After Bitcoin drops below $60,000 twice in a week, what’s next?

07/01/2024 07:00

Bitcoin fell below the $60,000 price range in the past week, and this led to different reactions from various key metrics.

- BTC saw its highest number of new addresses in months.

- BTC has maintained the $60,000 price range.

Over the past week, Bitcoin’s [BTC] price dropped below the $60,000 mark on two separate occasions, which was accompanied by a slight increase in the reserves held by exchanges.

Interestingly, alongside the increase in BTC on exchanges, there was a significant uptick in the creation of new addresses.

AMBCrypto’s analysis of Bitcoin’s price trend over the past week, as reported by AMBCrypto, indicated a period of significant volatility.

On the 24th of June, BTC experienced a notable drop of 4.60%, with the day’s trading closing at approximately $60,263.

Despite this close, the price had dipped as low as $58,411 during the day. Similarly, on the 28th of June, BTC’s price again tested lower levels.

It declined to $59,868, and closed at around $60,313, marking a decline of over 2%.

As of this writing, BTC was trading at around $61,400, showing a modest increase of less than 1%. The Relative Strength Index (RSI), a key indicator of price momentum, was around 38.

This suggested that BTC was in a strong bear trend. An RSI below 40 typically indicates bearish momentum, and values approaching 30 are often interpreted as signaling an oversold condition.

The move might thus precede a potential price rebound.

This week’s price movements have had an impact on broader market dynamics as well, including the creation of new Bitcoin addresses and changes in exchange reserves.

Typically, significant price declines can trigger increased activity on exchanges as traders move BTC to sell or buy at perceived key levels.

Also, new addresses may be created as new or existing participants enter the market to capitalize on the volatility.

Bitcoin on exchanges increase

AMBCrypto’s analysis of exchange reserve data from CryptoQuant revealed a subtle yet noteworthy uptick in the volume of Bitcoin held on exchanges recently.

While the exchange reserve has generally stayed around the 2.8 million BTC range, there have been minor fluctuations. Specifically, the reserve has increased by approximately 14,000 BTC in the last few days.

Given Bitcoin’s current market price, this increase in reserve translates to an influx of about $851 million worth of BTC to exchanges.

As of this writing, the total BTC held in exchange reserves was around 2.841 million BTC.

This increment in exchange reserves could have several implications. Typically, an increase in Bitcoin on exchanges is interpreted as a potential preparation for selling, which might exert downward pressure on prices.

Alternatively, it can also indicate greater liquidity, potentially leading to increased trading volume.

Notable on-chain growth takes place

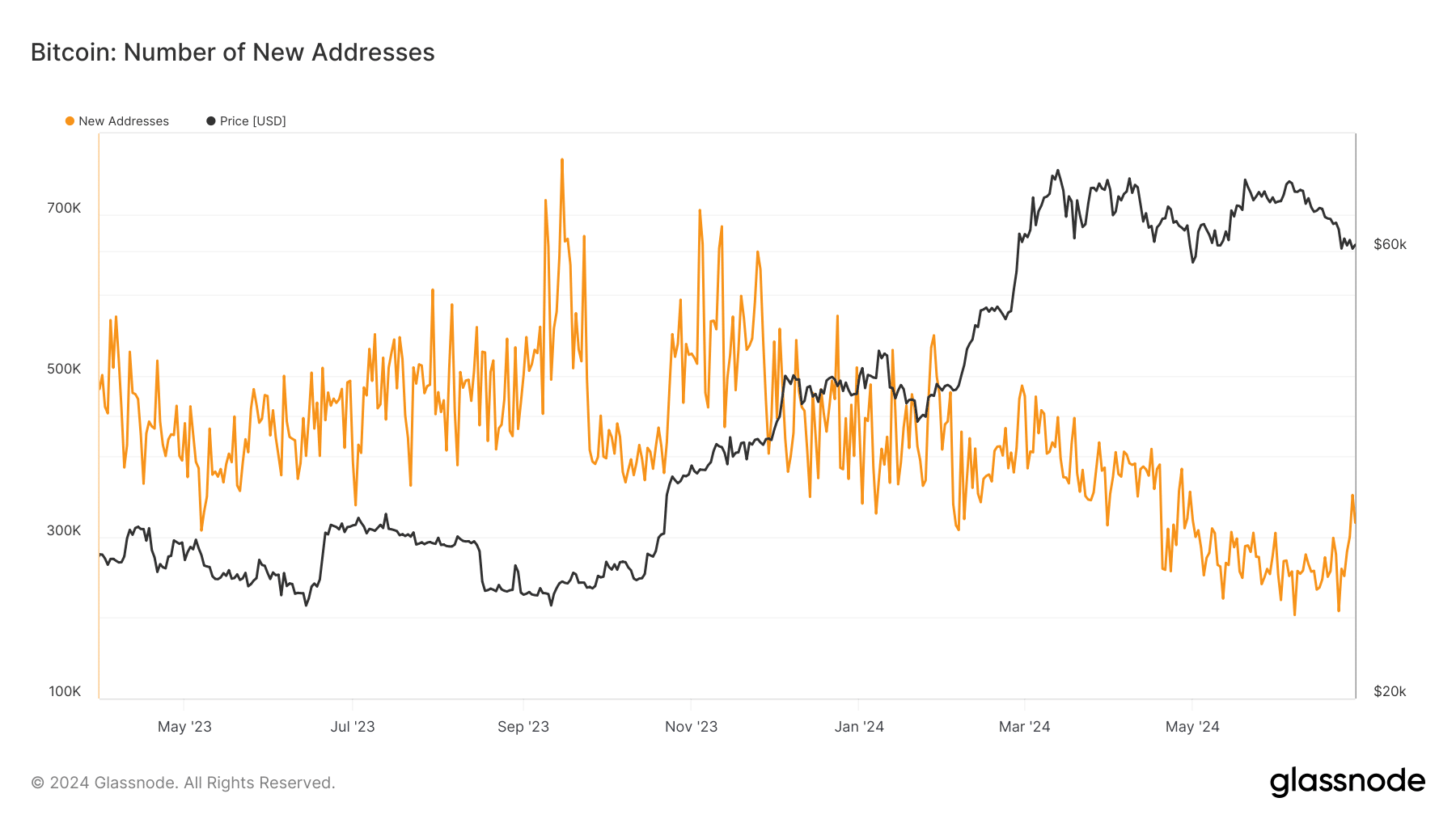

For the first time in nearly three months, there has been a notable increase in the creation of daily new Bitcoin addresses.

According to an analysis of the data from Glassnode, the number of daily new addresses surged to over 350,000.

This level of activity had not been observed within the month, and the last occurrence of such a significant number was back in April.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Furthermore, this spike in new addresses could signify a renewed interest in Bitcoin, potentially from new entrants to the market. It could also be from existing participants establishing additional addresses.

Such a significant rise often reflects broader market movements or sentiment shifts, which could have various implications for BTC’s network activity and price dynamics.