Mt. Gox’s Bitcoin repayment: Will $9B BTC dump sink prices again?

07/02/2024 22:00

After years of legal wrangling, Mt. Gox, the once-dominant crypto exchange, is sending $9 billion worth of BTC to its creditors.

- Mt. Gox, the infamous bankrupt crypto exchange, is returning $9 billion worth of Bitcoin to creditors.

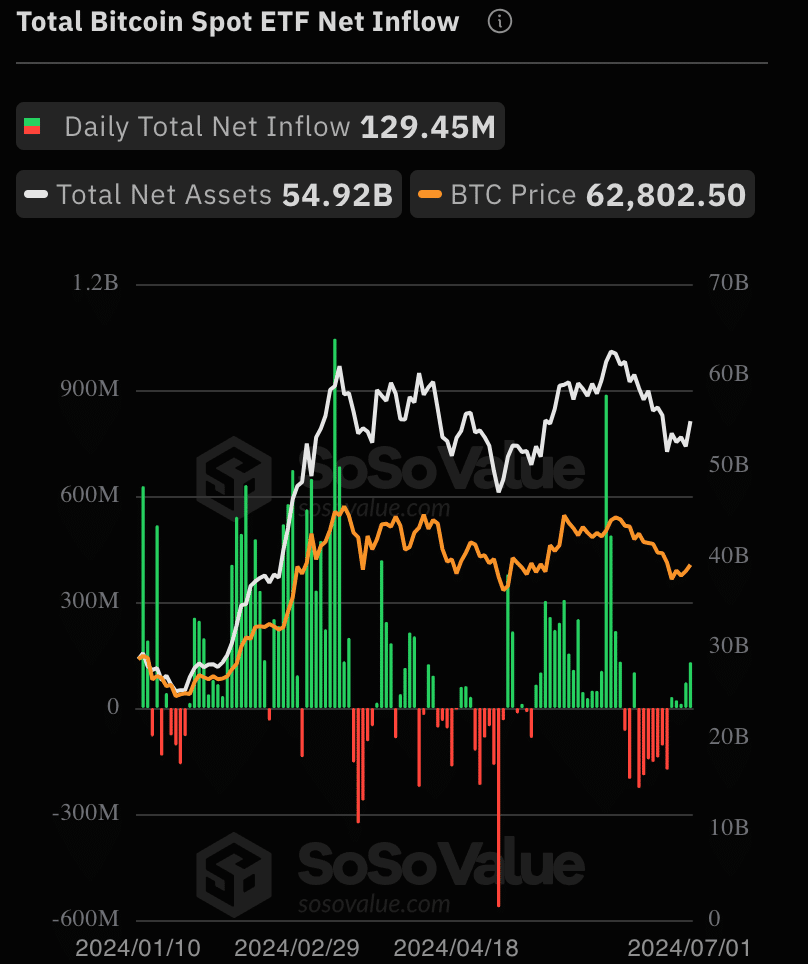

- Interest in Bitcoin ETFs also surged significantly over the last few days.

Bitcoin’s [BTC] recent uptick in price has resulted in a surge of optimism across the crypto markets. However, this optimism could be short-lived.

Will Mt.Gox lead to more loss for Bitcoin?

A decade after a devastating hack, a collapsed Bitcoin exchange is finally returning billions of dollars worth of cryptocurrency to its users.

Mt. Gox, a bankrupt Tokyo-based exchange that once dominated the Bitcoin market, will begin repaying thousands of users in early July.

The payout totals nearly $9 billion in tokens, a fraction of the 650,000 to 950,000 bitcoins stolen in 2014. Back then, those missing coins represented a much smaller sum, but at today’s prices, they would be worth upwards of $59 billion.

This return comes after a long and tedious bankruptcy process riddled with delays and legal hurdles. Finally, on 1st July, the court-appointed trustee overseeing the case announced that distributions to Mt. Gox’s roughly 20,000 creditors would commence.

The repayments will be made in a combination of Bitcoin and Bitcoin cash, an early variant of the original cryptocurrency.

While the long-awaited payout is positive news for users who lost their bitcoins in the hack, it arrives at a concerning time for the crypto market.

Last week, prices plummeted to $59,000, marking the second-worst weekly decline of the year. The mass influx of bitcoins from Mt. Gox could further dampen the price, causing anxiety among some investors.

Not all hope is lost

Even though the Mt.Gox dump may impact BTC prices in the short term, institutional investors and crypto whales haven’t lost interest in BTC. This was showcased by the high number of ETF inflows seen over the last 24 hours.

Bitcoin spot ETFs continued to see inflows on 1st July, extending the streak to five consecutive days. The total net inflow for the day reached $129 million.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Fidelity’s FBTC ETF led the pack with a single-day inflow of $65.034 million. Bitwise’s BITB ETF also saw significant inflows, bringing in $41.4022 million on the same day.

At press time, BTC was trading at $62,788.49 and its price had declined by 0.78% in the last 24 hours. The volume at which it was trading had also grown by 5.5%.