NewsBriefs - Solana leads altcoin inflows as crypto market sees major investments

07/08/2024 19:30

Crypto investment products experienced inflows of $441 million last week, led by Bitcoin with $398 million, which is 90% of the total. Despi...

Editor-curated news, summarized by AI

Solana leads altcoin inflows as crypto market sees major investments

Crypto investment products experienced inflows of $441 million last week, led by Bitcoin with $398 million, which is 90% of the total. Despite Bitcoin's dominance, investors also turned to altcoins, with Solana gaining $16 million, marking it as the standout performer. Regionally, the US dominated the inflows, contributing $384 million. However, blockchain equities faced a downturn, with a $8 million outflow continuing a negative trend for the year.

Latest

-

VanEck files for first spot Ethereum ETF with the SEC

VanEck has officially submitted the first S-1 filing for a spot Ethereum ETF, signaling an attempt to push the US Securities and Exchange Commission (SEC) on their stance regarding direct crypto investments. This move places VanEck at the forefront of the US crypto ETF space, further intensifying the discussion around crypto assets and regulatory acceptance.

Expand

-

Solana leads altcoin inflows as crypto market sees major investments

Crypto investment products experienced inflows of $441 million last week, led by Bitcoin with $398 million, which is 90% of the total. Despite Bitcoin's dominance, investors also turned to altcoins, with Solana gaining $16 million, marking it as the standout performer. Regionally, the US dominated the inflows, contributing $384 million. However, blockchain equities faced a downturn, with a $8 million outflow continuing a negative trend for the year.

Expand

-

Ether surpasses $3K as market indicators suggest pre-ETF rally

Ether recently crossed the $3,000 threshold, buoyed by disappearing discounts in investment vehicles like the Grayscale Ethereum Trust and stabilized prices on exchanges such as Coinbase. These changes, coupled with price chart patterns, suggest an uptick in crypto investor confidence and potential market recovery. Signs of seller exhaustion after a significant downturn indicate that the Ethereum token might continue trending up, particularly with the upcoming launch of spot Ether ETFs in the US, expected to notably increase investor demand.

Expand

-

Germany still controls $2.2 billion in Bitcoin amid market fluctuations

Germany possesses 29,286 Bitcoin (BTC) valued at $2.2 billion, continuing its liquidation strategy initiated in mid-June which has added selling pressure equivalent to 9% of Bitcoin's 24-hour trading volume. This ongoing disposal and the associated market movements have impacted Bitcoin's spot price notably, causing a near 20% drop in four weeks. The sales, seen as a strategic mistake by some industry voices, highlight concerns over the loss of potentially valuable assets in exchange for fiat currency.

Expand

-

BNB Chain launches MindPress, a new data marketplace

BNB Chain has launched MindPress, a data marketplace leveraging the capabilities of Greenfield and BNB Smart Chain to facilitate easy trading and development of crypto digital assets. This platform offers comprehensive functionalities for developers, including simplified development processes, and robust management of storage, trading, and content permissions.

Expand

-

Metaplanet continues Bitcoin buying spree with ¥400 million investment

Metaplanet, a Tokyo Stock Exchange-listed company, has acquired an additional 42.47 BTC for approximately 400 million Japanese Yen, continuing its strategy to use Bitcoin as a reserve asset. This latest purchase follows a recent ¥200 million investment, bringing Metaplanet's total Bitcoin holdings to over 203 BTC, valued at around 2 billion Yen. Metaplanet's investment approach aligns with global trends where firms use Bitcoin to mitigate economic uncertainty.

Expand

-

Celo initiates Dango Layer 2 testnet to integrate with Ethereum ecosystem

Celo has launched the Dango Layer 2 testnet, utilizing Optimism’s OP Stack, marking its initial move to transform from a standalone Layer 1 network to an integral part of the Ethereum ecosystem. This development aims for enhanced transaction efficiency and simpler token bridging between Ethereum and Celo, with plans for a mainnet release in early winter 2024.

