Bitcoin options traders increase their downside bets as near-term implied volatility spikes: analysts | Headlines | News | CoinMarketCap

07/08/2024 18:43

An increase in put options indicates traders' growing demand for downside protection following bitcoin's recent price correction, analysts said.

An increase in put options indicates traders' growing demand for downside protection following bitcoin's recent price correction, analysts said.

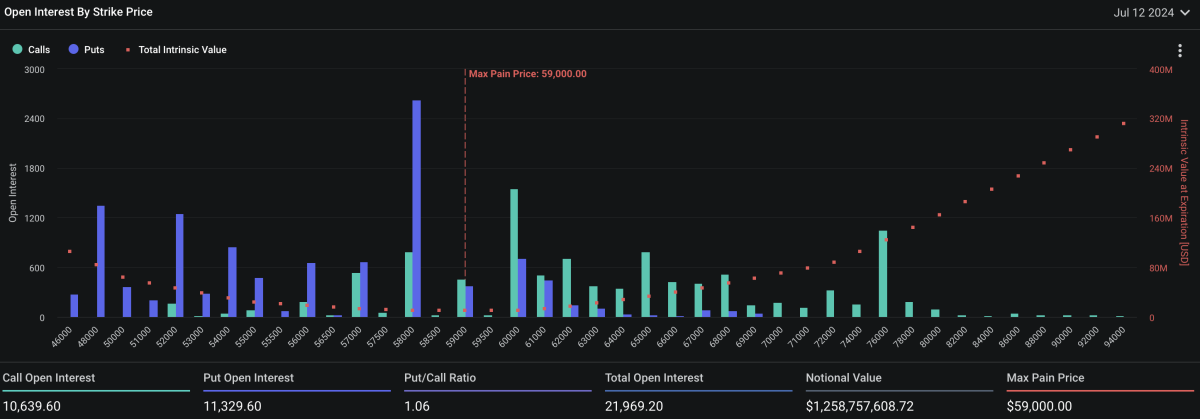

According to Deribit data, the put-call ratio for bitcoin options open interest ahead of this Friday's weekly expiry has risen above one, which is seen as a bearish market signal. A ratio above one means significantly more put options than call options are being traded. This indicates that more investors are betting on or hedging against a price decline rather than an increase.

Deribit data shows that the largest cluster of options open interest for Friday's expiry consists of puts at a strike price of $58,000, with significant concentrations of puts also at the $52,000 and $48,000 strike prices.

The put-call ratio of bitcoin …