Ethereum (ETH) Exchange Outflows Plummet, Casting Doubt on $4,000 Prediction

06/13/2024 21:00

Ethereum (ETH) has encountered an increase in selling pressure. This may put the bullish price predictions on hold. Read more.

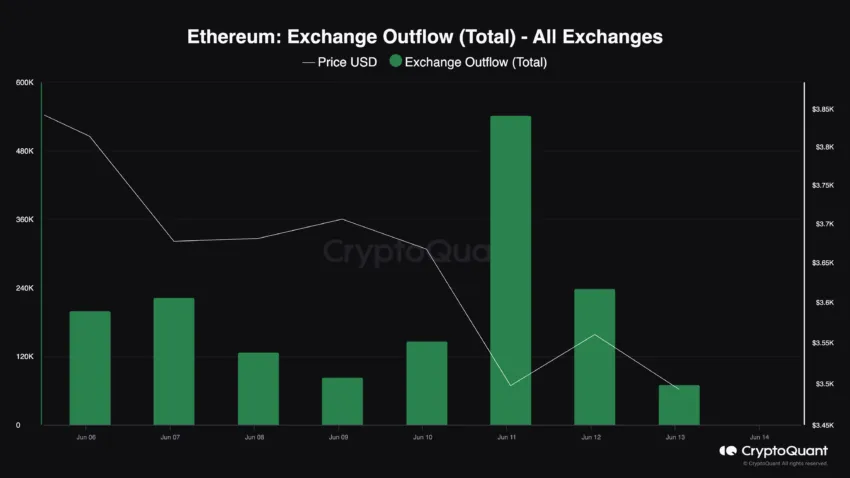

Readers will find today’s analysis of Ethereum (ETH) interesting. On June 11, about 542,000 ETH moved out of exchanges— the largest outflow of the year.

However, the trend did not take long to change, prompting speculation that the potential increase to $4,000 may be delayed.

Ethereum Opens the Floor for Bears

According to data from CryptoQuant, the number of ETH withdrawn from exchanges has decreased. For instance, the figure recorded on June 12 fell by almost half from what it was the day before.

As of this writing, BeInCrypto observes that 70,839 ETH has flown out of top exchanges. In simple terms, exchange outflow is the total amount of coins retired from exchanges into cold wallets or self-custody.

By holding more cryptocurrencies off-ramp, assets may face decreasing selling pressure. However, for Ethereum, that may not be the case. A low exchange outflow may lead to consolidation.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

Also, if exchange inflow increases, prices may decrease significantly. For context, exchange inflow measures the number of coins sent into exchanges. When this figure increases, it puts selling pressure on the price. On the other hand, a decrease in exchange inflow reduces the chances of a major nosedive.

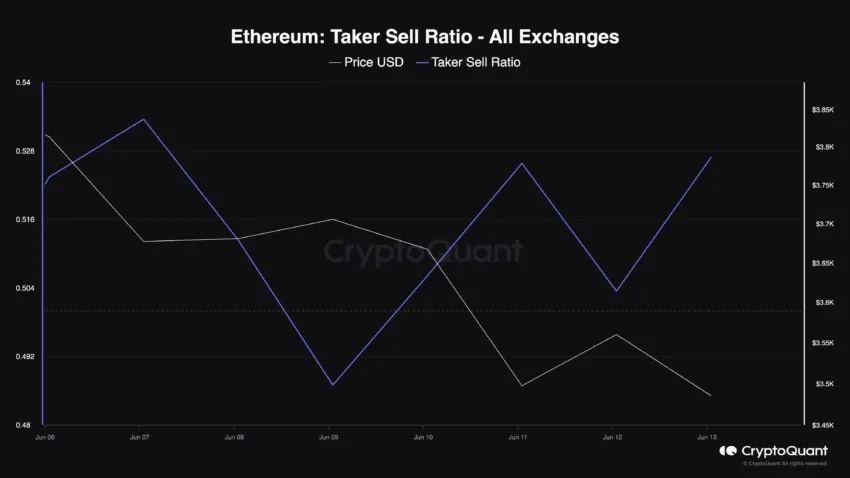

Ethereum’s price trades at $3,494, down from an earlier peak of $3,881 last week. Like the metric above, the Taker Sell Ratio paints a bearish picture. By definition, the Taker Sell Ratio is calculated as the number of sell orders divided by the total perpetual swaps in the market. If the value is over 0.50, it implies that sellers are dominant.

However, a reading lower than 0.50 shows that selling sentiment is below the possible peak. For ETH, the Taker Sell Ratio was 0.52, indicating a high presence of bears in the market.

Will ETH Price Mirror Bitcoin’s Reaction?

Further, a look at the ETH/USD Daily chart shows a double-top formation with the ceiling at $3,885. In trading, a double top is a bearish reversal pattern. It happens when a cryptocurrency hits a high value two consecutive times while registering slight declines between the two highs.

According to the chart below, the bearish structure broke the support level at $3,665. If this trend continues and bulls don’t appear, ETH may fall to $3,317, which was the next major support.

In addition, the Awesome Oscillator (AO) reading has dropped to 65.10. This comes with red histogram bars. The AO is a technical tool that compares recent market movements to historical trends to determine momentum.

On the daily chart, the indicator’s decreasing reading suggests that ETH is sliding toward a downward momentum. Should this trend continue or the reading becomes negative, the price of Ethereum may drop to $3,317.

Interestingly, this is where the 0.382 Fibonacci Retracement Indicator was positioned. The Fibonacci Retracement Indicator identifies potential reversal price levels. Hence, $3,317 is one spot to watch.

Read more: How to Invest in Ethereum ETFs

However, this prediction may be invalidated if the recently approved Ethereum spot ETFs start trading live. Despite the green light from the U.S. Securities and Exchange Commission (SEC), some of the applicants have not fulfilled all the requirements.

However, once a high trading volume starts entering the ETFs, ETH may mirror Bitcoin’s (BTC) reaction to a similar development in the first quarter of 2024. If this happens, ETH’s price may bounce, and the first significant target maybe $4,162.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.