How and why DOT’s whales dictated altcoin’s 9% price hike

07/07/2024 02:00

Polkadot's (DOT) large transactions have captured the attention of the crypto community. In fact, according to reports, the altcoin has...

- DOT’s price surged by 9.73% in 24 hours following weeks of decline

- Surge came on the back of high whale activities, with large transactions and staking

Polkadot’s (DOT) large transactions have captured the attention of the crypto community. In fact, according to reports, the altcoin has seen a 33% hike in transactions, despite DOT’s low price. That wasn’t all though, with Polkadot Watch tweeting,

“50,000 $DOT ($291,500 USD) was transferred from unknown wallet to unknown wallet.”

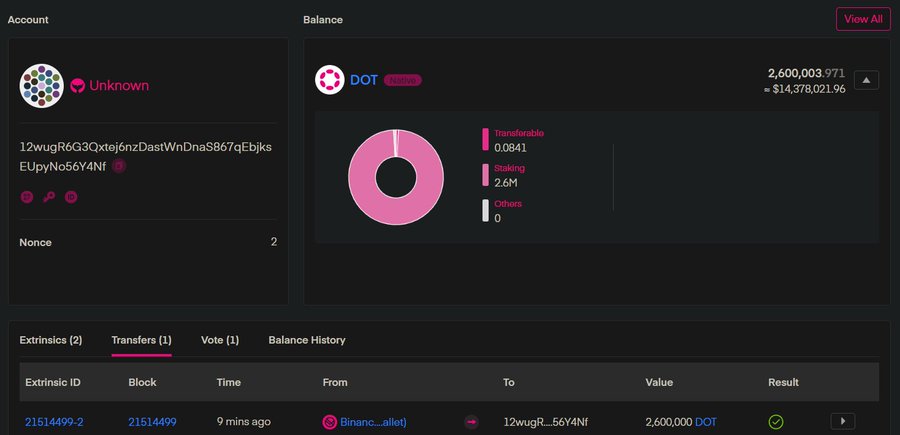

Equally, DOT has also recorded a widespread surge in staking as whales continue to do so. According to Toni Bitcoin’s post on X (formerly Twitter), DOT has received $2.6M in staking.

“Polkadot received in staking 2,600,000 of $DOT ($14,378,021.96) as Whales continue to buy $DOT and put it in #staking.”

What’s driving whale activity?

These activities have spurred speculations about what is driving higher investments in DOT. One notable factor driving whale activities and higher staking for DOT is the speculation around a DOT ETF.

According to Voice Lark, there is positive market sentiment because of a potential DOT ETF application by Coinbase.

” Coinbase Plans Polkadot ETF, Signaling Potential Boost for DOT Price and Popular Altcoins.”

Prevailing market sentiment

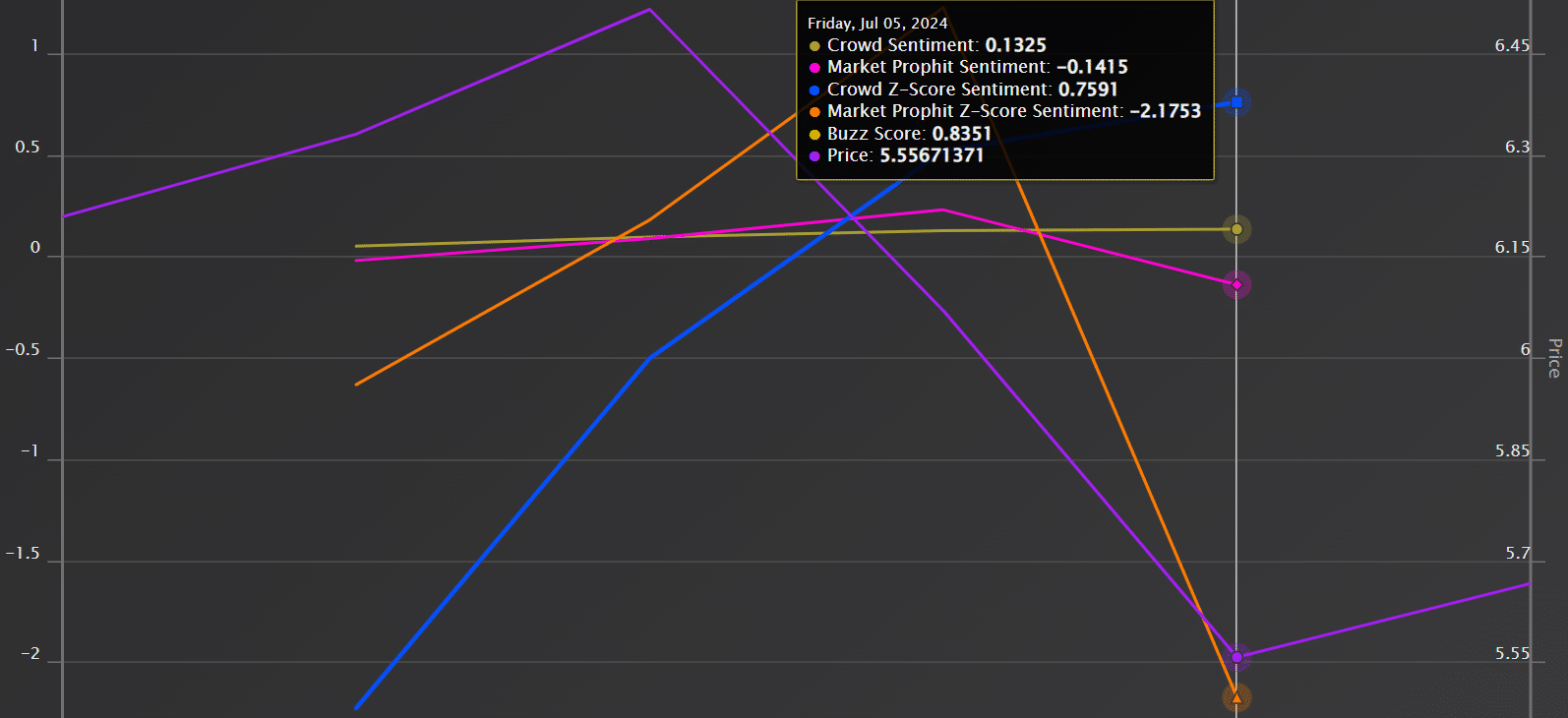

AMBCrypto ‘s analysis of DOT’s market sentiment indicated that it has been largely positive lately.

