Bitcoin, Ethereum lead the way as crypto outflows surpass $500M

06/25/2024 16:00

As expected, Bitcoin [BTC] had the highest outflows with$630 million. The report explained that the gloomy perception among investors and

- Negative sentiment in the market caused the increase in outflows from BTC and ETH.

- Projected distribution by a defunct exchanges puts the cryptos at risk of another decline

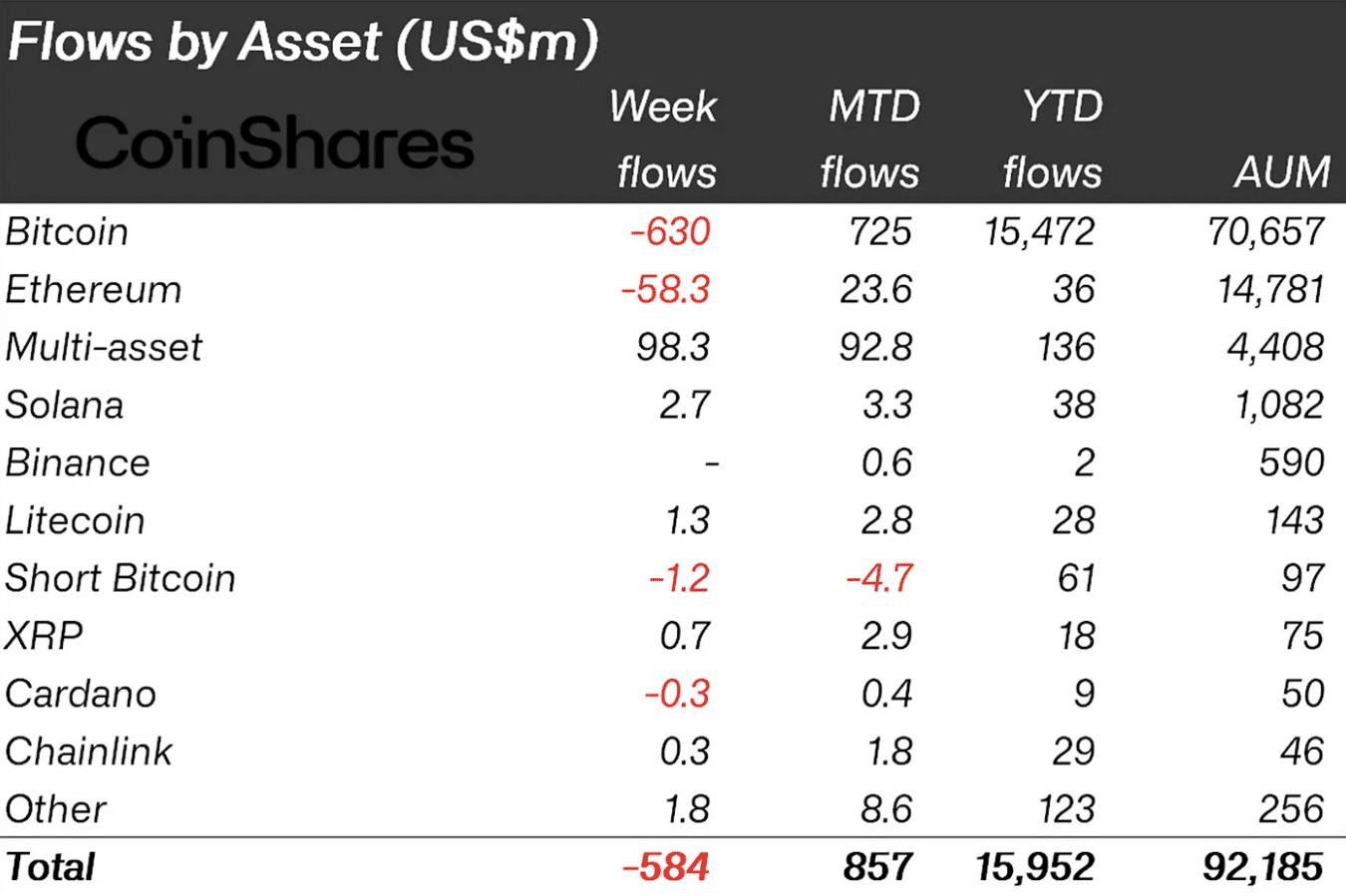

Crypto investment products saw massive inflows for the second consecutive week, CoinShares’ latest report revealed. According to the digital assets management, outflows last week were worth $584 million.

This brought the total outflows in two weeks to $1.2 billion. As expected, Bitcoin [BTC] had the highest outflows with$630 million. The report explained that the gloomy perception among investors and projected interest rate cut contributed to the capital flow.

It explained that,

“We believe this is in reaction to the pessimism amongst investors for the prospect interest rate cuts by the FED this year.”

