Is Ethereum’s price under pressure? A look at on-chain data suggests…

06/30/2024 05:00

Though Spot Ethereum [ETH] ETFs would begin active trading in a few days, activity on the blockchain's network has been discouraging...

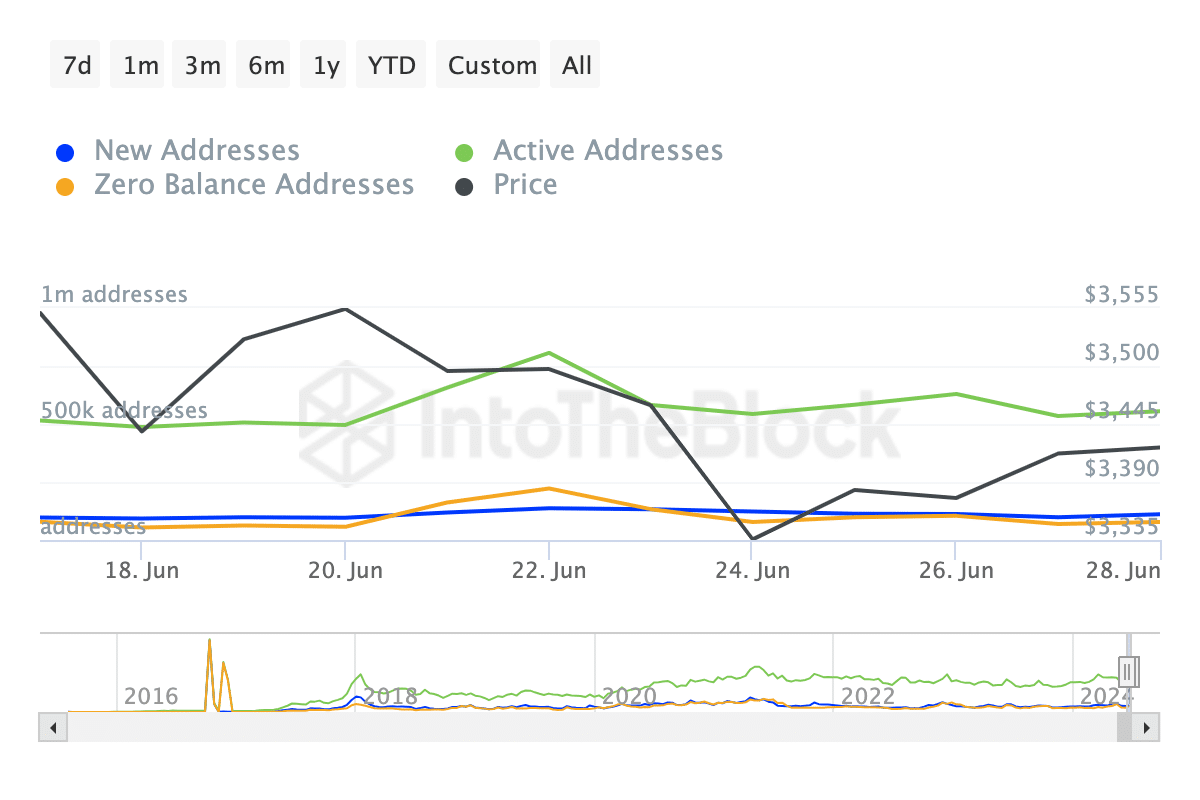

- The number of addresses on the network has been falling for the last seven days

- ETH supply on exchanges fell, reducing the potential of a sell-off

Though Spot Ethereum [ETH] ETFs would begin active trading in a few days, activity on the blockchain’s network has been discouraging. AMBCrypto found that out after evaluating the project’s network activity.

At press time, we observed that Ethereum’s active, new, and zero-balance addresses had dropped. By definition, new addresses refer to unique users making their first successful transaction on the network.

Activity falls, but there is a catch

This metric acts as a measure of traction or adoption. On the other hand, active addresses track the number of users participating in transactions. When this metric rises, it means an increase in the level of user engagement and growth.

However, at the time of writing, active addresses had fallen by 15.45%. in the last seven days. New addresses were not spared either with a 6.50% decline.

This development comes as a surprise considering how close the projected ETF launch is. If this decline lingers, the price of ETH could be affected. This, because a drop in Ethereum’s network activity could mean less demand for the cryptocurrency.

According to CoinMarketCap, ETH’s price was $3,379 at the time of writing. This represented a depreciation of 3.35% within the last week.

