Crypto investors capitalized on hammered digital asset prices to deploy capital into blockchain token-based funds.

According to a CoinShares report, $441 million in net inflows streamed in digital asset investment vehicles last week following a widespread market downturn and subsequent recovery.

James Butterfill, Coinshares’ head of research, said American investors took advantage of lower prices, with investors parking around $384 million in digital asset investment products on Wall Street. Other regions like Hong Kong, Switzerland, and Canada also recorded modest capital inflows. Bitcoin led the pack and comprised 90% of all inflows, but investors also diversified money into altcoins.

Crypto dip extends

The virtual currency industry experienced negative sentiment as the overall market lost over 9% of its value last week and fell to $2 trillion. Market leaders Bitcoin (BTC) and Ethereum (ETH) also dropped to two-month lows.

BTC fell below $54,000 on Mt. Gox fears and German sell pressure before rebounding above $58,000, while ETH slipped under $3,000. Last week, TradingView showed that the altcoin market cap dipped as much as 15%, and altcoins have generally declined up to 80% since before Bitcoin’s halving.

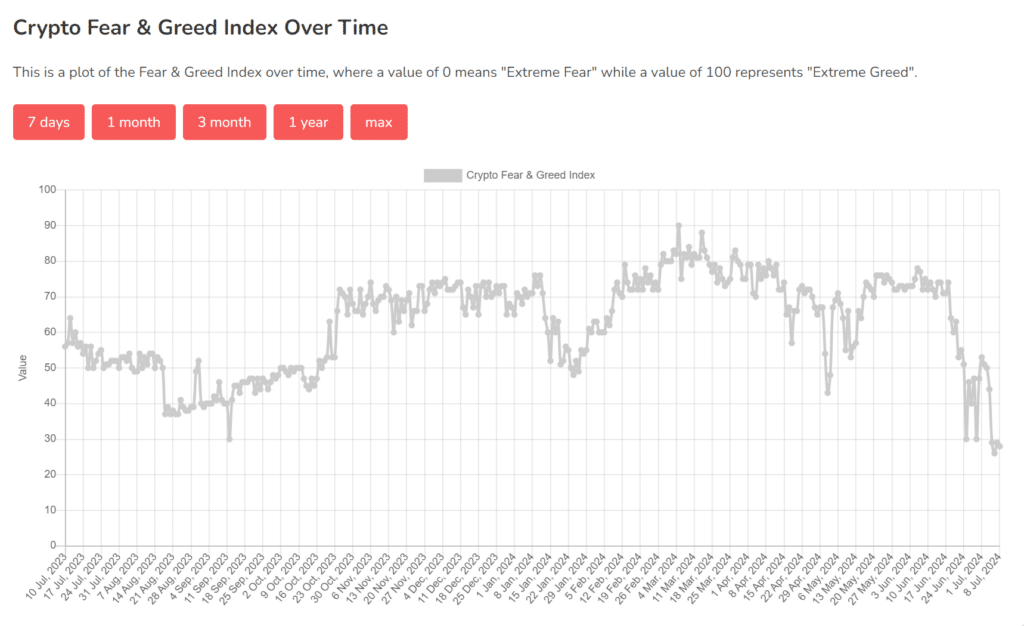

Data noted a 4% bounce on Monday as traders piled into opportunities for larger gains, but bearish marketwide sentiment persisted, and cryptocurrencies recorded losses again. The crypto “fear & greed” is now at 28, marking its lowest level since last September.

While the total digital asset market cap rose nearly 3% before falling again due to volatility and Bitcoin FUD, blockchain equities continued in a downswing. Butterfill wrote that shares from mining entities and other web3 companies have now had $556 million in outflows since the start of the year.