Ethereum ETF vs Bitcoin ETF: What Will Happen to ETH Once Approved?

06/29/2024 03:00

Analysts have projected a spike in ETH’s value, even to as high as $10,000 by the end of the year once spot Ethereum ETFs go live.

A number of exchange-traded funds (ETFs) that will track the spot price of Ethereum (ETH), which were previously greenlit in May, are expected to become tradeable in the first week of July. In a recent post on X, senior ETF analyst Eric Balchunas noted that spot Ethereum ETFs might go live as soon as July 2. In another report by Reuters, the US Securities and Exchange Commission (SEC) might give its approval by July 4.

As the market awaits the launch of these new funds, there is an expectation that the leading altcoin would react the same way Bitcoin (BTC) did when spot Bitcoin ETFs launched at the beginning of the year.

Ethereum To Touch New Highs: What the Analysts Are Saying

Like Bitcoin in January, when spot Ethereum ETFs launch, there will be substantial capital inflows into the coin.

In a recent analysis, financial services provider Citi found that net inflows into spot Bitcoin ETFs surpassed $13 billion between January 4, when they were launched, and May 20.

These inflows caused BTC’s price to skyrocket, climbing to an all-time high of $73,750 by March 14. According to Citi, the leading crypto asset saw a 6% value rise per $1 billion inflow.

The bank projects that if investors apply similar market-cap-adjusted flows to Ethereum, inflows could range between $3.8 billion and $4.5 billion following the launch of the ETFs. This can cause the ETH’s price to rise by 23-28%.

At its current price of $3,450, a 28% spike means that ETH will trade at $4,417 by November. Interestingly, this will still be less than its all-time high of $4,891, recorded in November 2021.

Others believe that the launch of spot Ethereum ETFs will push the coin’s price to $10,000 by the end of the year. Andrey Stoychev, the head of prime brokerage at Nexo, stated this in a recent interview. According to him:

“ETH ETFs in the USA and similar products in Asia could be the driver that helps the asset reach $10,000 by end-2024, catching up with Bitcoin’s performance post-ETF.”

Staking Rewards Are Not “Safe”

There is an ongoing debate regarding whether the launch of spot Ethereum ETFs would impact the network’s staking activity. According to Matthew Sigel, the head of Digital Assets at VanEck, staking yields would soar once these funds go live and ETH moves from staking protocols into ETFs.

However, this may result in broader security problems for Ethereum. Security on the Layer-1 (L1) is dependent on validators who stake their coins. Once they start withdrawing their coins to put into ETFs, there would be fewer validators on Ethereum, making it prone to attacks.

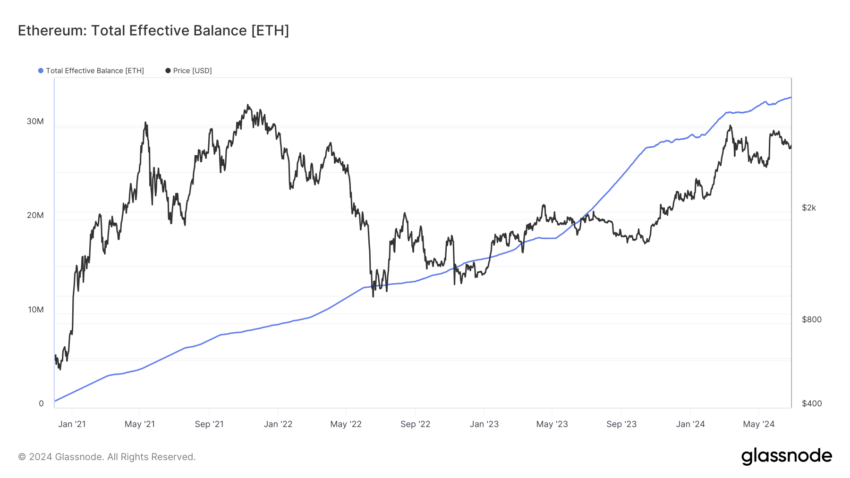

As of this writing, there are 1.02 million validators on the Ethereum network, with an effective balance of 32.95 million ETH.

However, others believe that ETFs would not bring gains that would prompt ETH stakers to unstake their coins. In a recent report, CCData Research said:

“Hypothetically, if you had opened a 1000 ETH position on January 1st, 2023, with an ETF provider, instead of holding native Ether, which accrues staking rewards, you would have missed out on gains of over $200,000.”

As of this writing, investors have staked 27.68% of ETH’s total circulating supply of 120.18 million ETH.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.