Chainlink ranks #3 in gains: Joins BTC, ETH with 86% LINK in profit

06/07/2024 15:00

Chainlink [LINK] ranks third behind Bitcoin [BTC] and Ethereum [ETH] as the cryptocurrency asset with the most supply in profit.

- LINK is the third cryptocurrency with the highest supply in profit.

- In the last week, more LINK transactions have ended in profit than loss.

Chainlink [LINK] ranks third behind Bitcoin [BTC] and Ethereum [ETH] as the cryptocurrency asset with the most supply in profit, Santiment noted in a recent post on X.

An asset’s supply in profit tracks the total amount of its circulating supply that was last transferred on-chain at a price lower than the current price. Put simply, this metric measures the portion of coins or tokens that are currently held at a profit.

According to the on-chain data provider, 86.8% of Chainlink’s total supply is held above the cost basis at which it was acquired by token holders.

This puts the altcoin in third place, behind BTC, with 98.3% of its supply in profit, and ETH, with 95.1% of its supply held in profit.

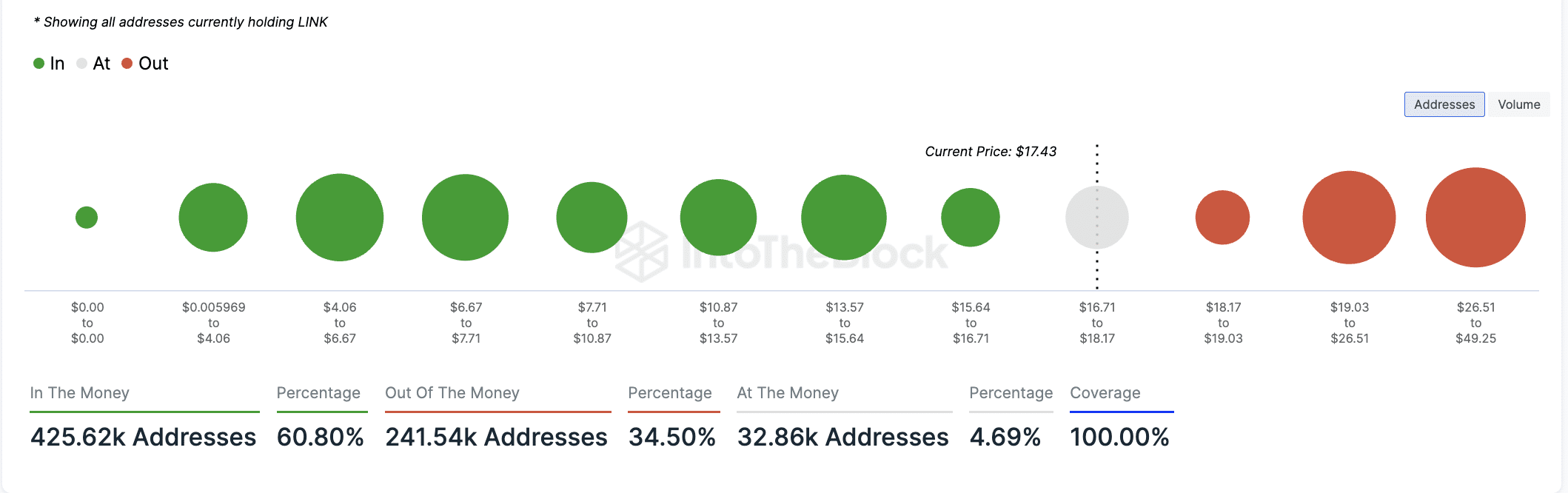

As of this writing, 425,620 addresses, which represent 61% of all LINK holders, are “in the money,” according to IntoTheBlock’s data. An address is said to be “in the money” when it holds its tokens or coins at a profit.

Conversely, 241,540 addresses, representing 35% of all Chainlink holders, are “out of the money;” that is, they hold the altcoin at a loss.

LINK faces a minor setback

At press time, LINK traded at $17.49. According to CoinMarketCap’s data, its price has declined by 3% in the past seven days due to a slight drop in daily demand for the altcoin during that period.

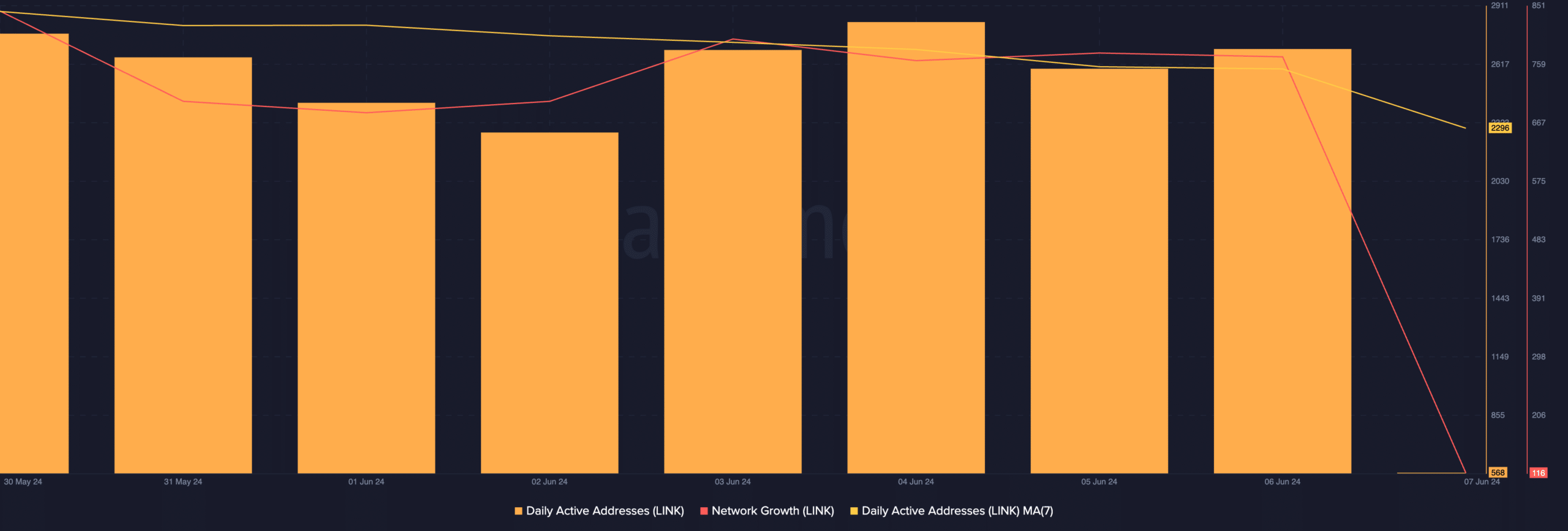

On-chain data from Santiment showed a drop in the daily count of addresses involved in LINK transactions in the last week. Assessed using a seven-day moving average, the number of LINK’s daily active addresses has dropped by 3% during that period.

Likewise, new demand for the altcoin has cratered. Within that period, the count of new addresses created daily to trade LINK has plummeted by 10%.

The decline in LINK’s demand in the last week can be attributed to how profitable daily transactions involving the token were during that period.

AMBCrypto assessed the daily ratio of LINK’s transaction volume in profit to loss (using a seven-day moving average), and its value was 1.73.

Realistic or not, here’s LINK market cap in BTC’s terms

This suggested that for every LINK transaction that ended in a loss, 1.73 transactions returned a profit for token holders.

The desire to make a profit may have triggered the selling activity that led to a minor decline in LINK’s value in the last week.