Fetch.ai (FET) Attracts Whales Ahead of ASI Transformation

07/06/2024 05:00

Fetch.ai's price is mostly witnessing the effect of the anticipation surrounding the merger of OCEAN, AGIX and FET into ASI.

Fetch.ai’s (FET) price is no longer Fetch.ai’s price; it is the price of the Artificial Superintelligence Alliance.

As Ocean Protocol (OCEAN) and SingularityNET (AGIX) merged into Fetch.ai (FET), their collective identity has been converted into ASI.

Whales Welcome Fetch.Ai’s Conversion Into ASI

Fetch.ai’s price was expected to rise ahead of July since the token merger commenced this week, with a projected completion by mid-July. The Artificial Superintelligent Alliance will trade under the FET ticker during this transition. With a current market capitalization nearing $3 billion, it has emerged as the second-largest asset in the AI token market.

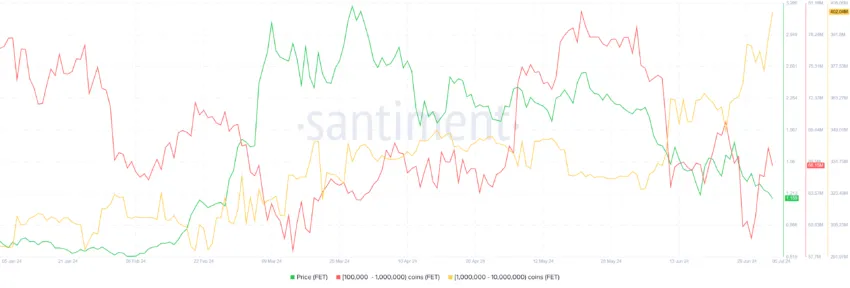

FET whales noted the profit opportunity this presented and jumped to accumulate as much as they could. Within a week, the addresses holding between 100,000 and 10 million FET added more than 62 million FET worth close to $73 million.

These investors expect a price surge following the merger’s completion, resulting in profits.

However, optimism is not limited to whales; it is also shared by retail investors. The weighted sentiment has been largely positive, with Fetch.ai noting mentions across social media platforms.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

Their optimism reflects the bullishness surrounding ASI and its potential in the near future.

FET Price Prediction: Breaking out of the Consolidation

Fetch.ai’s price was expected to reap the bullishness arising out of the merger, but the broader market cues countered this. As a result, FET is still consolidated between $1.7 and $1.0, and it has been continuing for nearly a month now.

This consolidation will continue in the coming days as well until the merger is completed, and the resulting bullishness will help FET break out of it.

Read More: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

Although the altcoin has shown signs of potential decline and losing the lower limit of $1.0, it cannot be ruled out completely. If this happens, the bullish thesis would be completely invalidated.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Aaryamann Shrivastava is a technical and on-chain analyst at BeInCrypto, where he specializes in market reports on cryptocurrencies from diverse sectors, including Telegram Apps, liquid staking, Layer 1s, meme coins, artificial intelligence (AI), metaverse, internet of things (IoT), Ethereum ecosystem, and Bitcoin. Previously, he conducted market analysis and technical assessments of various altcoins at FXStreet and AMBCrypto, covering all aspects of the crypto industry, including...

Aaryamann Shrivastava is a technical and on-chain analyst at BeInCrypto, where he specializes in market reports on cryptocurrencies from diverse sectors, including Telegram Apps, liquid staking, Layer 1s, meme coins, artificial intelligence (AI), metaverse, internet of things (IoT), Ethereum ecosystem, and Bitcoin. Previously, he conducted market analysis and technical assessments of various altcoins at FXStreet and AMBCrypto, covering all aspects of the crypto industry, including...

READ FULL BIO