Why Solana nodes are ’10x higher than Ethereum’ – founder Anatoly Yakovenko

06/12/2024 13:00

Solana mulls upgrading its consensus mechanism to gain Ethereum-like efficiency and cut barrier costs for node operators.

- Solana’s founder proposed a mechanism to lower entry barriers to node operations.

- The executive mulled ways of dealing with voting fees to address the issue.

Solana [SOL] and Ethereum [ETH] leaders have debated various issues in the space for a while.

Most recently, the Solana Foundation’s clampdown on validators using MEV (Maximum Extractable Value) sandwich attacks caught major attention.

The Foundation withdrew financial support to some validators to reduce the attacks.

It emerged that running a Solana validator node is very costly, about $65K per year, which calls for the Solana Foundation to offer financial support in some cases.

On the contrary, an Ethereum validator costs 32 ETH as a one-off payment, and excludes hardware and other resources.

Solana founder Anatoly Yakovenko clarified the cost difference on ‘Ethereum’s better investment’ in its consensus system.

‘Economic barrier for honest nodes participate in consensus on Solana is 10x higher than ethereum atm. Largely due to the investment Ethereum has made into BLS aggregation for consensus messages.”

The BLS refers to Boneh-Lynn-Shacham, an efficient signature scheme leveraged by Ethereum. Notably, the scheme can contain several independently verified messages by validators.

This allows several messages to be aggregated effectively, lowering overall costs.

As Yakovenko noted, Solana’s current mechanism doesn’t match Ethereum’s technique. However, the founder added that Solana would eventually implement such a system.

‘Maybe that’s something that Solana will implement eventually, maybe it will be voting subcommittees, maybe nothing. As hardware improves, the lower bound fee to send a message to the entire cluster will drop, so the cost per vote will drop, and the economic barrier will drop as well’

However, one user noted that most of the cost was inflated by voting fees and asked how Solana would solve that. In his response, Yakovenko said,

‘Voting subcommittees would allow lowering the vote fee, and rotating the boxes in/out of the committee, which would reduce the vote load and results in lower vote costs’

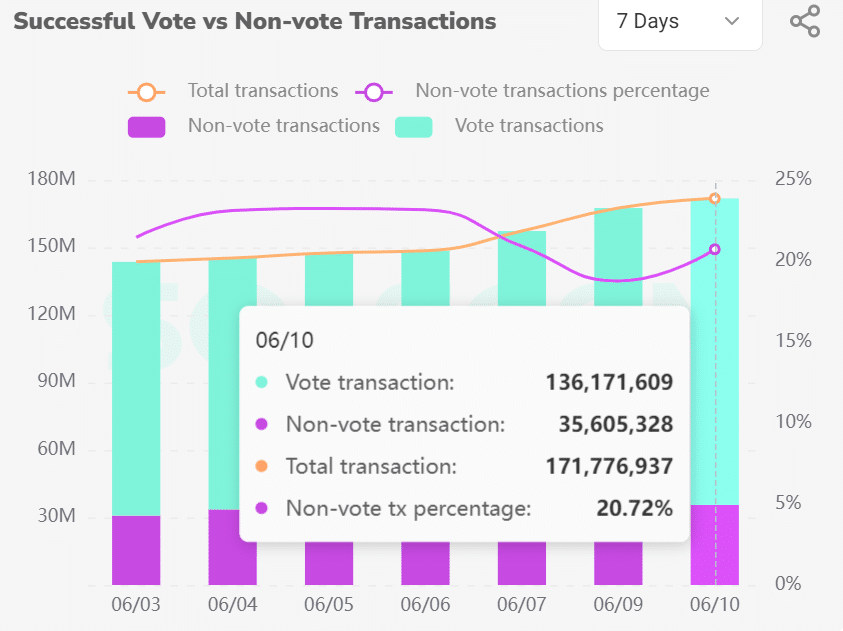

In the past seven days, 80% of total Solana transactions were related to votes, underscoring their dominance on block transactions.

Since the vote transactions also attract fees like the rest, validators bear the cost. Their higher dominance suggests that voting fees are the main contributor and perhaps barrier to entry into the space.

It remains to be seen whether Solana will implement the solution as floated by the founder.

In the meantime, SOL shed 6% as crypto investors de-risked ahead of the FOMC (Federal Open Meeting Committee) meeting.

SOL hit a low of $145 on the 11th of June, the level last hit in mid-May, as the market rout extended liquidations across the markets.