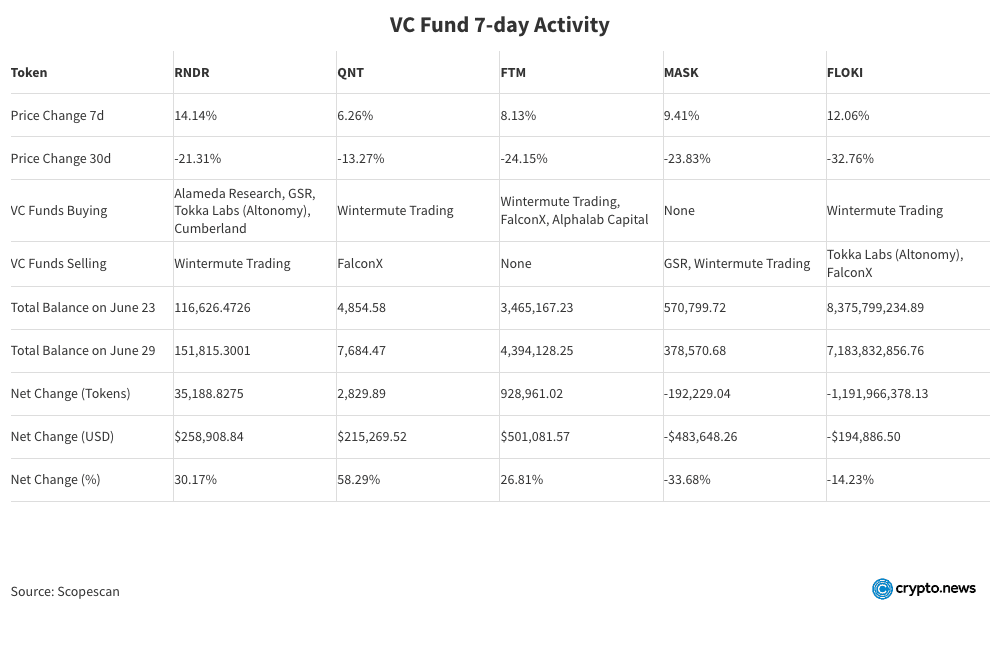

Over the past week, crypto venture capital (VC) funds made strategic adjustments to their portfolios. Data from Scopescan, analyzed from June 23 to June 29, shows that top VC funds increased their holdings in RNDR, QNT, and FTM while reducing positions in MASK and FLOKI. These moves followed substantial downturns in these assets over the past month.

Major Buys

VC funds such as Alameda Research, GSR, Tokka Labs (Altonomy), and Cumberland increased their holdings in RNDR. This led to a net token change of 35,188.83 and a net USD increase of $258,908.84, reflecting a 30.17% rise. Wintermute Trading showed strong support for QNT, adding 2,829.89 tokens and increasing its USD value by $215,269.52, which is a 58.29% rise. FTM also attracted investments from Wintermute Trading, FalconX, and Alphalab Capital, with a net increase of 928,961.02 tokens and $501,081.57 in value, reflecting a 26.81% rise.

VCs likely pursued these investments to take advantage of depressed prices. This strategy involves acquiring assets that have experienced significant price declines, with the expectation of future recovery and value increase. For RNDR, QNT, and FTM, price drops of -21%, -13%, and -24% in the preceding month created attractive entry points. VCs seem to be positioning for potential rebounds and long-term gains, anticipating that these assets are undervalued and will appreciate over time.

Major Sell-offs

MASK and FLOKI faced large sell-offs. Wintermute Trading and GSR reduced their MASK holdings by -192,229.04 tokens, decreasing its value by -$483,648.26, a -33.68% decline. FLOKI saw similar reductions, with significant sales from Tokka Labs (Altonomy) and FalconX, resulting in a decrease of -1,191,966.37 tokens and -$194,886.50 in value, down by -14.23%.

The reasons behind VC funds choosing to sell these tokens are intriguing. MASK experienced a 30-day price decline of -23.83%, while FLOKI dropped by -32.76%. Over the past 7 days, MASK’s price increased by 9.41% and FLOKI’s by 12.06%. Despite the drop in prices over the past month and the recent slight surge unlikely accounting for profit, VCs decided to liquidate their positions. This move suggests a calculated strategy rather than a reaction to immediate market conditions, potentially aimed at optimizing portfolio balance or managing risk exposure.

The Rationale Behind VC Fund Activities

When evaluating VC fund activity, it’s important not to simply interpret buys as bullish and sells as bearish. Multiple strategic reasons can drive their decisions to buy or sell assets.

Reasons for Buying or Selling:

- Portfolio Rebalancing: Adjusting the portfolio’s composition to maintain a desired risk profile or capitalize on new opportunities.

- Profit Realization: Locking in gains after a period of price appreciation to ensure investment returns.

- Risk Mitigation: Reducing exposure to assets perceived as high risk to protect the overall portfolio from potential downturns.

- Liquidity Requirements: Generating cash flow for operational needs or funding new investment opportunities.

- Regulatory Considerations: Anticipating changes in the regulatory environment that could impact the value of holdings.

- Tax Optimization: Selling assets to optimize tax outcomes, such as offsetting gains with losses elsewhere in the portfolio.

- Macroeconomic Factors: Reacting to global economic trends that suggest better returns might be available in other markets.

- Diversification: Ensuring the portfolio remains diversified across various asset classes to reduce risk.

Looking at the past week’s performance, the positions in RNDR, QNT, and FTM are already in the green. However, the sold-off MASK and FLOKI are also performing well. This outcome raises questions about the long-term effectiveness of the VCs’ strategic decisions. Will the gains from RNDR, QNT, and FTM continue to outpace MASK and FLOKI, or will the decision to reduce positions in MASK and FLOKI ultimately prove less beneficial? Only time will tell.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.