What to Expect From Bitcoin (BTC) This Week

07/08/2024 15:16

How low can BTC price drop during this cycle?

Contents

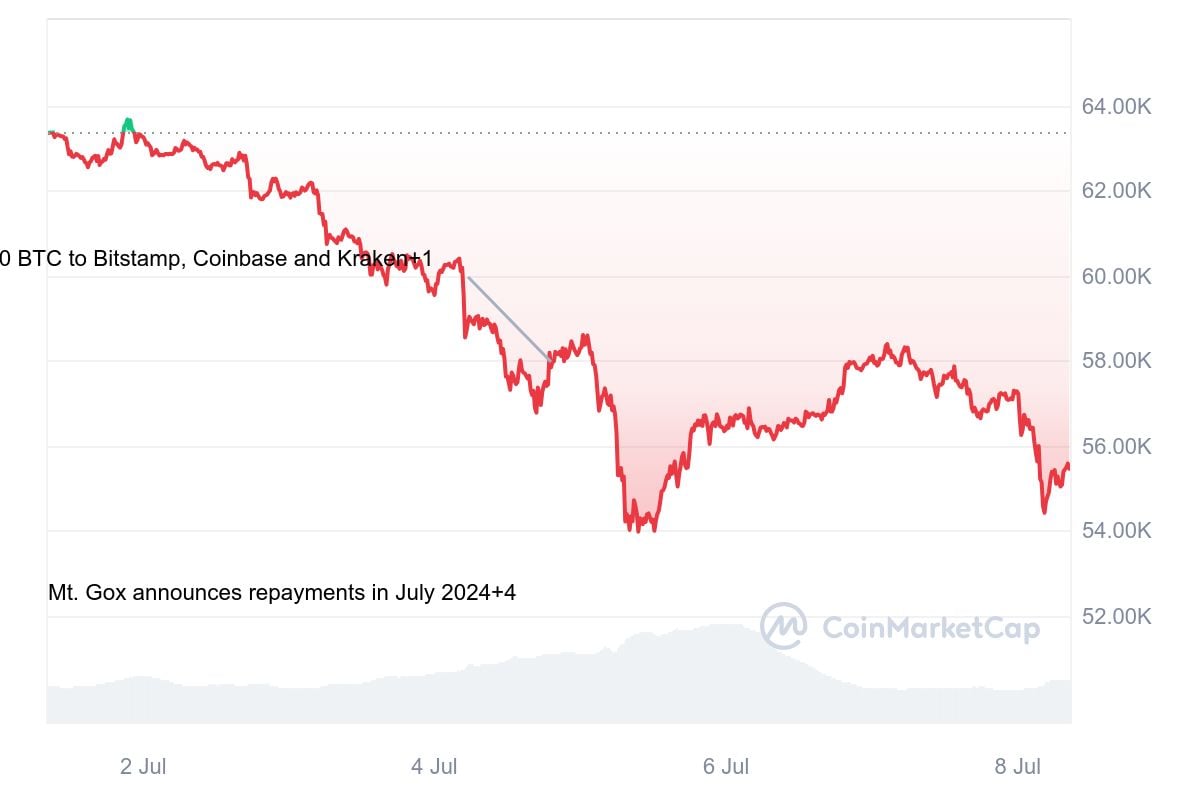

This past week, Bitcoin has plummeted over 10.5% to around $57,000. At its lowest, BTC touched $53,550, driven by fears of a market dump due to Mt. Gox’s ongoing reimbursement of over 140,000 BTC to its clients, as well as the German government’s BTC liquidations.

The entire cryptocurrency market shed over $170 billion in combined market capitalization in a 24-hour period, according to CoinGecko data. This marks the market transition to extreme fear sentiment.

Despite weekend trading, Bitcoin bulls managed to recover some lost ground, with the most recent daily close at $58,250, just shy of the desired $58,450.

Sentiment has also been hampered by signs of German government disposals of seized Bitcoin. Germany continues to sell Bitcoin, signaling a potential plan to liquidate portions of its reserves. Arkham, which tracks Germany’s Bitcoin wallet, noted that the government still holds over 40,000 Bitcoin worth more than $2 billion.

— Arkham (@ArkhamIntel) July 5, 2024Update: German Government BTC Movements

German Government wallets received 1915 BTC ($111.5M) last night back from addresses linked to Kraken, Bitstamp and Coinbase.

1047.4 BTC ($57.2M) has been moved out of their wallets this morning:

-547.4 BTC ($30.1M) to Flow Traders

-500… pic.twitter.com/e6ARrAh4Td

Bitcoin’s daily RSI reading is near its oversold threshold of 30, suggesting a potential reversal or a slowdown in the current downtrend, hinting at a possible rebound.

Bullish signs

One key piece of information to look at is the expectation of U.S. interest rate cuts. As a slowdown in employment growth continues, the Fed is looking forward to cutting rates to stimulate the weak job market. Lower interest rates are generally bullish for Bitcoin and other riskier assets because they make traditional safe investments less attractive.

Another important indicator is the resumption of inflows into U.S.-based spot Bitcoin ETFs after two days of consecutive outflows, with spot Bitcoin ETFs seeing their largest net inflows in a month, totaling $143.1 million.

However, crypto analyst Willy Woo points out that it is difficult to predict price movements based on these numbers as BTC futures have flooded the market.

— Willy Woo (@woonomic) July 6, 2024Everyone is looking at the wrong thing.

- 9332 spot BTC sold so far by Germany

- 170,000 paper BTC synthesized since the last 72k top

It's awful hard for spot demand to move price up if that much paper supply has flooded a market.

Pro tip: Long spot, not futures.

The hashrate also dropped by 7.7%, reaching a four-month low of 576 EH/s after hitting a record high on April 27. This decline suggests that some miners are scaling back operations, reflecting the financial stress within the mining community post-halving.

These metrics signal that the Bitcoin market might be nearing its bottom, similar to previous cycles where miner sell-offs and operational reductions preceded market recoveries.

Price analysis

Historical market cycles have shown that Bitcoin’s halving event, which cuts the supply of new Bitcoins, has always preceded a period of price expansion lasting between 12 and 18 months before producing a cycle top.

The last halving took place on April 19 this year, so those historical time frames have yet to pass. Analyst Peter Brandt highlighted a significant bearish pattern: the bear flag. Brandt also marked $44,000 as a potential bottom price level.

This pattern indicates potential further declines for Bitcoin, and Brandt's chart visually depicts this bearish trend, signaling caution for investors.

According to Ali Martinez, BTC needs to climb up to $61,000 to revive the uptrend, as it is currently lacking any support levels.