Ethereum (ETH) co-founder Vitalik Buterin has expressed his dissatisfaction with the way the U.S. handles cryptocurrency regulation.

In a recent interaction on Warpcast, Buterin said he believes the current regulatory system promotes the creation of projects that offer vague promises of returns without real substance.

Buterin further argued that if crypto returns and rights are categorized as securities, the emphasis should shift towards developing tokens that maintain or increase in economic value.

Additionally, the Ethereum co-founder stressed that this shift requires sincere collaboration from both regulators and the crypto industry.

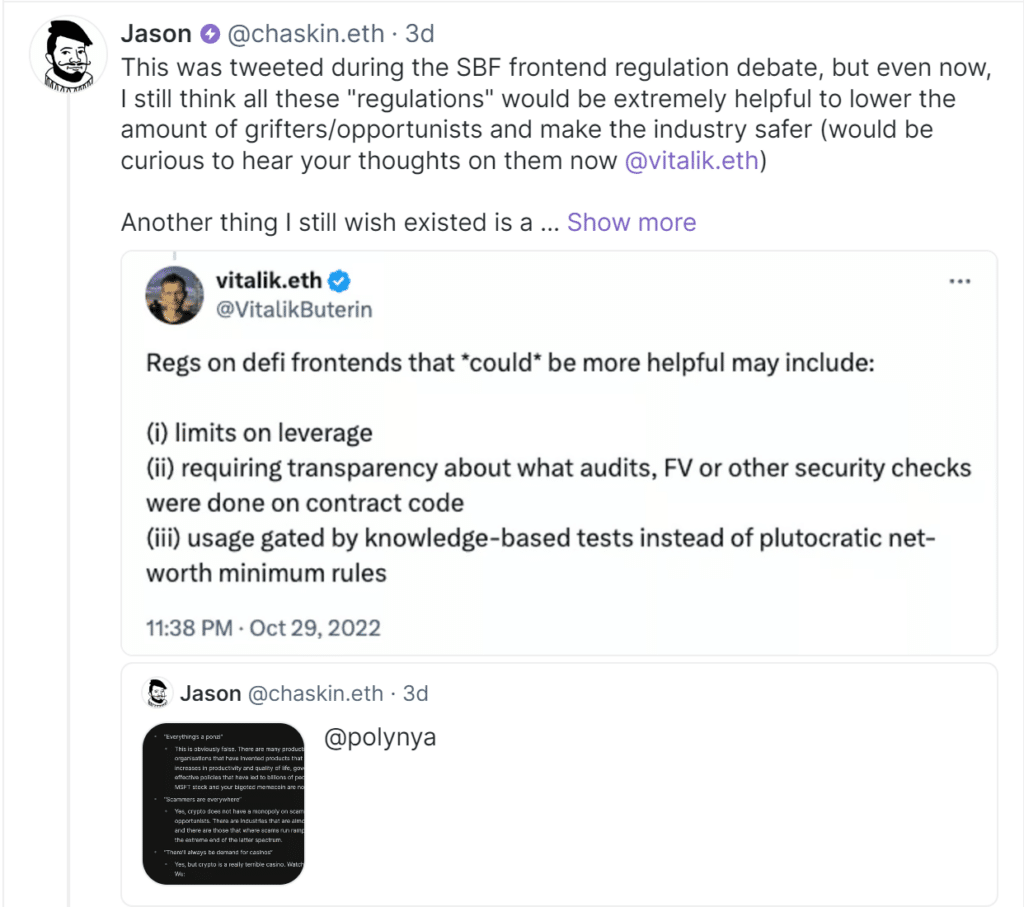

It all began on June 28, when a member of the Ethereum Foundation called Jason posted on Warpcast, reflecting on a tweet Buterin posted in 2022 during the debate on Sam Bankman-Fried’s proposed frontend regulation.

In the tweet, Buterin suggested several regulations on the frontends of decentralized finance (defi) platforms that could help reduce the number of opportunists in the industry and enhance safety.

They included limits on leverage, transparency about audits or other security checks on contract code, and usage gated by knowledge-based tests rather than net-worth minimum rules.

While sharing the post, Jason stated that he still believed in the value of those regulations proposed by Buterin and invited the Ethereum co-founder to share his current thoughts on the matter.

Jason also proposed the idea of a popup that displays the current tokenomics breakdown of a coin before a swap, with links to Etherscan showing how top holders acquired their coins.

Responding to Jason on June 29, Buterin highlighted the core issue with crypto regulation, particularly in the U.S.

He pointed out that projects offering vague promises can operate freely, but those providing clear information about returns and rights are often classified as securities and face stricter regulations. He referred to this as an “anarcho-tyranny” that is detrimental to the crypto space.

The main challenge with crypto regulation (esp in the U.S.) has always been this phenomenon where if you do something useless, or something where you’re asking people to give you money in exchange for vague references to potential returns at best, you are free and clear, but if you try to give your customers a clear story of where returns come from, and promises about what rights they have, then you’re screwed because you’re “a security”

Vitalik Buterin, Ethereum co-founder

Buterin also desires a regulatory environment where issuing a token without a clear long-term value proposition is riskier.

In his opinion, providing a transparent long-term outlook and adhering to best practices should offer safety for crypto tokens. Achieving this, he noted, would require genuine engagement from both regulators and the industry.

Buterin’s comments come in the wake of a U.S. judge’s June 28 decision to dismiss the claim by the U.S. Securities and Exchange Commission (SEC) that secondary sales of Binance’s BNB token qualify as securities.

This ruling was influenced by the SEC vs. Ripple case, where the economic reality of transactions was emphasized in applying the Howey Test.

The judge ruled that secondary sales of Binance Coin do not qualify as securities, marking a significant win for crypto traders.