Expand

-

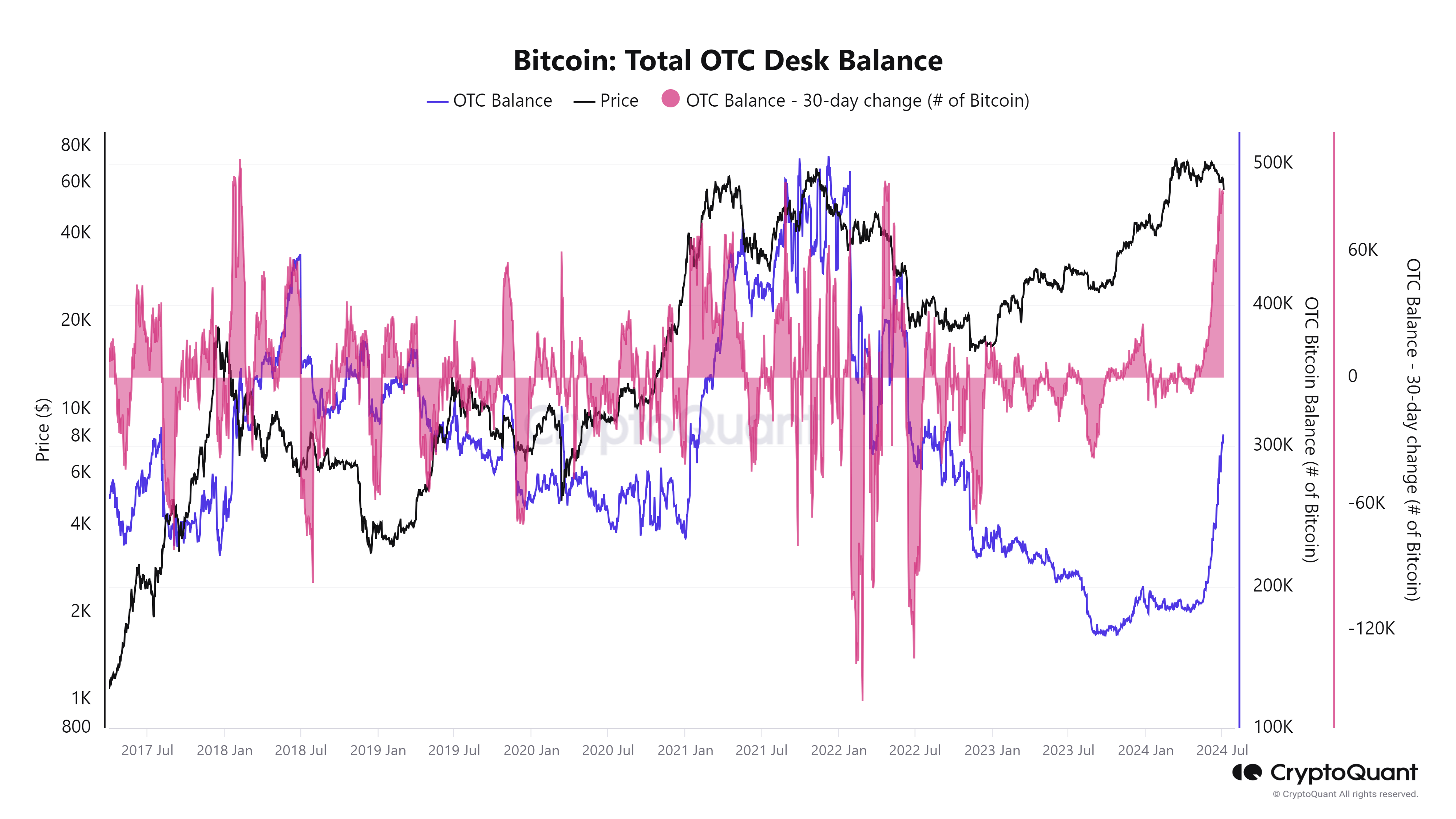

Bitcoin OTC desk balances surpass 300,000 BTC amid price surge

Recent data from CryptoQuant shows that the cumulative balance of Bitcoin at Over-The-Counter (OTC) desks has exceeded 300,000 BTC, coinciding with a significant Bitcoin price increase to around $55,000. Historical trends indicate that OTC desk balances typically rise alongside Bitcoin's price peaks, suggesting increased large-scale transactions by institutional investors which may not affect the market price directly. The recent escalation in balances might indicate an anticipation of future price adjustments by these investors, reflecting broader market sentiment.

