Litecoin holders move to sell 928 million LTC: Will prices drop below $70?

07/04/2024 01:00

In the last seven days, the price of Litecoin [LTC] has increased by 4.18%, trading at $74.64. However, all these gains could get erased.

- About $70 million worth of LTC are in line to be sold, possibly plunging the price below $70.

- Network activity also dropped, while Litecoin could also be overvalued.

In the last seven days, the price of Litecoin [LTC] has increased by 4.18%, while trading at $74.64. However, all these gains could be erased if coin holders decide to go ahead with confirming the sell orders on exchanges.

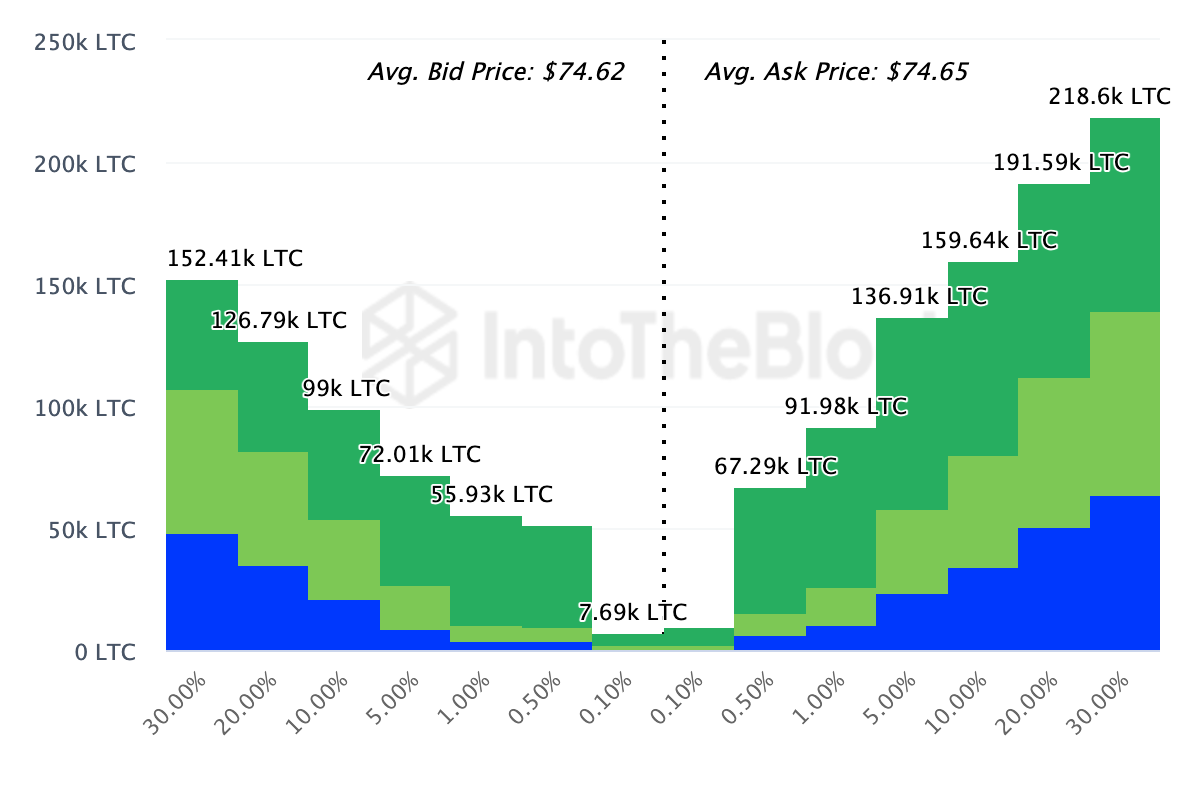

According to IntoTheBlock, the Exchange On-Chain Market Depth shows that more coins are lined up on the ask side. In trading terms, to ask is to sell, while to bid is to buy.

Litecoin holders are ready to liquidate

As seen below, the number of LTC on the bid side was significantly lower. Specifically, about 928,200 coins, valued at nearly $70 million, will be sold once Litecoin hits $74.65.

If this happens, the price of the coin could fall, with possible targets between $72 and a little lower than $70. AMBCrypto found another metric supporting a price decrease for the coin.

This time, it was the Network Value to Transaction (NVT) ratio. This metric considers the relationship between the market cap and transactions on a network.

When the market cap is growing faster the volume, the NVT ratio rises. In this case, the network is overvalued.

However, if the volume outpaces the market cap, the NVT ratio falls, indicating that the network is undervalued.

At press time, Litecoin’s NVT ratio had jumped, according to Glassnode data. Therefore, it is not out of place to mentioned that, relative to the current market condition, LTC is overvalued.

Therefore, the price of the cryptocurrency could decrease in the short term. Apart from the metrics above, AMBCrypto also examined Litecoin’s MVRV ratio.

More profits, more issues

MVRV stands for Market Value to Realized Value. It measures profitability of holders with respect to valuation. If the MVRV ratio is at an extremely high level, the coin could be termed overvalued.

However, if the reading is negative, it is undervalued and could offer a good buying opportunity. At press time, Litecoin’s 30-day MVRV ratio was 14.10%. This means that if all LTC holders sell, the average return will be around 14%.

When looking at it from the lens of the broader market condition, which has seen most cryptos trade sideways, LTC could be overvalued. In addition, we examined the active addresses on Litecoin.

According to Santiment, Litecoin’s 24-hour active addresses was down to 401,000. When active addresses increases, it means that unique addresses are increasingly making transactions.

Realistic or not, here’s LTC’s market cap in BTC terms

However, a decrease suggests otherwise. The number of active addresses on the network was a notable decline from what it was during the last week of June.

Should the network activity continue to drop, demand for LTC will mostly likely decrease. If this is the case, the price may have no option than to decrease. But if buying pressure increase, Litecoin’s price may rebound.