As Germany dumps another 1K Bitcoin, traders feel the tremors

07/08/2024 17:30

The German Government has transferred another 1,000 Bitcoin, worth $55.8 million, according to data from blockchain intelligence firm Arkham.

- The German government has once again transferred a notable 1,000 BTC worth $55.8 million to crypto exchanges and unmarked wallets.

- Bitcoin was bearish at press time, moving below the 200-day EMA, with a high possibility of hitting the $52,800 level.

The cryptocurrency market once again turned bearish, with major assets including Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] experiencing a price drop of over 2.5%, 2.7%, and 4.5%, respectively.

Amid this ongoing market downturn, the German government has once again transferred a notable 1,000 BTC worth $55.8 million, according to data from blockchain intelligence firm Arkham.

German government dumps another 1,000 BTC

According to Arkham, out of the 1,000 BTC transferred by the German Government, a significant 500 BTC was sent to cryptocurrency exchanges including Bitstamp and Coinbase, worth $27.9 million.

Meanwhile, another 500 BTC worth $27.9 million was transferred to an unmarked wallet address “139PoP.”

Since the 19th of June, the government has transferred significant BTC to different exchanges and the same wallet address.

So, this unmarked wallet address “139PoP” might belong to an institution or an OTC services provider’s address.

Impact of the dump

This continuous transfer of BTC by the government of Germany has badly impacted the cryptocurrency market.

Since the 19th of June, BTC has fallen by more than 15%, dropping from the $65,200 level to the $55,700 level. During this period BTC reached a low of $53,269 according to TradingView.

Looking at this continuous dumping, on the 4th of July, Tron [TRX] founder Justin Sun offered to buy all BTC holdings worth $2.3 billion off-market from the German Government to minimize the impact on the market.

However, it appears that the government has ignored Sun’s offer.

Based on the historical data, if this BTC transfer continues in the market, there is a high possibility that BTC will fall further.

