Bitcoin mining trends: Miners bet on recovery after BTC drops 10%

07/09/2024 02:00

Bitcoin [BTC] mining difficulty dropped along with its price, but hashrate increased over the last several days

- BTC was down by more than 10% in the last seven days.

- BTC miners’ balance increased, meaning that they were buying the coin.

Bitcoin [BTC] off late has faced multiple price corrections as its price continues to trade under the $57k mark. This bearish price action would definitely have a direct effect on market sentiment.

Therefore, AMBCrypto planned to have a look at how the Bitcoin mining sector was affected due to the price drop.

Bitcoin miners’ state after price corrections

CoinMarketCap’s data revealed that BTC’s price declined by more than 10% in the last seven days. In the last 24 hours alone, the coin was down by over 1.3%.

At the time of writing, BTC was trading at $56,651.71 with a market capitalization of over $1.12 trillion. A drop in price often results in less profitability for miners.

Additionally, BTC recently underwent its fourth halving, which had already reduced miners’ rewards.

AMBCrypto’s look at BitInfoChart’s data revealed that the BTC mining sector’s profitability had indeed reduced substantially over the last week. At the time of writing, Bitcoin miners’ profitability stood at 0.0432 USD per day.

However, it was interesting to note that BTC’s hashrate remained relatively stable throughout the last week. In fact, the metric spiked on the 7th of July and reached 691.8 Eh/s.

Generally, a rise in the metric means an increase in computational power, suggesting that more Bitcoin miners entered the network. Usually, when hashrate rises, the blockchain’s mining difficulty also follows a similar trend.

However, on this occasion, things were different. Our look at CoinWarz’s data revealed that BTC’s mining difficulty dropped on the 5th of July. At the time of writing, Bitcoin mining difficulty stood at 79.50T.

Are Bitcoin miners selling BTC?

Though there was an increase in hashrate, miners’ profitability did drop. Therefore, AMBCrypto planned to have a closer look at how miners were behaving after the coin’s price plunged.

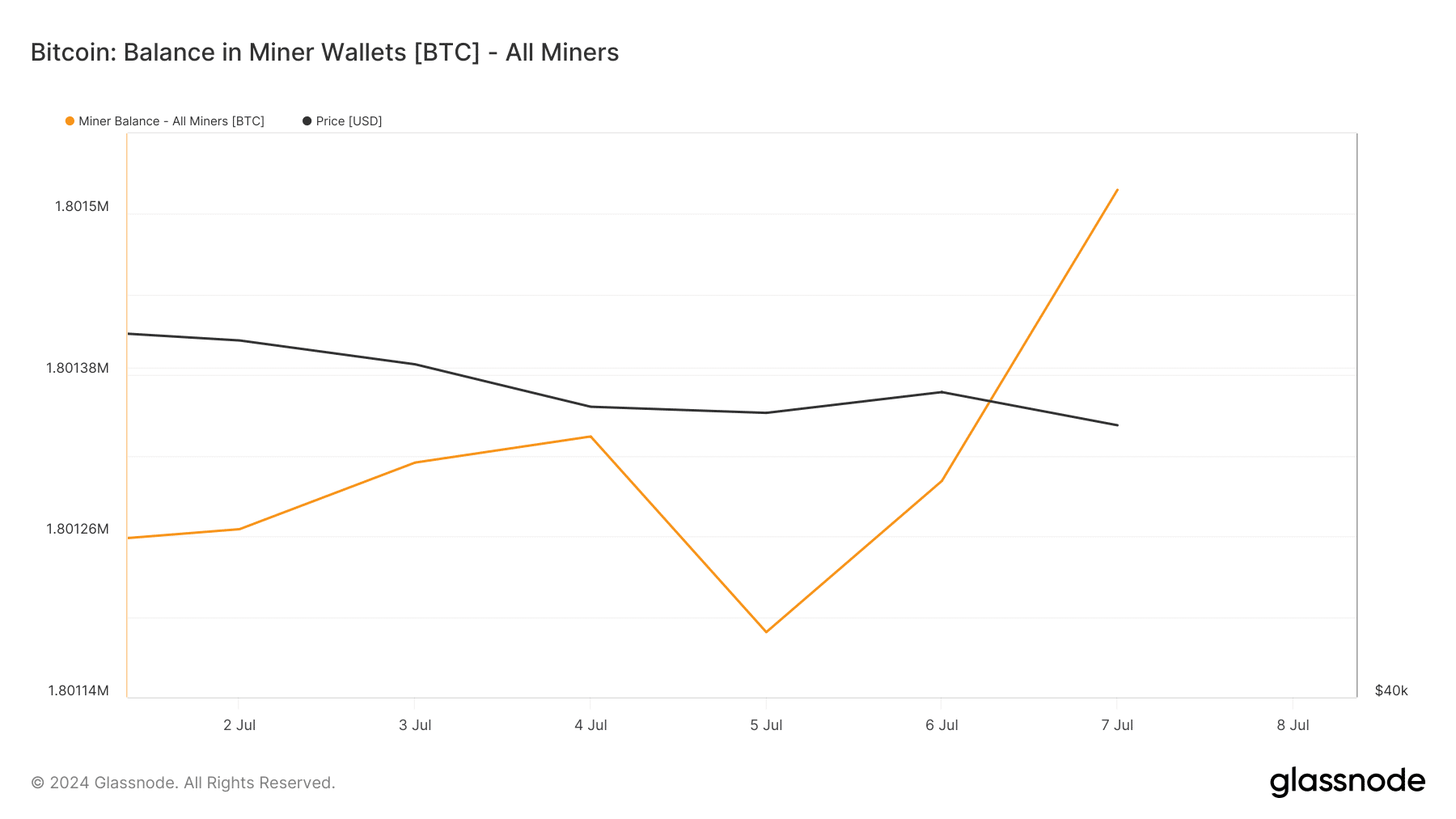

AMBCrypto’s analysis of Glassnode’s data revealed that BTC’s miners’ net position change was in the negative zone throughout the last week. This meant that selling pressure on BTC from miners was high.

However, it was interesting to note that Bitcoin miners’ balance registered a sharp uptick on the 8th of July. This clearly indicated a rise in confidence among BTC miners, as they expected the coin’s price to rise in the coming days.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

To see whether this rise in miners’ balance would have a positive impact on BTC’s price, we checked its daily chart. We found that both its Money Flow Index (MFI) and Chaikin Money Floe (CMF) registered upticks, hinting at a price rise soon.

Nonetheless, the technical indicator displayed a bearish advantage in the market.