Bitcoin whales ‘buy the dip’ to leave retail investors…

07/07/2024 12:00

Bitcoin [BTC]'s latest price crash shocked the crypto markets as a whole. However, even though many market bulls suffered major losses...

- Bitcoin whales accumulated significant amounts of BTC amidst market volatility

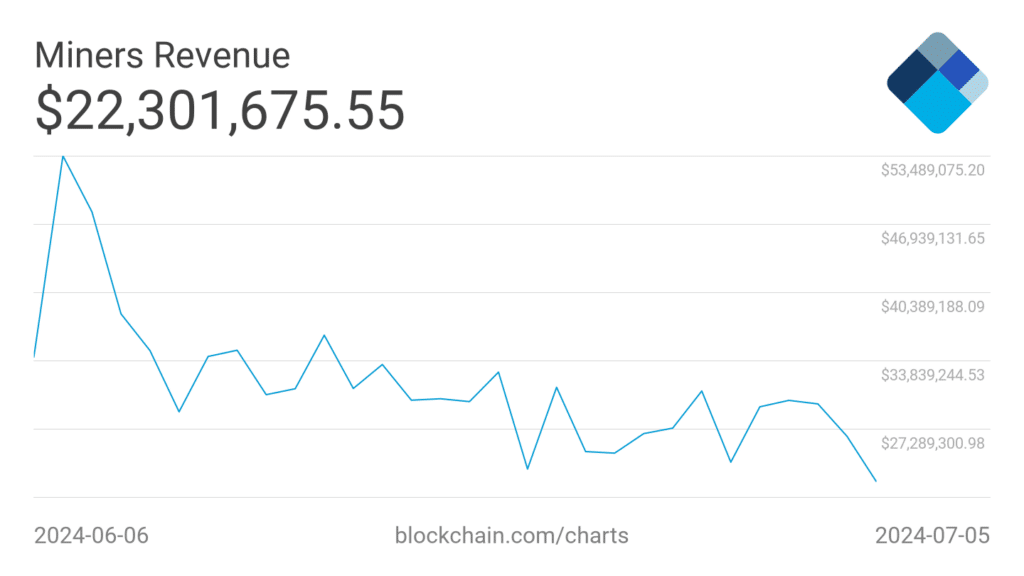

- Miner revenue fell, resulting in significant selling pressure on the crypto

Bitcoin [BTC]‘s latest price crash shocked the crypto markets as a whole. However, even though many market bulls suffered major losses, some addresses gained from the cryptocurrency’s recent correction.

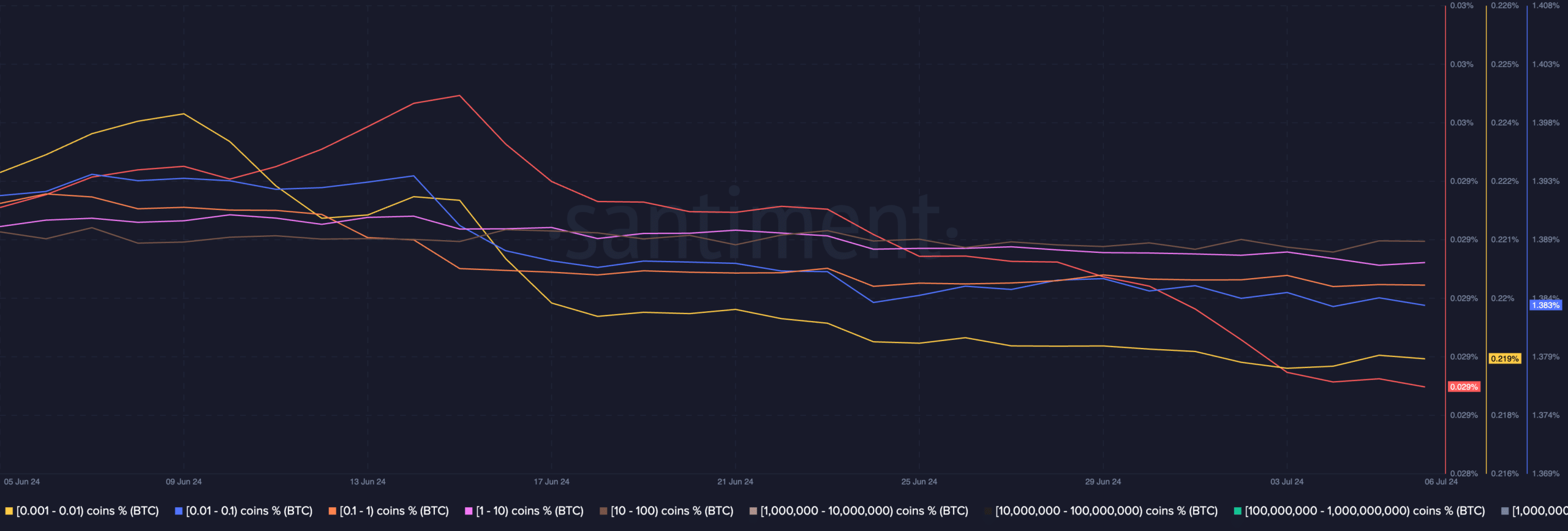

Wallets holding more than 10,000 Bitcoin have been major beneficiaries of the recent market volatility. These large addresses, believed to be primarily owned by exchange liquidity providers, significantly bolstered their holdings over the past six weeks. By some estimates, these addresses amassed an additional 212,450 BTC, representing a 1.05% hike in their share of the total Bitcoin supply.

The actions of these large wallets can be seen as a sign of confidence in Bitcoin’s long-term potential. This positive sentiment might attract other investors to the market, further boosting the price. This may also help BTC regain previously achieved levels and may help it hit the $60,000-level, if there is no additional selling pressure.

However, this is a double-edged sword. If whales continue to collect large amounts of BTC, it might impact the centralization of BTC. These whale addresses will have a lot of power and could manipulate BTC prices, depending on their behavior. This could leave retail investors vulnerable, especially when these whales decide to sell their holdings.

Another concerning factor is the fact that retail investors have not been showing the same level of enthusiasm as whales.

AMBCrypto’s analysis of Santiment’s data revealed that the number of retail addresses in the 0.1 BTC to 1 BTC cohort did not show any interest in buying BTC. If sustained over the long term, this can fuel centralization and leave retail investors at the mercy of whale addresses.

How are miners holding up?

While whale interest might temporarily buoy Bitcoin’s price, struggling miners could exacerbate selling pressure. Daily miner revenue has fallen considerably in recent days, highlighting their financial strain. This decline in revenue could incentivize miners to sell their BTC holdings to cover operational costs, putting downward pressure on the price.

Read Bitcoin’s [BTC] Price Prediction 2024-25

At press time, BTC was trading at $56,741.70, with its price up by 2.8% in the last 24 hours. Despite its lukewarm recovery though, the crypto’s volume fell by over 37% in the aforementioned period.

If this remains consistent over the next week or so, it will be difficult for BTC to break past $60,000 on the charts.