Bitcoin technical analysis and key levels

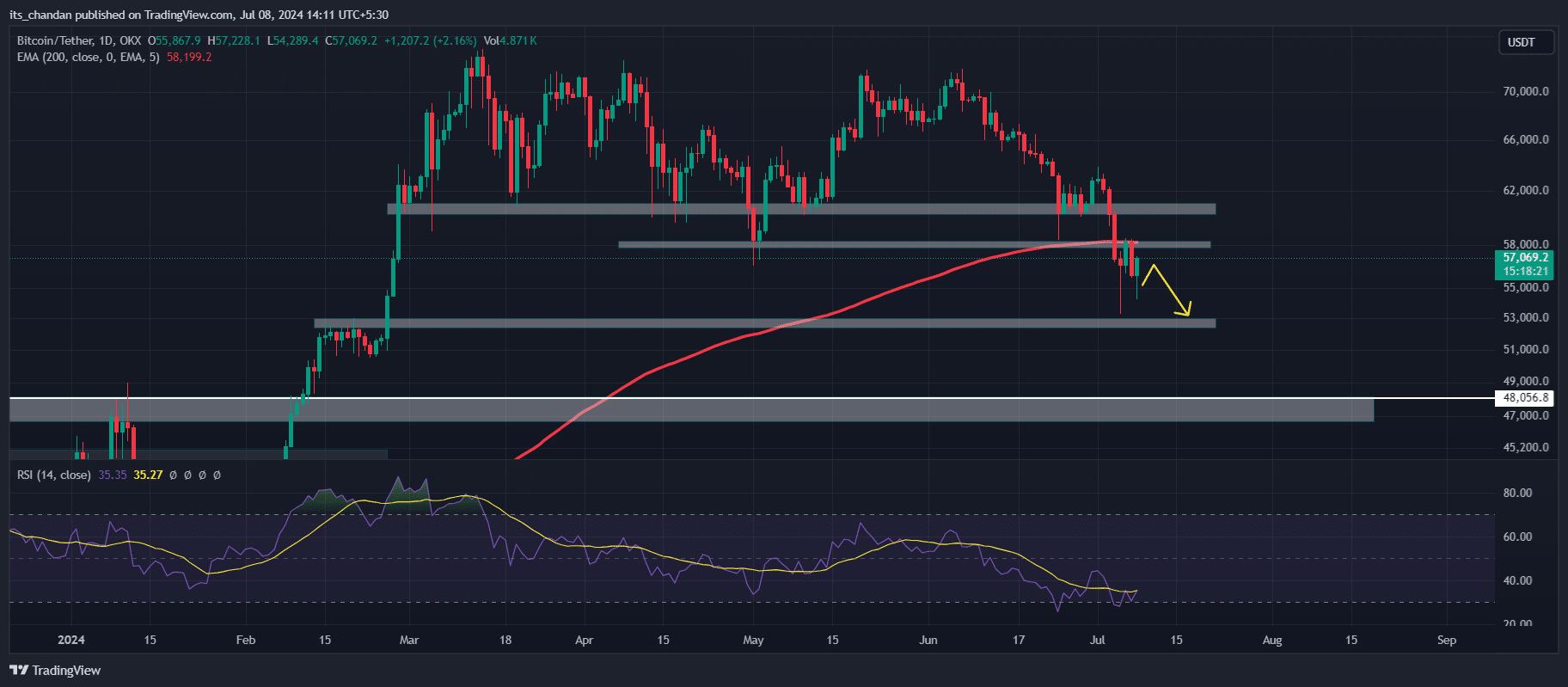

On-chain, Bitcoin was looking bearish as it gave a strong breakdown of major support levels of $58,000, retested that level, and formed a strong bearish candle below it.

Besides this breakdown, BTC was moving below the 200 Exponential Moving Average (EMA) on a daily time frame, which signaled bearishness.

There is thus a high possibility that BTC will reach the $52,800 level, which serves as its next support.

Despite the bearish signals in the chart, the Relative Strength Index (RSI) was in oversold territory, suggesting potential for a recovery.

Short liquidation turns higher

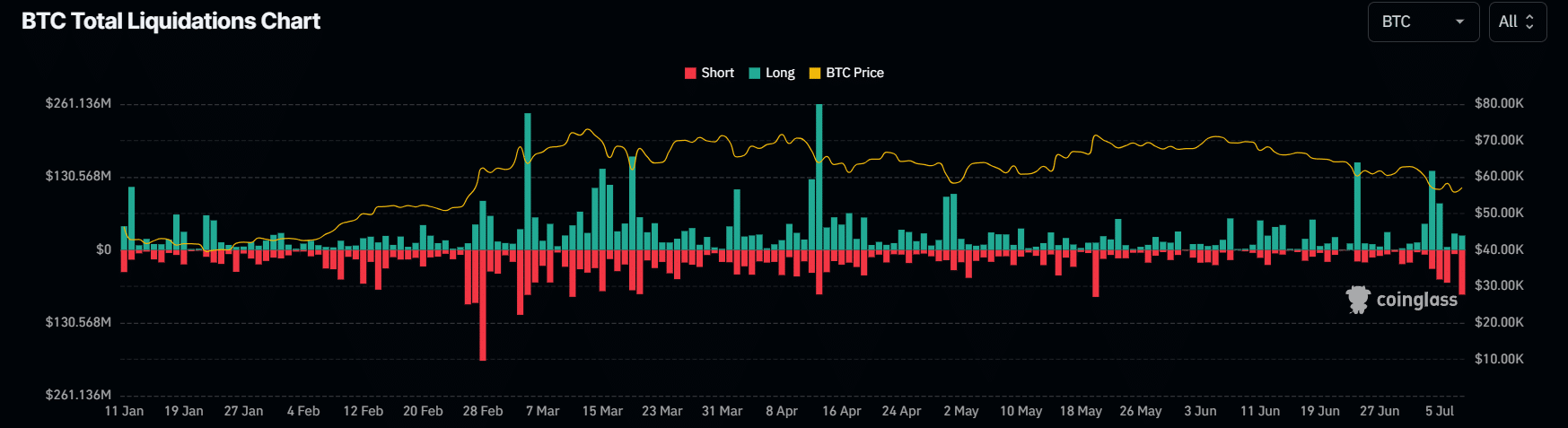

Despite this fall, bulls have liquidated only $46.97 million of long positions whereas short sellers have liquidated over $86 million of short positions, according to on-chain analytic firm Coinglass.

This higher number of short liquidations indicated that bulls were still there in the market. Whereas, the Open Interest (OI) dropped by 4.3%, signaling fear among market participants.

Realistic or not, here’s TRX market cap in BTC’s terms

As of this writing, BTC was trading near the $56,000 level, having experienced a price drop of over 2.5% in the last 24 hours. During this period, it also reached a low of $54,400 level.

Looking at BTC’s performance over a longer period, it has dropped by 10% in the last seven days. Over the last 30 days, BTC has lost over 18% of its value.