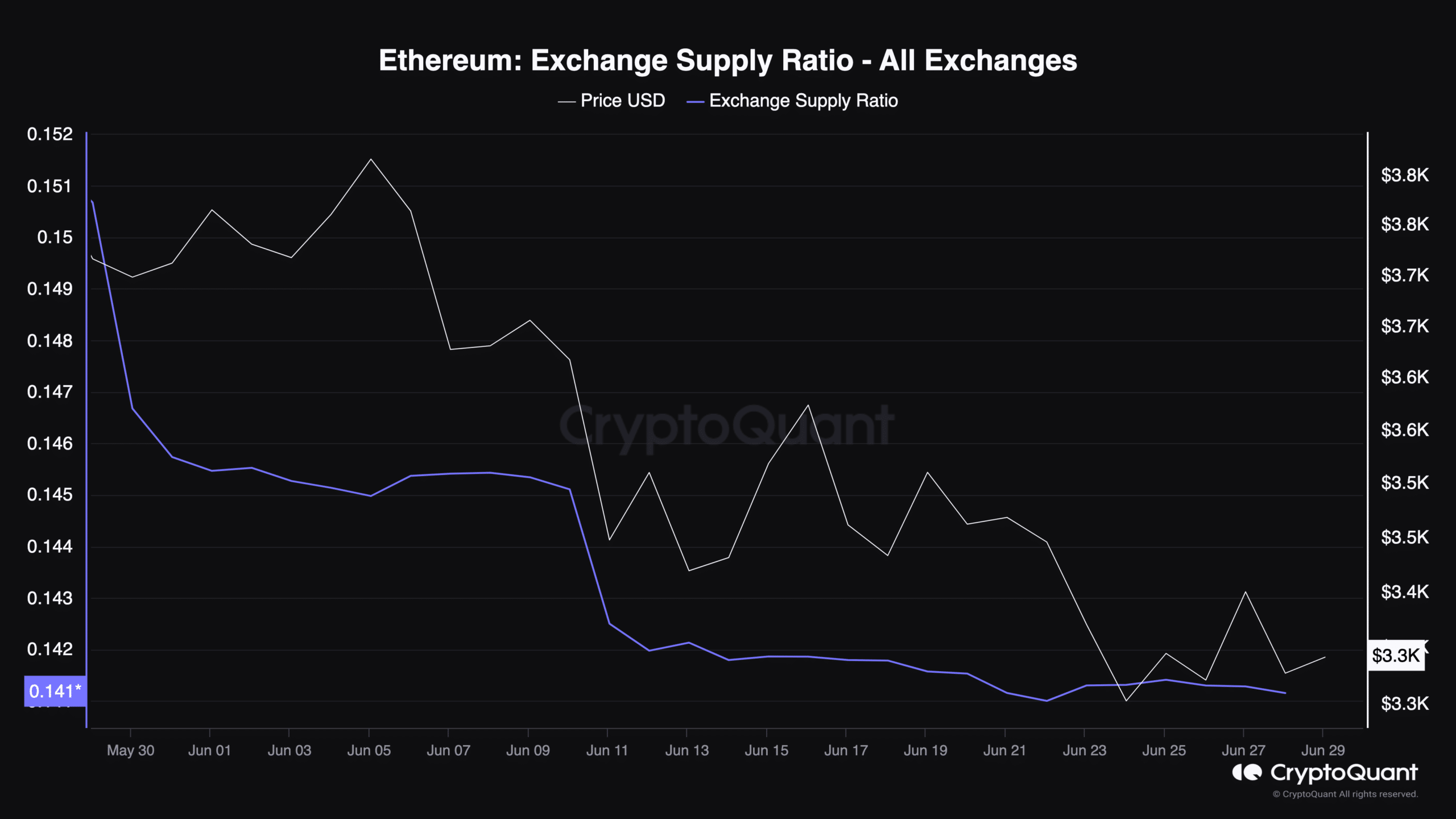

Another indicator AMBCrypto examined was the Exchange Supply Ratio. This is the ratio of coins reserved in exchanges, relative to the total ETH supply.

When it hikes, it means that the number of coins sitting on exchanges is moving up. A potential consequence of this is a rise in selling pressure which could later on lead a price fall.

However, at press time, the ratio seemed to be falling, according to data from CryptoQuant. This decline lowers the risk of a sell-off as holders seem to be comfortable locking their assets for safekeeping.

ETH traders are not confident

As funds move away from exchanges, the potential for a bull run rises. However, for this to affect ETH in a positive manner, buying pressure needs to rise.

If this is the case, ETH’s price could climb towards $3,600 within the first few days of July. However, if the opposite happens, the value could consolidate between $3,200 and $3,400.

