Bitcoin: ‘Resilient asset’ or more declines ahead? Differing views emerge

07/05/2024 07:00

Bitcoin is currently trading at $57K, showing a 4% decline in the past 24 hours, indicating bearish sentiment.

- Bitcoin’s volatility may push the price to $50K despite market optimism.

- Investor sentiment was divided over buying the dip.

Despite rumors of Bitcoin [BTC] potentially crossing the $70K mark in the near future, the current price trajectory of the leading cryptocurrency was concerning.

However, many remain unconcerned. Notably, Anthony Pompliano, in a recent conversation with Fox Business, said,

“I think that retail investors and institutions have both realized that Bitcoin is a resilient asset that’s going to be worth a lot more 5 or 10 years from now than it is today and therefore when there are these dips they look at them as buying opportunities.”

Echoing similar sentiment was X (formerly Twitter) account Bitcoin for Freedom.

“If this dip makes you scared you need to study #bitcoin more.”

The recent market fluctuations have reignited the classic “buying the dip” strategy, attracting traders and investors eager for potential bargains.

There are contrasting views

Yet, this optimistic approach isn’t common. Markus Thielen, CEO of 10x Research, expressed a more cautious stance in a separate post, suggesting that the current timing might not be ideal for such optimism.

In his recent blog post, Thielen claimed,

“Price declines could accelerate as support gets broken and sellers scramble to find liquidity. Only ill-informed traders are willing to buy here. Breaking this support could cause a sharp decline to the low $50,000s.”

Thielen had the same views a few months ago, wherein he had noted,

“Buying this dip is still too early. Technically, we still expect Bitcoin to trade below 60,000 before a more meaningful rally attempt is started.”

It remains to be seen whether Bitcoin will defy Thielen’s prediction or validate it by dropping to $50K.

Bitcoin’s recent market trends

According to CoinMarketCap, at press time, BTC was trading at $57,730.17, marking a 4% drop in the past 24 hours.

Also, Spot Bitcoin Exchange Traded Funds (ETF) recorded an outflow of $20.5 million on the 3rd of July.

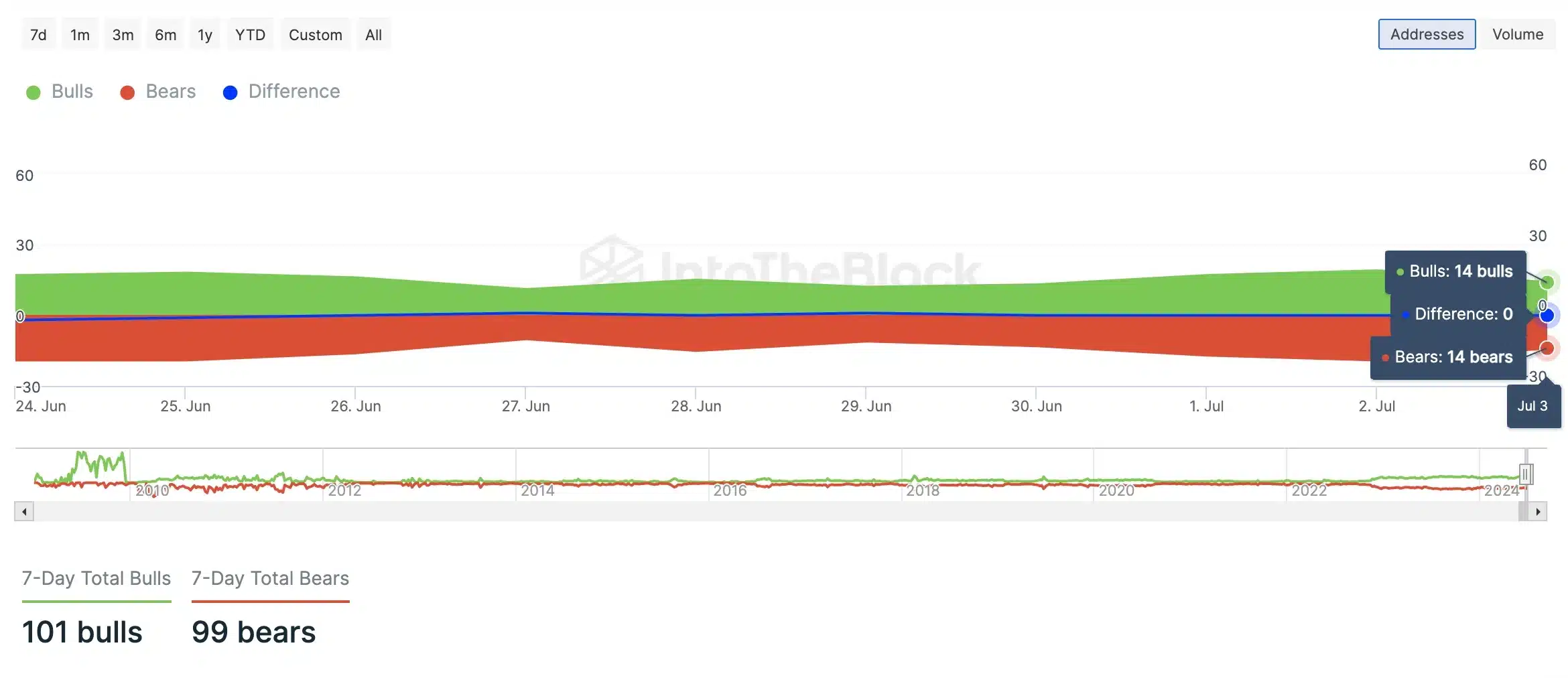

However, IntoTheBlock’s Bears and Bulls data showed no clear dominance of either side. As of the 3rd of July, bulls and bears were evenly matched, indicating no significant buying or selling pressure.

In fact, while examining the BTC ETF flow data for July, we see that inflows have outpaced outflows within just three days of trading.

On the 1st of July, BTC ETFs recorded inflows worth $129.5 million, significantly higher than the combined outflows of $34.2 million on 2nd and 3rd July.

Notably, June saw maximum outflows for BTC ETFs, but as Q3 began, there were signs of improvement.