WIF remains bearish, but THIS group has something to gain

07/01/2024 04:00

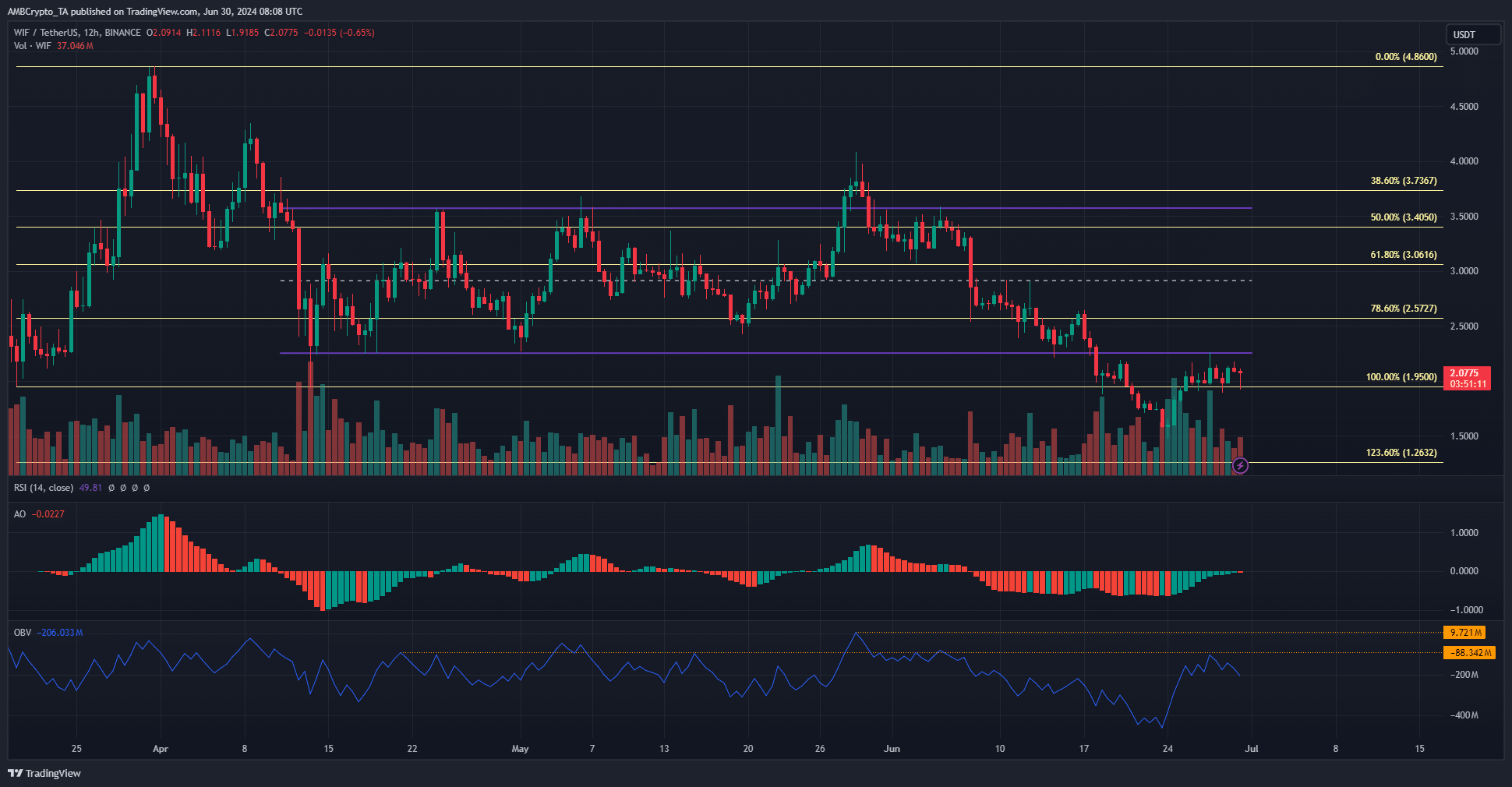

In the short-term, data suggested a bounce toward $2.3 is possible for WIF, but the higher timeframe bias remained bearish.

- WIF had a strong bearish market structure at press time.

- The buying pressure of last week suggested the sentiment might be changing, but the price action did not signal an uptrend.

dogwifhat [WIF] did not show a clear direction in the market at press time.

AMBCrypto’s recent report highlighted that the long/short ratio has alternated between bullish and bearish frequently in recent days, highlighting a lack of conviction.

Last week, a whale added to their WIF holdings. Combined with the increase in buying pressure on the 24th of June, there is a potential that WIF could make a move above the $2.5 level.

A buyer comeback might be brewing

WIF has made a series of lower lows and lower highs on the 1-day price chart since the first week of June. Its rejection from the $3.8-$4 resistance zone saw the meme coin price slip to the range lows and then fall even lower.

In the past three weeks, the Awesome Oscillator has been stubbornly below the zero line, indicating bearish momentum. This has changed over the past week. The AO climbed higher and the trading volume jumped too.

The buying pressure rapidly picked up pace on the 24th and 25th of June. This brought the OBV up to a local resistance level.

With the $1.95-$2 zone serving as support at press time, continued OBV gains would indicate bullishness for WIF.

Which way does short-term bias lean?

The cumulative liquidations levels delta had been massively negative on the 28th of June. This saw WIF prices bounce from $1.9 to $2.15. Since then, the delta has fallen once again as prices retraced the bounce.

Is your portfolio green? Check the WIF Profit Calculator

The recent losses encouraged short-sellers, but also skewed the balance. The short positions could be hunted for liquidity before the next move.

AMBCrypto’s analysis of the liquidation levels marked the $2.2 and $2.3 as short-term bullish targets. After a retest of these pools of liquidity, WIF might continue its prior downtrend.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.