BTC, ETH play second fiddle to other altcoins

Apart from the outflows, trading volume of Exchange Traded Products (ETPs) fell to $6.9 billion. This was the lowest volume Bitcoin has had since the 10th of January ETF approval.

Ethereum [ETH] was second on the list with an outflow of $58.30 million. This was surprising considering that the broader market expect the Ethereum spot ETFs to begin trading in July.

Typically, this was supposed to bring about optimism. However, that did not happen as the report stated that,

“Ethereum did not escape the negative sentiment, seeing US$58m in outflows. While a range of altcoins saw inflows after recent price weakness, most notable were Solana, Litecoin and Polygon at US$2.7m, US$1.3m and US$1m respectively.”

At press time, Bitcoin’s price was $60,028 after it briefly fell below $59,000. ETH, on the other hand, changed hands at $3,349.

It’s the season to apply caution

The initial decline in prices could be linked to the disclosure that Mt.Gox. intended to pay back creditors $9 billion worth of BTC from July.

Mt.Gox is the defunct Bitcoin exchange that was hacked in 2011. It then went bankrupt in 2014, leading to a broader market collapse. If the distribution begins in July, there is a high chance that the recipients would sell off some of the coins.

Should this be the case, BTC could plunge to $54,000 as predicted in some corners. For ETH, the anticipated live trading of the ETFs could save it from another round of correction.

If this happens, ETH’s price might resist another downside, and this could be the ticket to the altcoin season that has failed to appear.

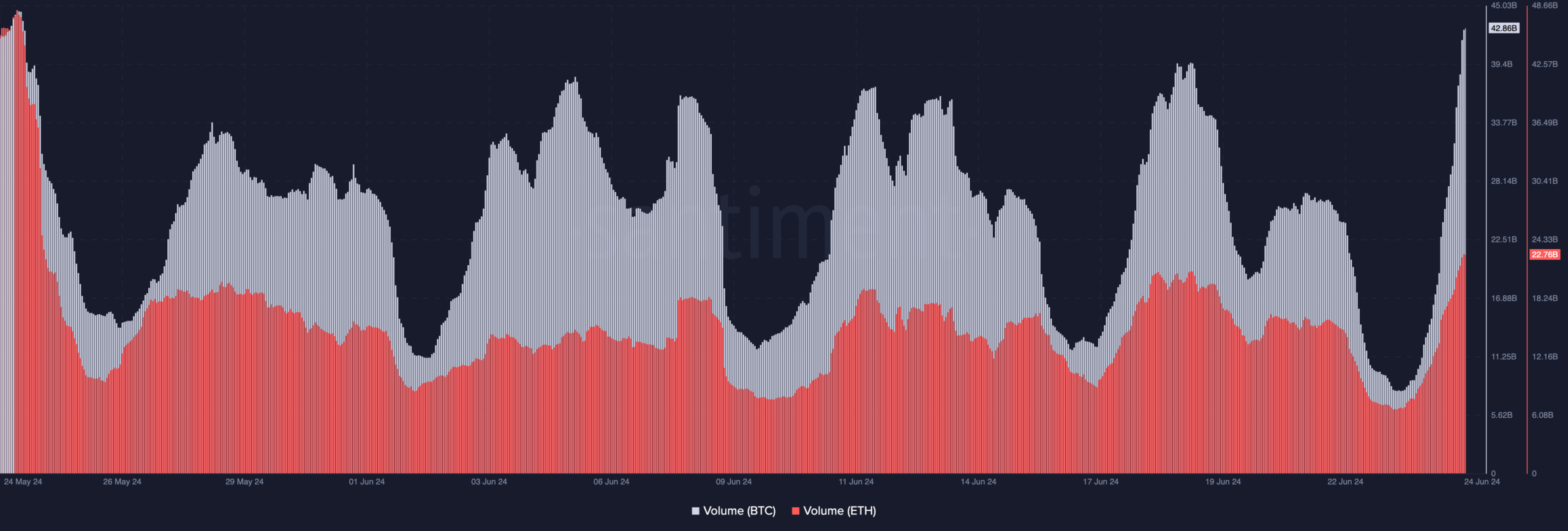

Meanwhile, Bitcoin’s volume neared its monthly high. At press time, the volume was $42.86 billion. Volume measures buying and selling, indicating interest in a cryptocurrency.

But considering BTC’s decline, it means that there was more selling than buying. While ETH’s volume also increased, it was not the same as Bitcoin.

Realistic or not, here’s ETH’s market cap in BTC terms

As of this writing, ETH’s volume on-chain was $22.76 billion. As it stands, BTC seemed to be resisting a further decline. If bulls can defend the coin, the price might rebound to $63,000.

In ETH’s case, the value could revisit $3,500. However, if selling pressure increases, the prices could hit new quarterly-lows.