Polkadot’s development activity takes a dip: What this means for DOT

07/01/2024 12:00

Development activity has always been a key part of Polkadot's [DOT] growth. On several occasions, AMBCrypto reported how

- The project’s development activity reading dropped; however, participants remain bullish on DOT.

- Indicators showed that DOT’s price risked falling below $6.

Development activity has always been a key part of Polkadot’s [DOT] growth. On several occasions, AMBCrypto reported how the blockchain led on this front.

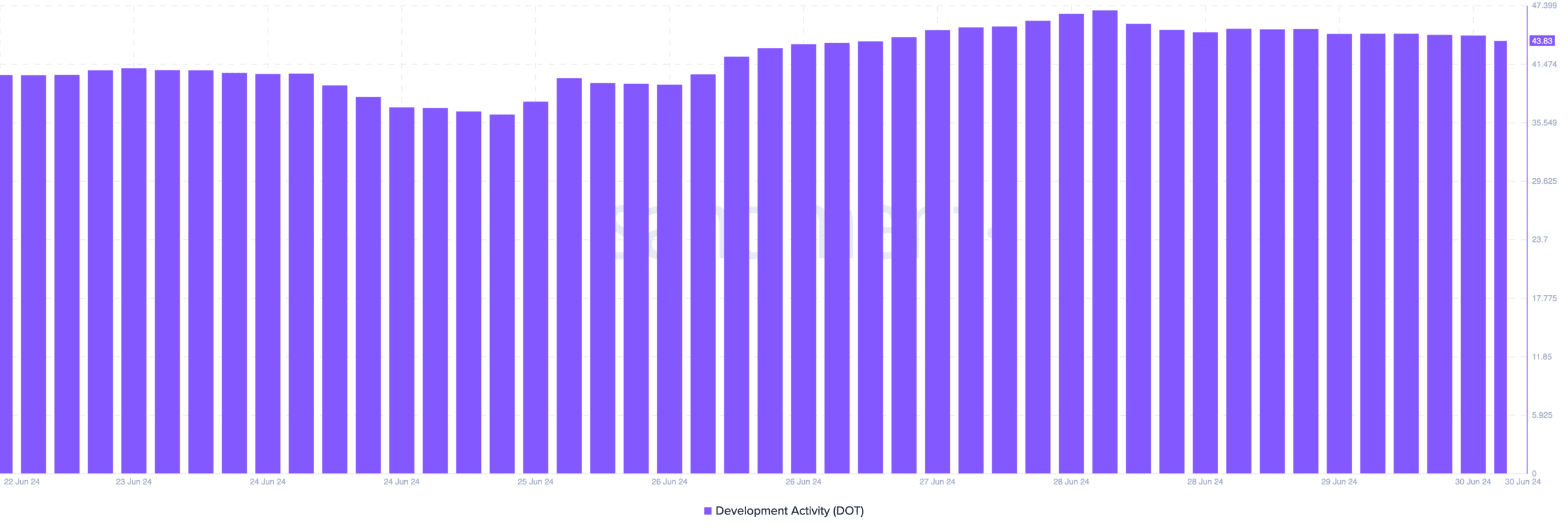

Last week, something similar happened as the development activity metric hit 46.93. But on the 28th of June, the reading started to drop. When development activity increases, it means that a project is shipping out new features on its network.

However, a decrease occurs when the commitment to polishing the network is not at its highest. At press time, this was the case with Polkadot. But it is necessary to point out that the protocol made significant strides during the mentioned week.

Shipping stalls amid optimism

For example, Snowbridge, a trustless cross-chain project, developed on the network, launched. There were also notable developments apart from this. Some involved Non-Fungible Tokens (NFTs), and another was linked to security of assets.

Should this continue into the new week, then the project’s development activity might return to the upside. In terms of the price, DOT changed hands at $6.11.

Surprisingly, it was one of the top gainers out of the top 20 projects in the market. Furthermore, several analysts in the market have shared their thoughts on the cryptocurrency, saying it was undervalued.

