PEPE price prediction: Is another 13% decline on the way?

06/25/2024 04:00

The PEPE price prediction is bearish in the short term based on technical indicators and on-chain metrics, and a support retest is expected.

- PEPE holders might opt to cash in on a bounce in prices in the coming days

- The price prediction remains bearish and a retest of a key support zone is expected

Pepe [PEPE] bulls thought they had begun to reverse the downtrend last week after prices consolidated above a former local resistance, now support. However, in the past 24 hours, this began to change.

The increase in the meme coin’s selling pressure came alongside a Bitcoin [BTC] drop below the $64.8k mark that began on the 21st of June.

Sentiment across the crypto space was bearish, and the PEPE price prediction showed traders anticipated a retest of this support zone.

The bullish order block — can it save PEPE?

PEPE is likely to see another double-digit percentage price drop.

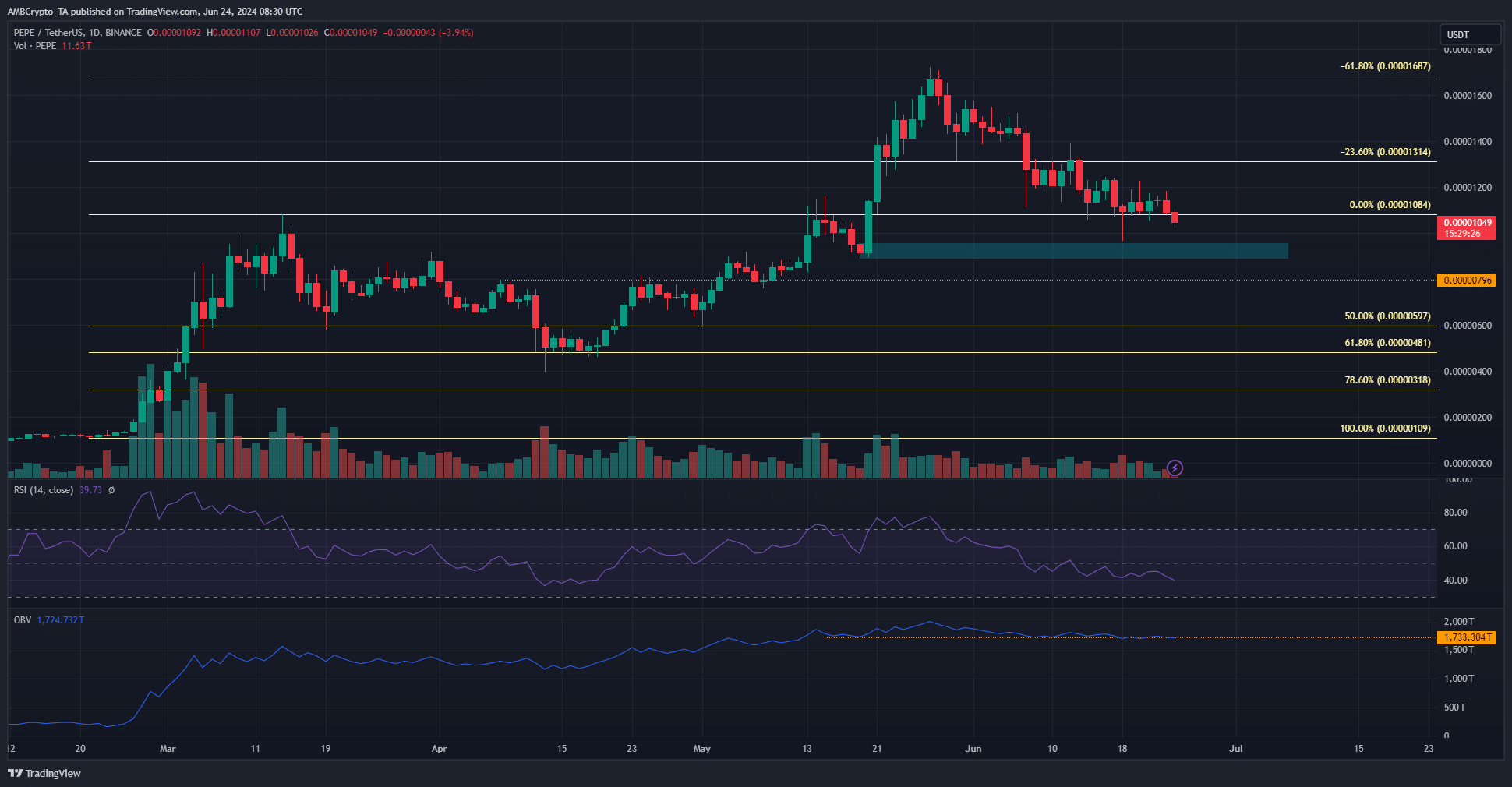

The PEPE price prediction is that a move to the $0.0000093 support zone (cyan box), a bullish order block from mid-May, is likely to materialize in the coming days.

The RSI on the daily chart has been below neutral 50 in June, coupled with the lower timeframe bearish market structure flip when the meme coin fell below the $0.00001314 support.

The OBV was barely holding on to a local support level. The trading volume has been low in recent weeks, which suggests that the recent downtrend lacked substance.

A market-wide shift in sentiment could see a quick recovery for PEPE, based on the trading volume as well as the in/out of the money chart.

Sell pressure could fizzle out soon

Data from IntoTheBlock showed that 77.58% of PEPE holders were in the money, meaning they were still at a profit despite the recent downtrend.

A large chunk of PEPE tokens in profit was bought at the $0.000002-$0.000003 zone, the area where the token began its meteoric uptrend in late February.

Read Pepe’s [PEPE] Price Prediction 2024-25

Around the price, a larger percentage of tokens were out of the money, which meant that a price bounce could see selling pressure from holders looking to exit at break-even. Therefore, in the short-term, a price dip is expected.

Over time, the uptrend might continue after a retest of the $0.0000093 bullish order block.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.