WIF price prediction – Examining if a local bottom might be finally in

07/07/2024 00:00

dogwifhat [WIF] saw turbulence on the price charts over the past week as Bitcoin [BTC] tumbled below the $60k-mark. This suggested that...

- Market structure and momentum on the daily chart were bearish

- There was evidence of buying pressure over the last ten days

dogwifhat [WIF] saw turbulence on the price charts over the past week as Bitcoin [BTC] tumbled below the $60k-mark. An AMBCrypto technical analysis report had noted then that WIF’s bearish trend was strongly in place, but a bounce to $2.3 can be expected.

This came to pass, with the memecoin reaching the $2.37-mark on Tuesday, 2 July. Since then, the bears have driven prices south once more. Will we see the downtrend resume, or can the bulls muddy the waters over the weekend?

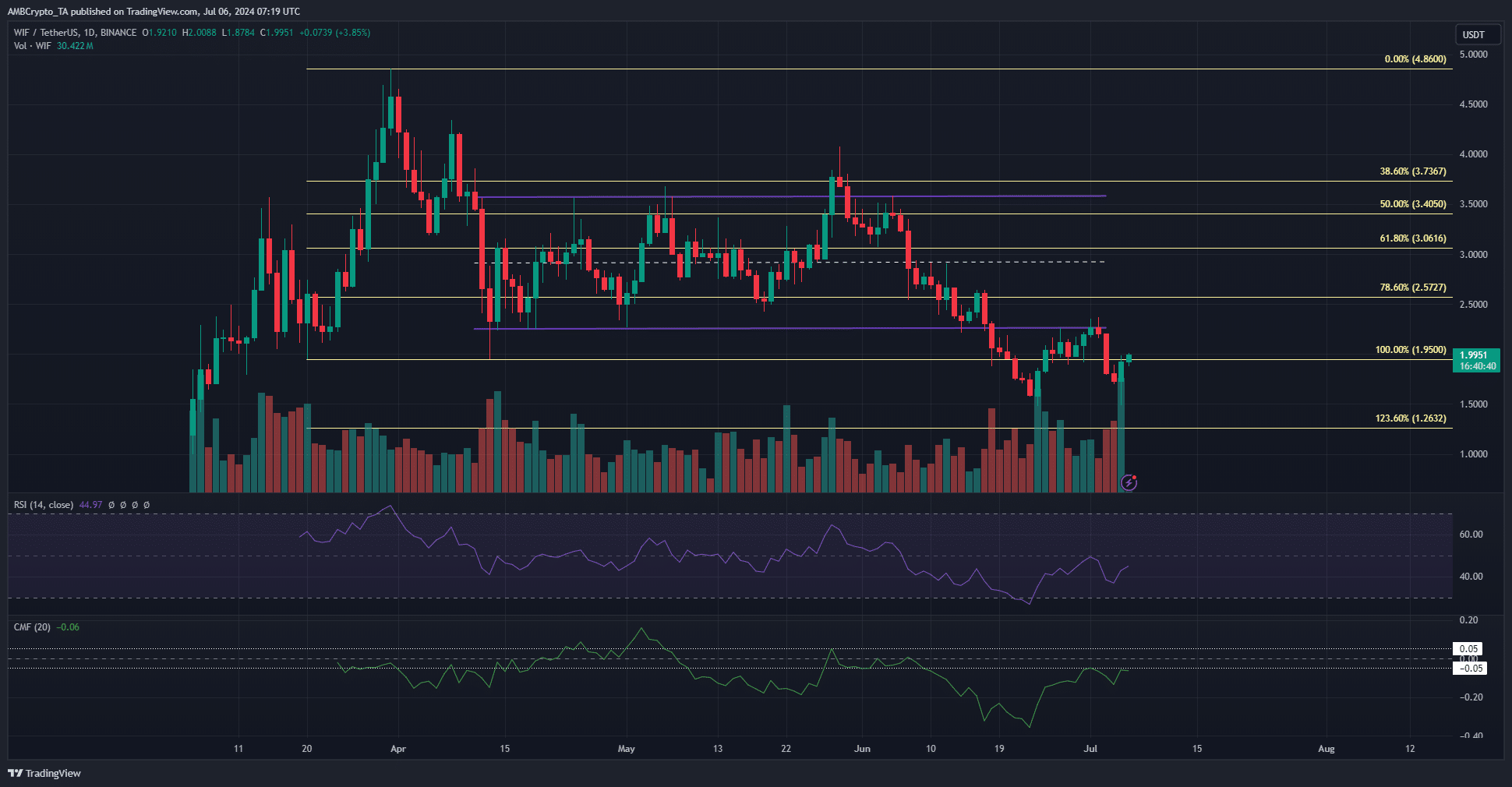

Potential for a short-term range formation under the older one

Over the last two weeks, the price has oscillated between $1.5 and $2.34. This, after the memecoin broke below the three-month range marked in purple between $2.26 and $3.58. At press time, the RSI showed momentum was bearish with a reading of 45.

The CMF was zigzagging just below the -0.05-mark. This indicated selling pressure was dominant, but the bulls posed some threat and might succeed in changing this.

The price action on the daily timeframe remained firmly bearish and seemed likely to form new lows and drop towards $1.26. That being said though, the $1.5 and $2.34-levels might see another range established. Unless these levels are beaten, traders should expect the range to continue.

Spark of hope for buyers amidst the price losses

The spot CVD had been on a downtrend until the final week of June. Soon after, however, it turned a corner and began to trend higher.

The past week saw the CVD pushed lower, but the indicator had already begun to recover from this at press time.

Realistic or not, here’s WIF’s market cap in BTC’s terms

Finally, the Open Interest showed that bulls were not afraid to bid during WIF’s price hikes. This bravery might be rewarded if an uptrend is established. However, based on the evidence at hand, neither bulls nor bears seemed to have the advantage in the short term.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.