Expand

-

Tron unveils gas-free stablecoin solution for Ethereum and Tron chains

Justin Sun, founder of Tron, has announced plans to launch a gasless stablecoin transfer feature by the fourth quarter of 2024. This initiative, set to first roll out on the Tron network before expanding to Ethereum and other EVM-compatible networks, aims to eliminate gas fees charged on stablecoin transactions. By covering fees within the stablecoins themselves, Trali stands a testing point in defining peer-to-peer stablecoin operations. The feature targets enhancing the usability of stablecoins and fostering broader adoption across large companies. Tron's recent rise in stablecoin metrics positions it as a significant player against competitors like PayPal’s PYUSD and Circle's USDC.

Expand

-

North Carolina Governor vetoes bill against federal CBDCs

North Carolina Governor Roy Cooper vetoed a legislative bill that sought to prevent the implementation of any central bank digital currency (CBDC) by the US Federal Reserve in the state. The bill had previously garnered significant support in North Carolina's General Assembly. Governor Cooper criticized the bill as premature and unclear, suggesting the state should await federal guidelines on CBDCs. Additionally, national discussions continue with the US House recently voting to restrict the creation of a CBDC without explicit Congressional approval.

Expand

-

Tangem and Visa introduce a crypto payment card with built-in hardware wallet

Tangem has collaborated with Visa to launch a Visa payment card that integrates a self-custodial hardware wallet, enabling users to directly utilize their crypto and stablecoin balances at merchants accepting Visa. This initiative offers a dual benefit: conventional payment card ease and full control of one's digital assets through a self-contained crypto wallet. This technology, available across Europe, allows users to manage private keys via a secure, user-held card, enhancing security and merging the features of traditional banking with digital asset convenience.

Expand

-

Bitfinex to issue refunds for failed El Salvador Hilton hotel project

Bitfinex Securities will refund investors after failing to meet the $500,000 minimum funding goal for its Hilton hotel project at El Salvador’s international airport. The project, El Salvador's first public offering of digital debt assets, only raised $342,000, falling short of the intended $6.25 million target. The funds were to finance a 4,500 square foot Hampton by Hilton hotel. Investors had been offered a 10% coupon over a five-year term for their investment in the "HILSV" token on the Bitcoin Liquid Network.

Expand

-

Bitcoin could surge with potential Trump presidential win: FT

The possibility of Donald Trump's re-election is creating optimism among crypto traders, expecting a surge in Bitcoin's value due to Trump's favorable stance on crypto. Recent market volatility has been linked to regulatory actions and miner sales, but predictions suggest that Bitcoin could reach $100,000 should Trump secure a victory. This anticipation is compounded by the broader market implications of Trump's economic policies, which might lead to increased inflation and higher Treasury yields, presenting Bitcoin as a viable hedge against potential fiscal instability.

Expand

-

US House set for vote on overturning President Biden's veto of SAB 121 next week

Next week, the US House will conduct a vote to potentially overturn President Joe Biden's veto of Staff Accounting Bulletin 121 (SAB 121), which mandates that firms holding cryptocurrencies for customers list these assets as liabilities. The previous House vote passed the measure, and a two-thirds majority in both houses is required to override the veto. Though challenging, supporters of the override believe success is possible given the bipartisan support observed in related crypto legislation.

Expand

-

Mt. Gox Bitcoin movements trigger record liquidation levels

The recent transfer of Bitcoin and Bitcoin Cash by Mt. Gox to a new wallet led to a drastic 6% drop in Bitcoin's price, causing over $1 billion in market liquidations, the highest since the FTX debacle. Despite a partial price recovery, ongoing investor fears and external pressures from US inflation concerns continue to influence market volatility. This incident underscores the market's sensitivity to major creditor payouts and regulatory remarks.

Expand