One of them is Michaël van de Poppe. According to van de Poppe, DOT could follow in Ethereum [ETH] steps. He gave his reasons on X, noting that,

“DOT is likely going to follow Ethereum in its expansion upwards. This means that the current valuations of Polkadot are extremely low. I expect a lot from the Polkadot ecosystem with all the new segments.”

ETF rumors appear, but DOT does not care

Another reason for the speculation going around is that Polkadot is another project in line for an ETF. For context, ETF stands for Exchange-Traded Fund. If this happens, the traditional finance sector would have exposure to DOT, following in Bitcoin’s [BTC] and Ethereum’s path.

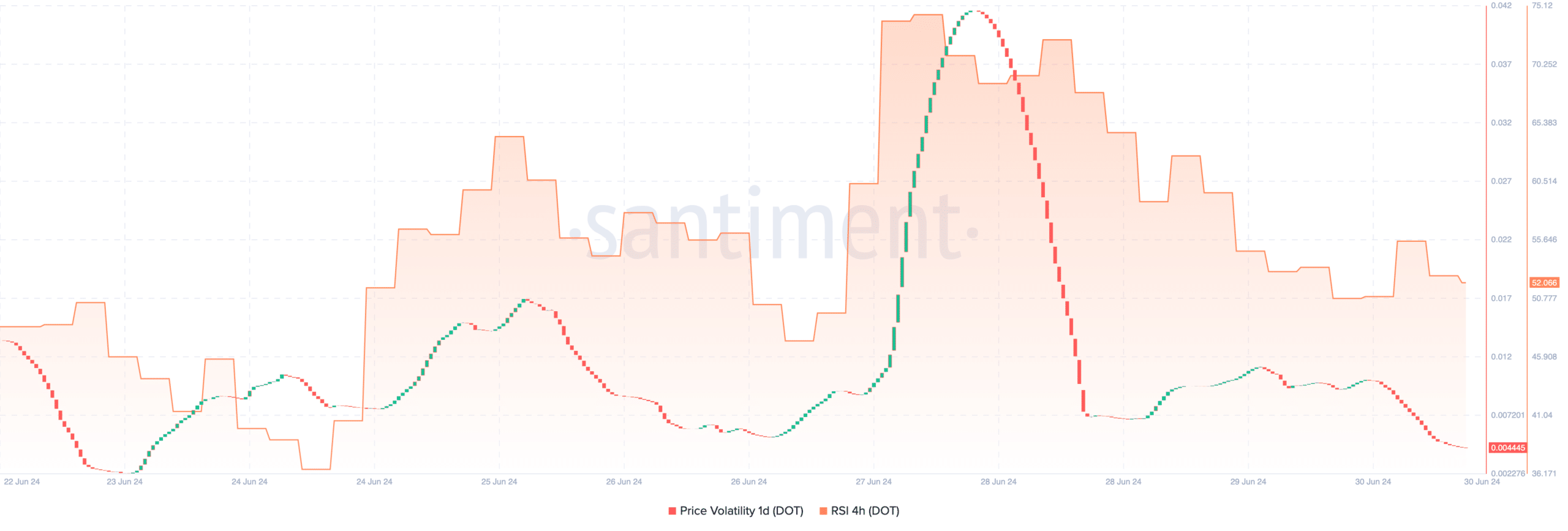

Despite the optimism around the token, AMBCrypto found that the previous bullish momentum was waning. We discovered after evaluating the Relative Strength Index (RSI) on the 4-hour chart.

The RSI measures momentum. If it increases, it means momentum is bullish. But when it decreases, it means that momentum is bearish.

At press time, the indicator reading had turned downwards to 52.06, indicating that sellers are taking profits off the recent gains. Furthermore, the one-day volatility dropped.

Read Polkadot’s [DOT] Price Prediction 2024-2025

The drop in volatility implies that the price might not experience rapid fluctuations in the short term. If selling pressure increases, DOT’s price might drop below $6.

However, if bulls come into the picture, the price might hold its ground above $6 or move toward $7.