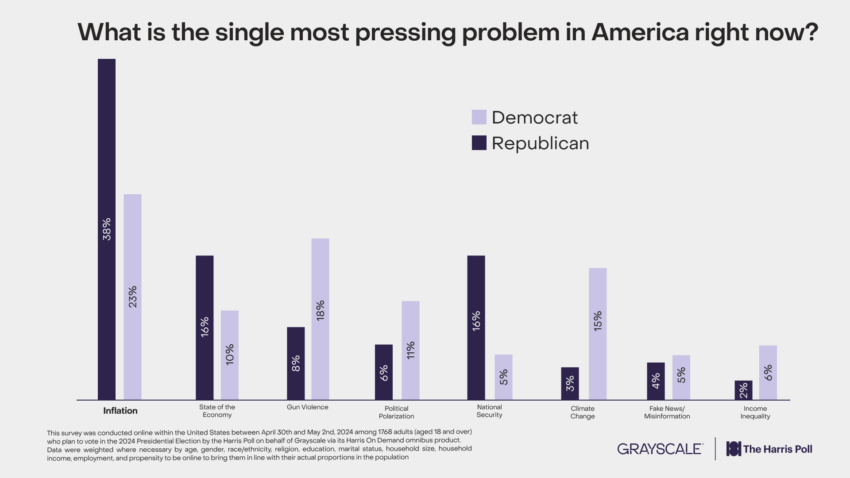

Despite the gap between the two major candidates, Grayscale’s report shows that crypto is a bipartisan issue, with similar ownership rates among Republicans (18%) and Democrats (19%). Voters are split on which party is more favorable to the industry.

Read more: How Does Regulation Impact Crypto Marketing? A Complete Guide

Thirty percent believe the Democratic and Republican parties have the most favorable positions on crypto policies, suggesting a balanced interest across the political spectrum.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.