Hedera (HBAR) Price Eyes $0.57 as Downtrend Strengthens

07/05/2024 00:30

If buying momentum remains low, Hedera (HBAR) risks falling to a price level last observed in November 2023.

HBAR, the native cryptocurrency of the Hedera Hashgraph network, has witnessed a 31% price decline in the past seven days.

It is at risk of plummeting to an eight-month low if the market downtrend continues to gain momentum.

Hedera Bears Dominate Market

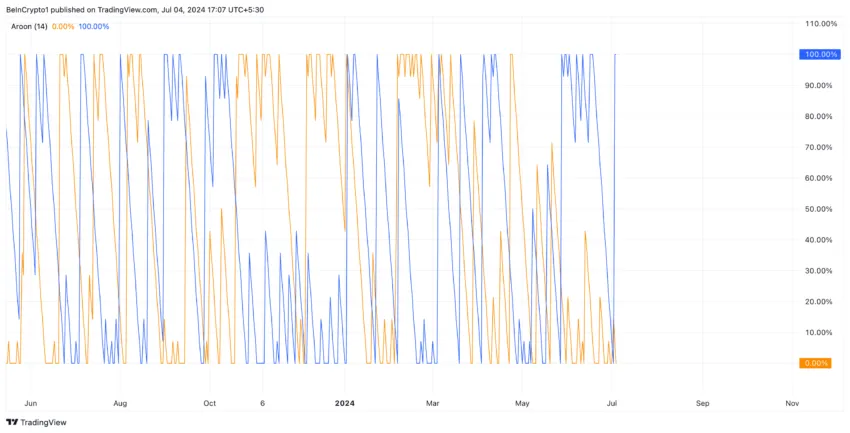

According to Hedera’s Aroon Indicator, its price decline is significantly strong. As of this writing, the altcoin’s Aroon Down Line (blue) is 100%.

An asset’s Aroon Indicator measures its trend strength and identifies its potential price reversal points. When the Down Line is at 100, it indicates that the downtrend is strong and that the most recent low was reached relatively recently. This is a bearish signal, suggesting that sellers are in control and the price may continue to decline.

Conversely, HBAR’s Aroon Up Line is at 0% at press time. This indicates weak attempts to initiate an uptrend and that the coin’s most recent high was reached long ago.

Read More: What Are Tokenized Real-World Assets (RWA)?

Further, the decline in HBAR’s spot price has negatively impacted activity in its derivatives market. The coin’s futures open interest has steadily declined since it rallied to a year-to-date peak of $147 million on April 25.

At $38 million at press time, the altcoin’s futures open interest has decreased by 27% in the last month alone.

An asset’s futures open interest measures the total number of outstanding futures that have not been settled. When it declines, more traders are exiting their positions without opening new ones. This is a bearish signal, highlighting a decline in activity in an asset’s derivatives market.

HBAR Price Prediction: More Losses Ahead

At press time, HBAR trades at $0.069. Its Chaikin Money Flow (CMF) is negative, confirming a possible decline below the $0.06 price territory.

This indicator measures money flow into and out of an asset’s market. A negative CMF value signals market weakness and liquidity exit, indicating that the asset’s price will continue to drop.

If this happens, readings from HBAR’s Fibonacci retracement show that the coin’s value may drop to $0.057.

Read More: Real-World Asset (RWA) Backed Tokens Explained

However, if buying activity witnesses a resurgence, the coin’s value may rally to $0.070.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.