Aave community members are pushing for a fee switch proposal after the DeFi protocol’s annualized revenue reached new highs this week.

On June 2, Matthew Graham, a member of the Aave liquidity committee, reported that the protocol was “averaging just over $80 million in annual revenue from seven Aave v3 & v2 deployments” across various blockchain networks, including Ethereum.

Stani Kulechov, the founder of Aave, corroborated this milestone, stating:

“Aave DAO is now earning $115 million annualized. Let that sink in.”

This high revenue is not unexpected, considering CryptoSlate recently reported that Aave was one of the few decentralized applications preferred by crypto users over traditional blockchain networks.

Consequently, the impressive earnings have reignited community calls for a fee switch proposal. A fee switch allows a platform to toggle specific user fees on or off, potentially redistributing transaction-generated fees to platform participants. Notably, several DeFi protocols, including Uniswap, are contemplating initiating an initiative for their users.

Meanwhile, these calls come more than a month after Marc Zeller, founder of the Aave Chain Initiative, suggested that a fee switch proposal was in development. Zeller highlighted that the Aave DAO has a substantial profit margin, providing a financial cushion for the next five years.

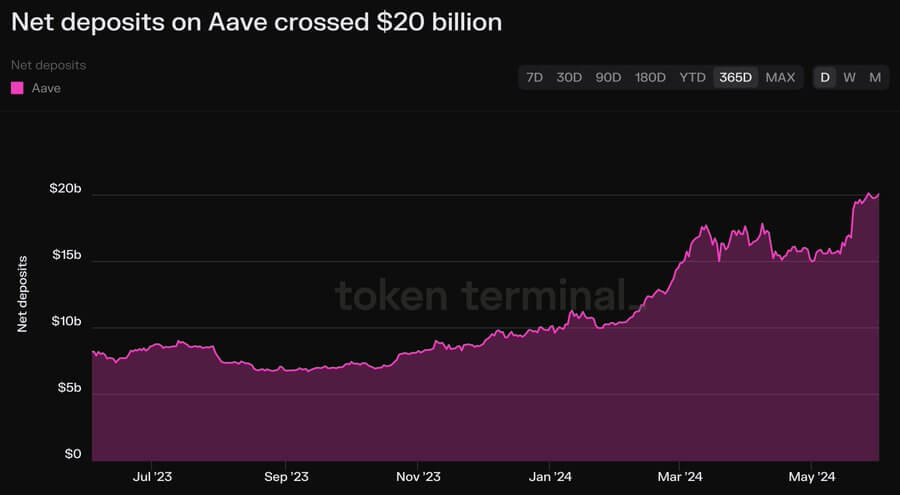

Deposits cross $20 billion.

According to Token Terminal data, the amount of crypto deposited in Aave has exceeded $20 billion, a level not seen since the crash of Terra’s UST algorithmic stablecoin in 2022.

Market experts said the protocol’s growth shows that the DeFi sector was rapidly recovering from the lows of the 2022 bear market that led to the collapse of several centralized lenders like Celsius, Genesis, and others. Additionally, they said the increased liquidity reflects the growing investor interest in Ethereum, driven by the optimism surrounding the ETH exchange-traded fund (ETF) approvals.

According to DeFillama data, Aave is the largest crypto-lending platform in the industry, primarily based on the Ethereum network. The platform recently disclosed plans to introduce several key initiatives, including launching Aave V4, a new visual identity, and expanded DeFi functionalities for its users.