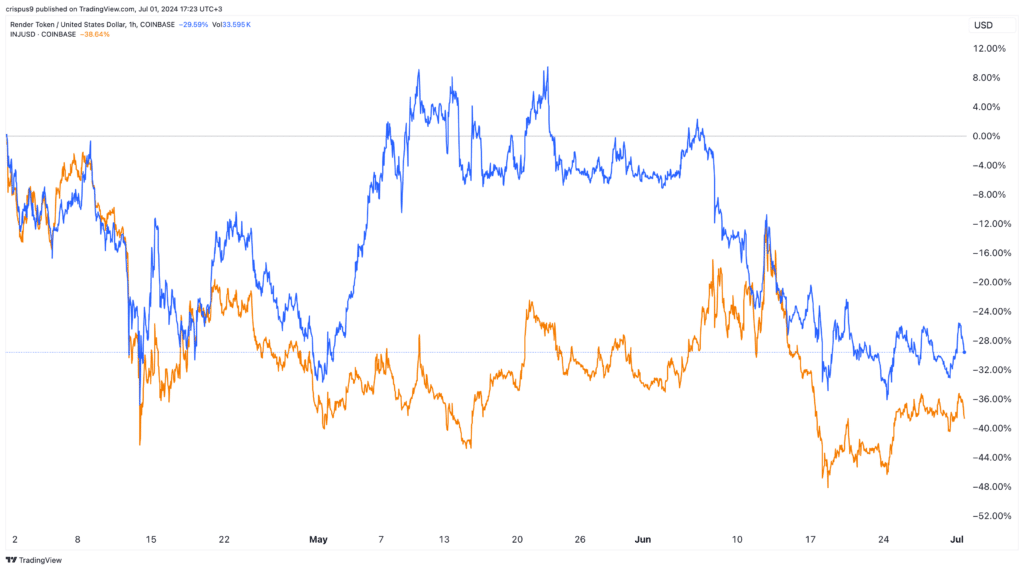

Injective (INJ) and Render Token (RNDR) prices have remained in a bear market since March and prior attempts to bounce faced strong resistance. Render was trading at $7.5605 on Monday, down by over 44% from its highest level this year, giving it a market cap of over $2.9 billion.

Injective, the venture-backed blockchain that made waves in 2023, has crashed by over 56% from the year-to-date high. This drop has brought its market cap from over $4.86 billion in March to $2.14 billion.

These cryptocurrencies have dropped in line with the performance of other meme coins like Cardano, Solana, and Chainlink.

Injective vs Render tokens

Analyst turns bullish on Render and Injective

A well-followed analyst has predicted that INJ and RNDR prices could be ripe for a bullish breakout in the longer term. Sensei, who has over 33k X followers, expects that INJ will jump to $100, meaning that it could soar by over 340% from the current level.

He also expects that Render token will rise to $150, implying a 2,000% surge from the current price. The analyst is also bullish on other tokens like Oasis Network (ROSE) and Bittensor (TAO), which he expects will rise to $2 and $1,000, respectively.

Sensei bases his analysis on fundamentals and technicals. Writing on the Render Token, he noted that it had formed a cup and handle chart pattern on the monthly chart. It had also found a strong support at the upper side of this pattern, raising the possibility of a rebound.

INJ and RNDR have headwinds

Fundamentally, Injective and Render are facing numerous headwinds. Injective, which is a blockchain network for the finance industry, has seen the volume of its assets retreat in the past few months. After peaking at $204 million in March, it has dropped to $114 million, its lowest point since February 17th.

Most big names in the ecosystem like Hydro Protocol, DojoSwap, and Mito Finance have seen their assets drop by over 10% in the past 30 days.

Still, Helix, its biggest DEX, which handled over $59 million in transactions in the past 24 hours. Also, according to the developers, over $1 billion worth of INJ tokens has been staked on chain.

On the other hand, Render Network is seeing strong competition from the likes of Akash Network, a platform that offers decentralized GPUs.

Further, most altcoins are contending with the lack of major market-moving news in the crypto industry. There are also concerns that a new crypto winter like the one that happened from November 2021 to November 2022 could be about to happen.