What this whale’s latest dump means for ETH, AAVE, and UNI’s prices

07/04/2024 19:00

On 3 July, on-chain analytics firm Lookonchain revealed that a single whales/institution sold millions worth of Ethereum-based tokens...

The recent update on Spot Ethereum ETFs (Exchange Traded Fund) by Nate Geraci, the President of ETF Store, has gained massive attention from investors and institutions. According to his post on X, the United States Securities and Exchange Commission (SEC), which was likely to greenlight the launch of these products by 2 July, has postponed the decision to mid-July.

Following this update from Geraci, a massive sell-off was seen across several Ethereum-based tokens.

Whales dump LDO, AAVE, and UNI tokens at a loss

On 3 July, on-chain analytics firm Lookonchain revealed that a single whales/institution sold millions worth of Ethereum-based tokens including Lido DAO (LDO), Aave (AAVE), UniSwap (UNI), and Frax Share (FXS). According to the data, they sold 3.13 million LDO worth $5.77 million, 49,771 AAVE worth $4.54 million, 269,177 UNI worth $2.41 million, and 250,969 FXS worth $708K – All at a loss.

Following this market dump, the tokens’ price plunged significantly. According to CoinMarketCap, for instance, LDO registered a 14% price drop, AAVE depreciated by 9%, UNI declined by 5%, and FXS lost 12% of its value.

Here, it’s worth pointing out that the whale initially spent over $73 million to buy Ethereum (ETH) and related tokens, following the approval of the spot Ether ETF form 19b-4 in May 2024. Besides this massive dump, the whale still holds a 3.33 million LDO worth $5.83 million and 31,191 AAVE worth $2.8 million.

Ethereum’s (ETH) price following ETF update

This massive dump is a sign that if the U.S SEC delays or postpones spot Ether ETFs once again, we may see another massive sell-off in ETH and related tokens in the coming days. In fact, following the ETF update, the Head of Asset Management giant Galaxy Digital, Steve Kurz, told Bloomberg that the U.S SEC could potentially approve spot Ether ETF within the next couple of weeks.

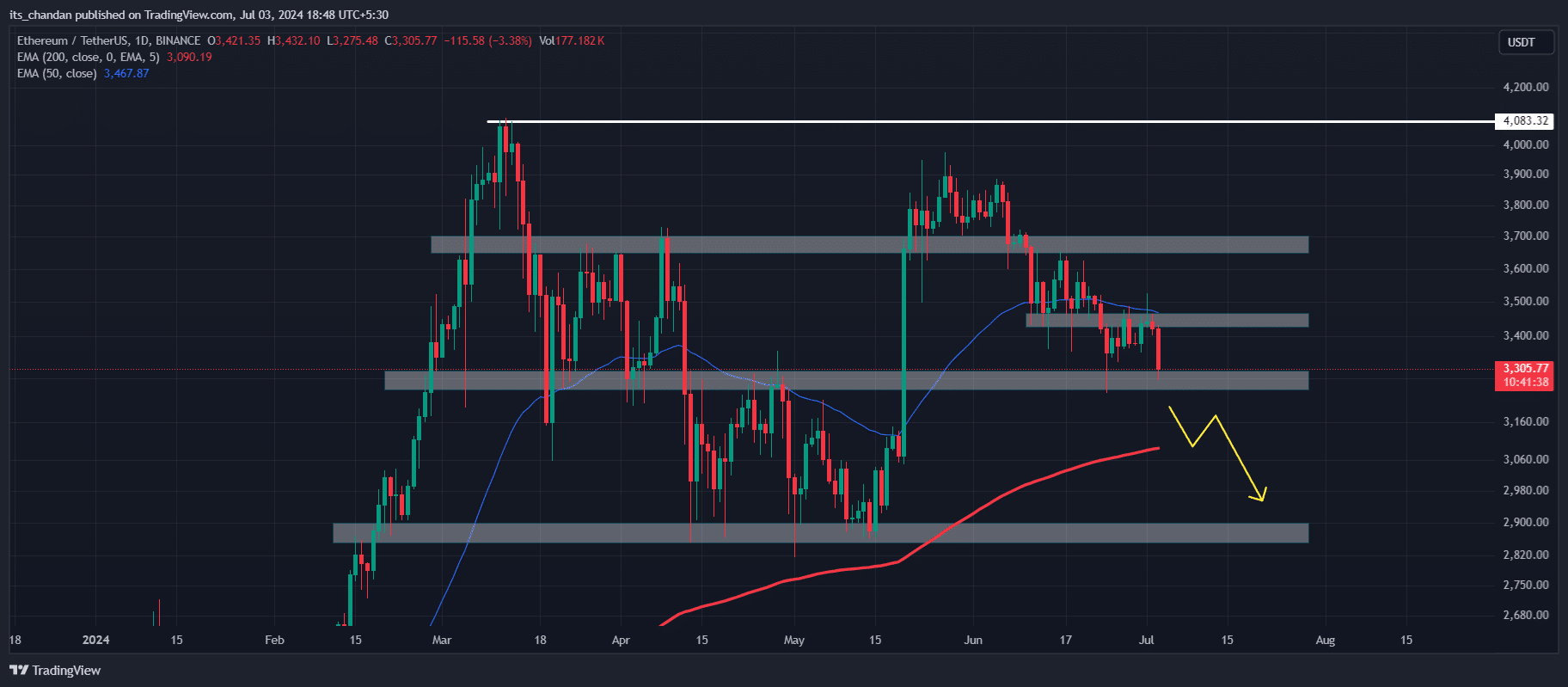

On the price charts, ETH seemed to be close to its crucial support level of $3,250 and below the 50 EMA (Exponential Moving Average). If ETH fails to sustain this level, we could see a massive downside move to the $2,870 level in the coming days.

Despite the optimism around Spot Ether ETFs, along with other Ether-based tokens, ETH also recorded a price drop of 5% in the last 24 hours.