Miners' $2 Billion Sell-off Impacts Bitcoin Price, May Cause Second Negative Monthly Close

06/23/2024 16:55

Bitcoin's price rally above $70,000 has stalled, attributed to a $2 billion sell-off by miners and recent outflows from spot ETFs.

Bitcoin’s (BTC) price had rallied above $70,000 early this month amid a 19 consecutive inflow streak for the exchange-traded funds (ETFs).

However, this rally has stalled, with the price now moving downwards. This could potentially lead to a second negative monthly close this year.

Miners Divest $2 Billion Worth of Bitcoin

Market analysts attribute this sluggish performance to significant selling by Bitcoin miners and recent outflows from spot ETFs.

Matthew Sigel, head of digital research at Bitcoin ETF issuer VanEck, noted that “nearly all Bitcoin miners are selling 100% of their coins.” Blockchain analytics firm IntoTheBlock supported this observation, reporting a substantial depletion in the Bitcoin reserves of top miners.

The Bitcoin reserve metric is used to gauge the financial health of miners. Typically, a reduction indicates that miners are selling their assets instead of accumulating. This month alone, the reserve has dropped to a yearly low of around 1.9 million BTC, with miners selling approximately 30,000 BTC worth $2 billion.

“Bitcoin miners have sold over 30,000 BTC (~$2 billion) since June, the fastest pace in over a year. The recent halving has tightened margins, prompting this sell-off,” IntoTheBlock stated.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

The increase in selling by miners comes as their revenues remain low following the recent halving event. The halving, which occurred in April, cut block rewards by 50% to 3.125 BTC. As a result, daily miner revenues have plummeted to about $35 million, down 55% from a peak of $78 million in March.

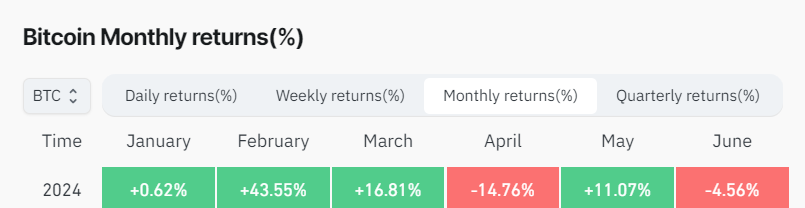

These trends have intensified the downward pressure on Bitcoin’s price, suggesting it may record a negative month if current performance persists. According to Coinglass data, Bitcoin is on track for its second negative monthly close of 2024, down 4.56% in June. The asset had already recorded a 14% decline in April.

Read more: Bitcoin (BTC) Price Prediction 2024 / 2025 / 2030

However, Bitcoin analyst Willy Woo believes BTC could reverse this downtrend by recovering its hashrate and eliminating weak hands.

“When Bitcoin sheds weakness what it looks like are inefficient miners running old hardware and high costs go into bankruptcy. While others are forced to upgrade hardware that’s more efficient. Why? Because their income got halved carrying the same costs. Both cases force miners to sell their BTC to pay for losses or hardware upgrades. After that’s done, the selling has ended and only the strong remain and they hodl waiting for higher prices,” Woo explained.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.