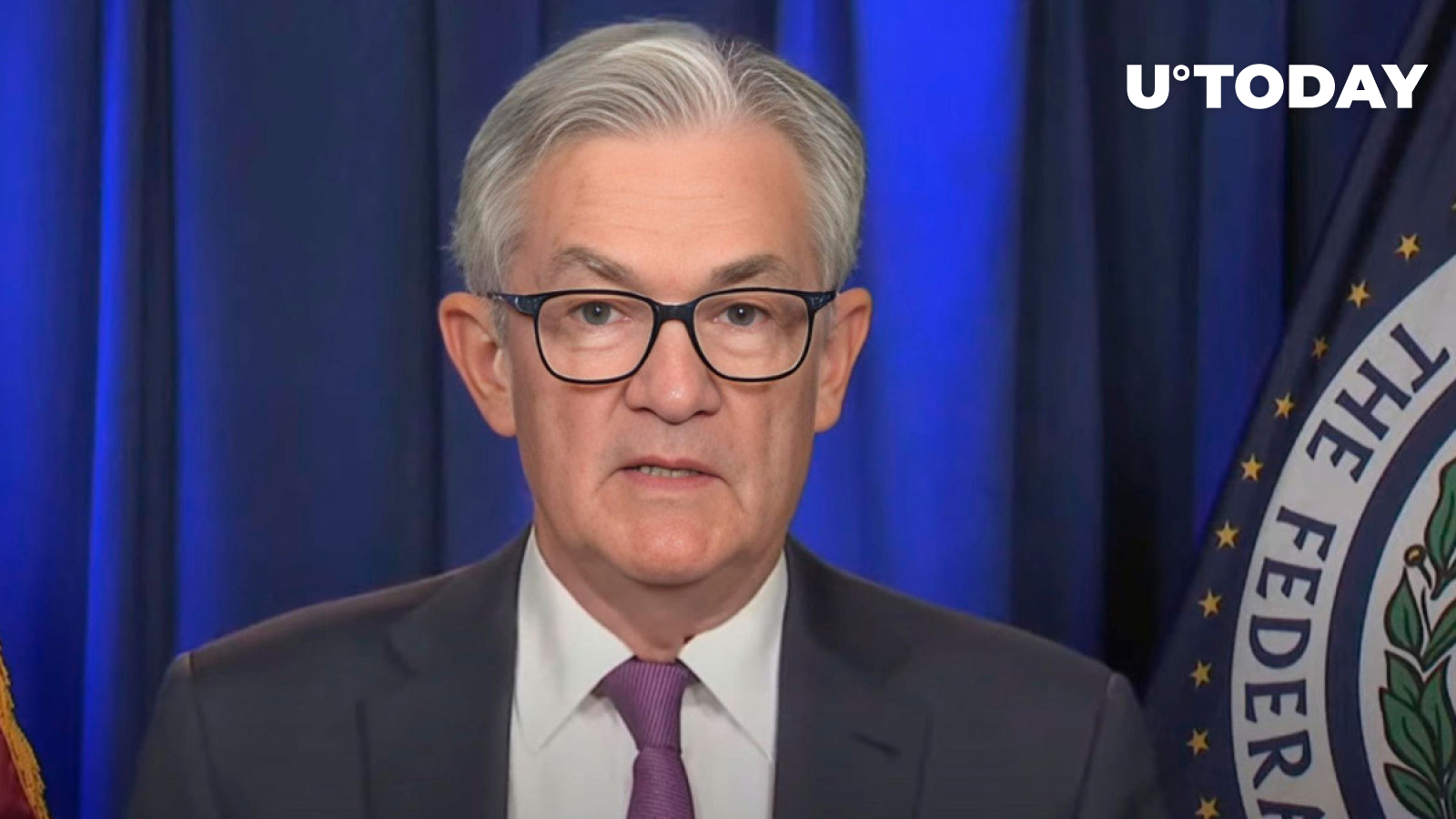

Fed's Jerome Powell Delivers Crucial Message for Crypto Markets

07/03/2024 18:44

Jerome Powell has delivered crucial message that has significant implications for crypto markets

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

Federal Reserve Chair Jerome Powell delivered a crucial message that has significant implications for crypto markets.

Powell spoke at a panel that included European Central Bank President Christine Lagarde and Brazil's Central Bank Governor Roberto Campos Neto.

Powell said that the Federal Reserve has achieved "quite a bit of progress" in its ongoing struggle with inflation. However, Powell emphasized the need for further evidence of sustained progress before considering any reduction in interest rates.

The comments come as markets keep a tight eye on the Fed as inflation appears to be slowing and other central banks, like the ECB, begin to gradually lower interest rates.

Earlier this year, investors anticipated at least six Fed rate decreases of a quarter point each. Market pricing has been adjusted to reflect two drops, one in September and the other before the end of the year.

Crypto market reacts

The crypto markets, known for their sensitivity to macroeconomic indicators, have been particularly attentive to Powell's remarks. Bitcoin fell 3.36% in the last 24 hours to $60,349.

Several cryptocurrencies are also trading in the red, with losses ranging from 2% to 13%. Following Powell's remarks on the economy, sentiment appeared to worsen.

Markets have somewhat reduced the odds of a rate cut at the Fed's Federal Open Market Committee (FOMC) meeting in September, which remain around 65%.

Going forward for Bitcoin price action, a break below $58,000 to $60,000 would result in a significant amount of short-term holders (STHs) losing money and trading below the 200-day moving average, according to Glassnode. Price activity between $60,000 and $64,000 continues the current sideways pattern of market hesitancy.