Uniswap decouples from Ethereum: Will UNI hold onto $9?

06/09/2024 23:00

For the last seven days, Uniswap's [UNI] price and Ethereum [ETH] have failed to move in the same direction. At press time, UNI changed hands

- Exchange supply for UNI increase while it dropped on Ethereum’s network.

- A declining sentiment, set off by decreasing demand, indicated that ETH could slide to $9.20 in the short term.

For the last seven days, Uniswap’s [UNI] price and Ethereum [ETH] have failed to move in the same direction. At press time, UNI changed hands at $9.98, representing a 2.22% increase in the last seven days.

ETH’s price, on the other hand, was $3,687. This was a 2.56% decrease within the same period. However, that is not the major issue at hand.

Something AMBCrypto observed using on-chain data from Glassnode was that the tides could soon change.

The correlation goes off

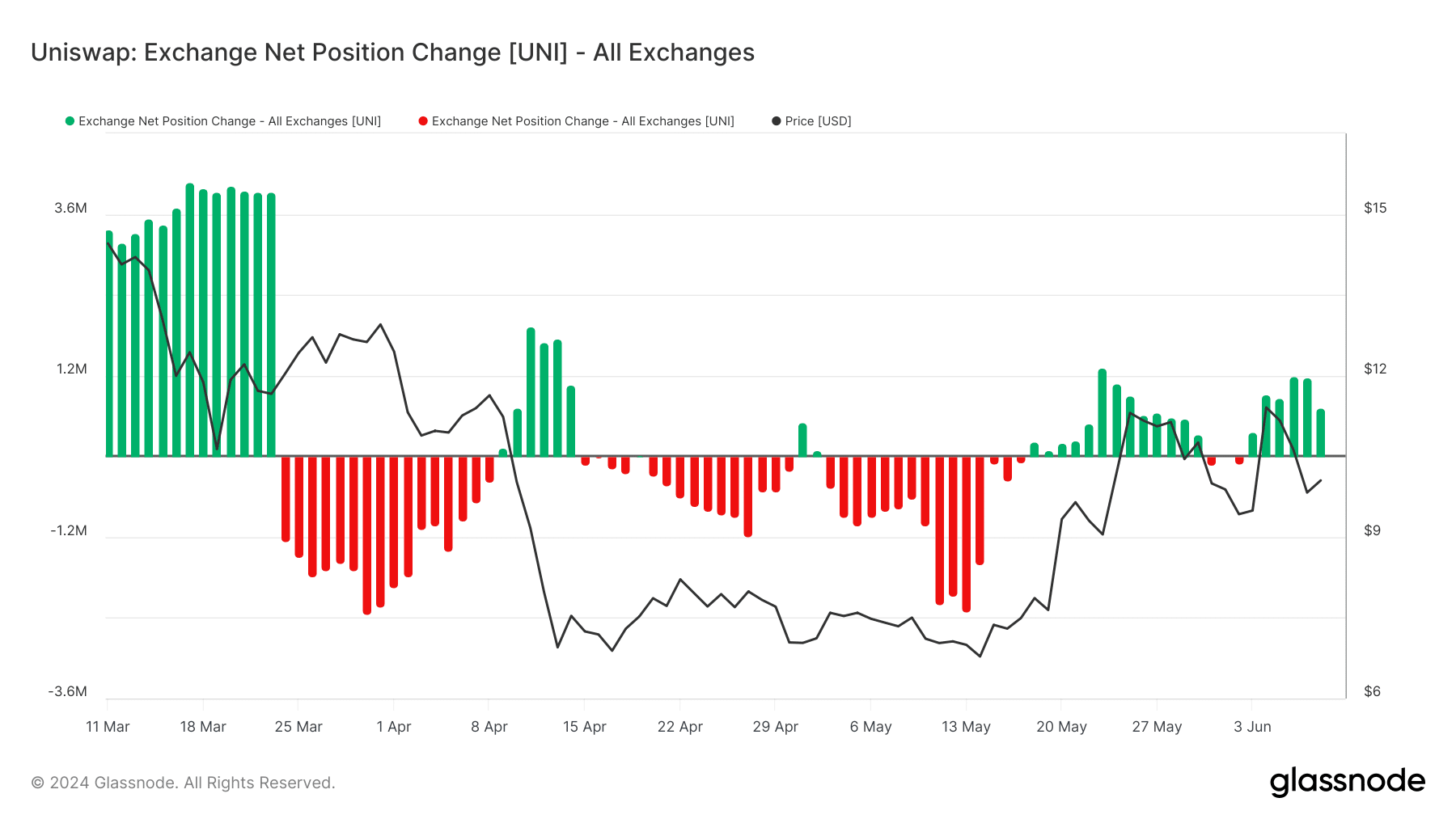

Evidence of this was reflected in the Exchange Net Position Change. According to our analysis, Uniswap’s Exchange Net Position Change was 733,683 on the 8th of June.

This metric is the total supply of tokens held in exchange wallets. If it is positive, it means that more tokens are going into exchanges, and this could lead to a price decrease.

However, a negative reading suggests a surge in withdrawals, which could lower selling pressure. For UNI, the number of tokens held on exchanges has been increasing since the 3rd of June.

Therefore, there is a high chance that the price of the token could lose hold on the $9 region if the supply remains positive. However, it was a different ball game for Ethereum.