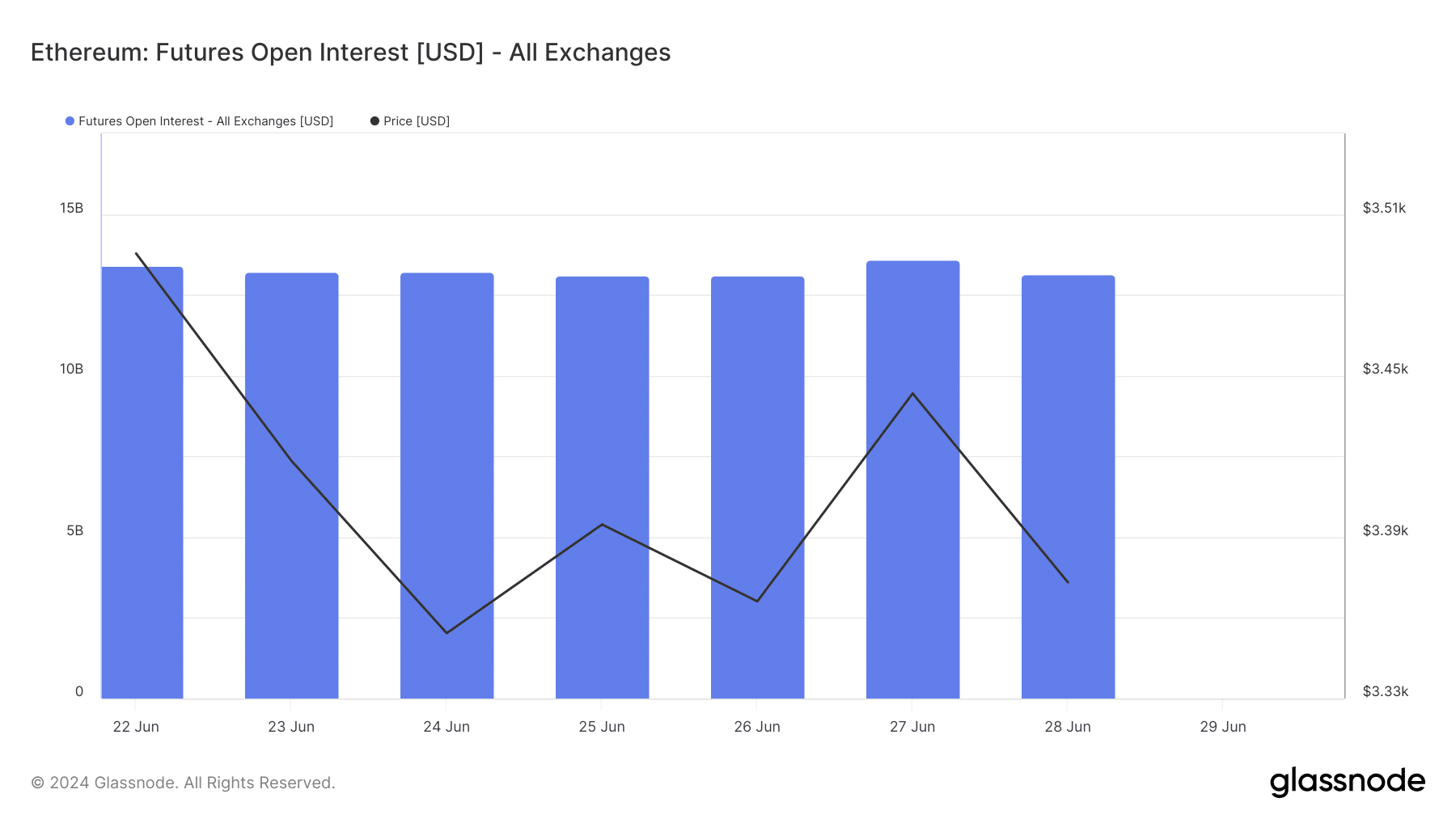

Additionally, Ethereum’s Open Interest dropped from the value it had on 27 June. OI, which is its short form, refers to the value of open positions in the derivatives market.

An increase in this metric implies that traders are involved in a lot of speculative activity. On the contrary, when it falls, it means that traders are closing existing positions and taking money out of the market.

With a value of $13.14 billion, ETH’s OI implied that participants are not refraining from opening positions to capitalize on movements from the price.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Should the value continue to fall, ETH’s price could also follow in the downward direction. However, this prediction might be invalidated if open contracts increase and buying pressure in the spot market follows.

If this is the case, ETH could begin a hike towards $4,000.