Spot Bitcoin ETFs Turn Negative as BTC Price Tumbles

07/06/2024 04:41

IBIT, FBTC, among others were in negative territory as bitcoin sank below $54,000.

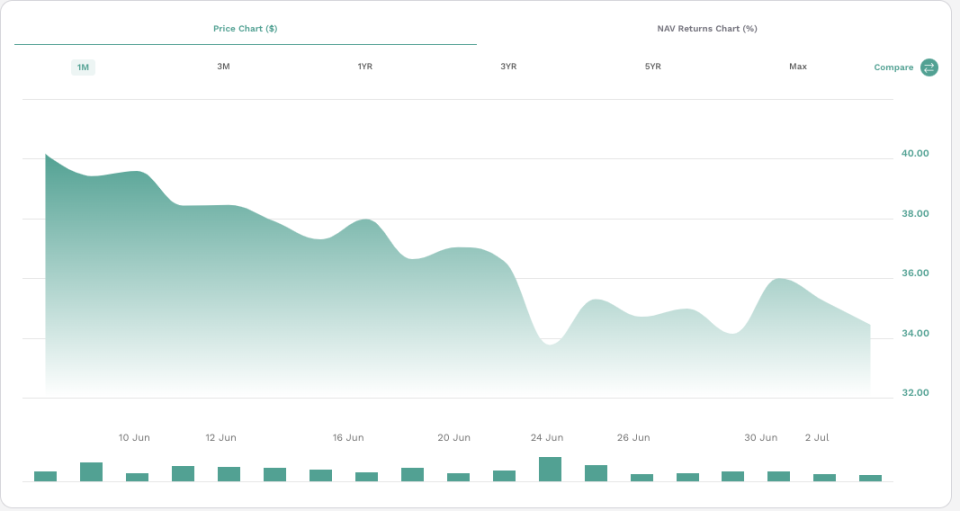

Spot bitcoin ETFs fell well into negative territory in early Friday trading as the price of their underlying asset plunged to its lowest levels since February.

The BlackRock Bitcoin Trust (IBIT), the largest fund in the category with more than $19 billion in assets, was recently down about 6.5%, according to etf.com data. The second and third largest spot bitcoin ETFs, the Grayscale Bitcoin Trust (GBTC) with $17.5 billion in AUM and Fidelity Wise Origin Bitcoin Fund (FBTC) with $10.6 billion in AUM, were down similarly.

Spot Bitcoin ETF Flows Follow BTC Price

GBTC had more than $34 million in outflows the two trading days prior to the July 4 U.S. holiday, while net flows to IBIT and FBTC, and the other eight spot bitcoin ETFs that started trading earlier this year, have been tepid, according to research from U.K.-based asset manager Farside Investors.

Read More: Spot Bitcoin ETF Outflows Surpass $1.1B in 7-Day Streak

Bitcoin dipped to about $53,600 on July 4, the first time since Feb. 25 that the largest crypto by market value has fallen below $54,000, according to crypto markets data provide CoinMarketCap. The asset regained some lost ground to more recently change hands at roughly $56,750 but is off 23% from its all-time high above $73,000 in March.

"Bitcoin is breaking significant technical and psychological levels at $60,000," wrote crypto research group 10X in a July 4 note. "This is a key level for Bitcoin miners and Bitcoin Spot ETF buyers, and it also broadly marks the bottom (support) of the three-month trading range. Price declines could accelerate as support gets broken and sellers scramble to find liquidity."

The latest decline comes amid continued liquidations by miners and other large bitcoin holders, including Germany and the U.S., which have recently sent more than $700 million bitcoin seized to exchanges. Spot bitcoin ETFs manage about $50 billion in assets, with the total fluctuating according to bitcoin's price.

In a note to etf.com, Mark Connors, managing director, head of global macro strategy at Onramp, a Dallas-based, crypto services firm, questioned how investors would react to the months-long bitcoin price slump.

Read More: Pantera Eyes $100M of Spot Ether ETF Shares

BTC Price Tailwinds Remain

"While the spot ETF flows have slowed and reversed a bit, this new class [of investors] has held tight for the most part," Connors wrote. "However, if BTC breaches $50K, the resolve of the 'class of 2024' may be tested as the majority" of the more than $15 billion of spot BTC ETF inflows occurred at about the $40K to $60K BTC (levels)."

Still, Connors said that an improving regulatory framework for crypto, favorable utterances by likely Republican Presidential nominee Donald Trump remain tailwinds supporting his firm's year-end price target of $110,000 for bitcoin.