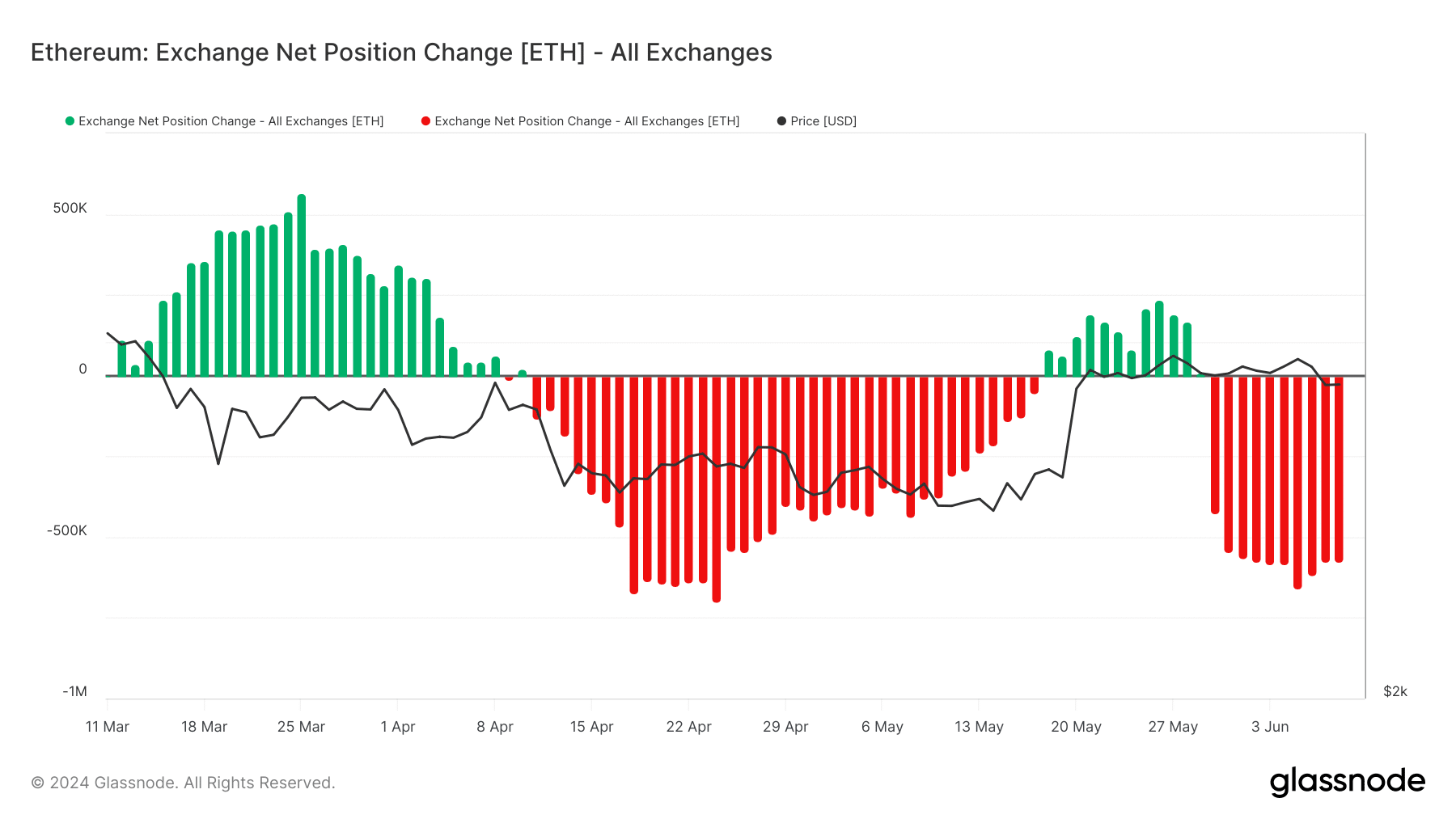

An evaluation of the same metric with ETH indicated an increase in coins taken ofd exchanges. According to Glassnode, about 576,851 ETH was withdrawn from exchanges on the same day 733,683 UNI tokens flowed in.

UNI is set to fall further

Therefore, it is possible to see the price of UNI fall while ETH could be in line for a swift recovery.

If validated, this could be contrary to the price performance of the cryptocurrencies when the U.S. SEC approved spot Ethereum ETFs.

In the build-up to the announcement, ETH’s price jumped, and UNI’s connection with the blockchain ensured it followed in the same direction. But how low can UNI go this time?

To check the possible targets, AMBCrypto analyzed the Weighted Sentiment, which shows the perception market participants have around a project. At press time, the Weighted Sentiment was -0.173.

This negative reading suggests that most comments about Uniswap tilted toward the bearish side of things. Thus, demand for the token could drop, and could trigger a price decrease.

In addition, the Market Value to Realized Value (MVRV) Z Score which was 27% a few days ago was down to 23.58%. When the MVRV Z Score is positive, it implies that the token is in a bull phase.

Realistic or not, here’s UNI’s market cap in ETH terms

On the other hand, a negative ratio suggests that a fall into the bear cycle. However, the recent decrease does not mean that UNI is dropping into a bear phase. But it is a sign that the price could slip down the charts.

By the look of things, a drawdown to $9.20 seems quite possible.