To be specific, the crowd sentiment was positive at 0.1325, the z score was 0.75, and the buzz was 0.83. Simply put, the crowd seemed to be optimistic about DOT’s prospects on the price charts.

Indicators and price charts

At the time of writing, DOT was trading at $5.87 after a 9.73% hike in the last 24 hrs. Despite the price rise, however, trading volume fell by 8.20% over the same period.

Additionally, Polkadot’s RSI had a reading of 46 after crossing RSI-based MA at 44 from below – A sign of an uptrend. A rising RSI usually implies strengthening momentum, with reduced selling pressure across the board.

Additionally, the On Balance Volume surged over the last 7 days from -$2.7M to $949k at press time. When the OBV rises, it means buying pressure may be outweighing selling pressure.

This is a bullish signal as a higher OBV often precedes rising prices.

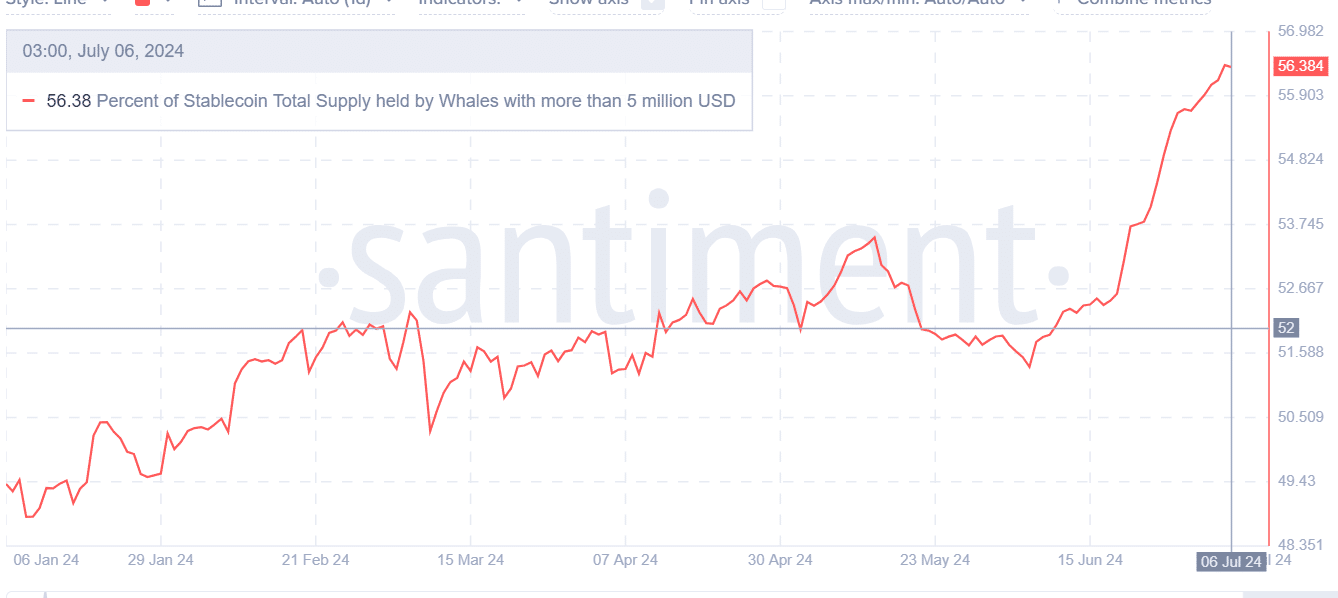

Also, according to Santiment, the total supply held by whales climbed from $48M to $56.3M in the last 7 days. Increasing whale accumulation shows long-position holders’ confidence in the altcoin’s direction and future potential.

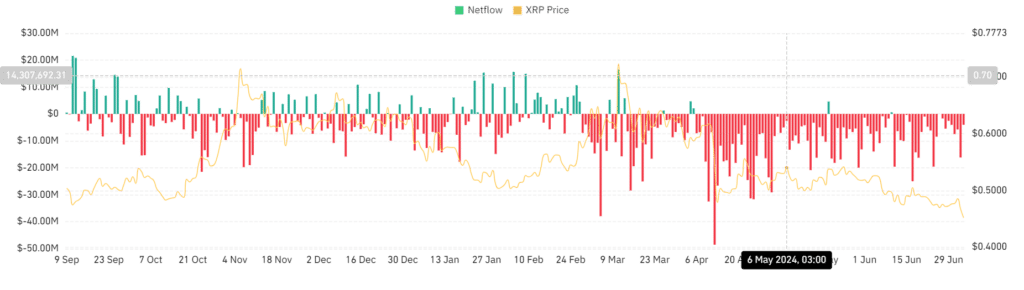

Source: Coinglass

Finally, DOT had a negative net flow of -$124.76k at press time, after negative outflows over a period of 4 days.