JasmyCoin price has recently lost its momentum and moved into a deep bear market as it dropped by almost 50% from its highest point in June.

JASMY was trading at $0.0230 on Tuesday, a 20% increase from its lowest point on Friday when most cryptocurrencies dropped.

The token has declined due to ongoing headwinds in the crypto industry as the German government continued moving Bitcoins to exchanges. Concerns about Bitcoin liquidations by Mt.Gox also contributed to a negative sentiment that is felt across the entire industry.

These events have led to a significant drop in the crypto fear and greed index, which has moved from the year-to-date high of 90 to the greed area of 38. In most cases, altcoins like Jasmy drop when there is a sense of fear among traders.

Analysts are still bullish on Jasmy price

JASMY price chart

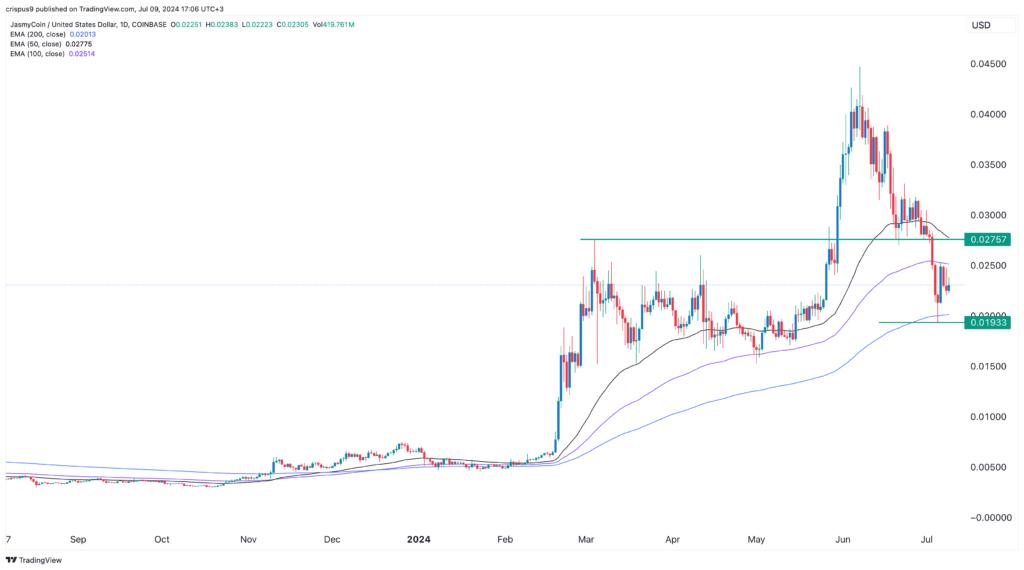

Jasmy’s sell-off has sent shockwaves among many holders as it dropped below important support levels. It moved below the 50-day and 100-day Exponential Moving Averages (EMA).

It also dropped below the key support level at $0.0275, its highest swing in March, signaling that bears are gaining control.

Bears also point to the fact that Bitcoin has formed a big double-top chart pattern, implying that it could drop to a support level of $44,000 in the near term. Such a move would lead to more downside for Jasmy and other altcoins.

However, JASMY bulls believe that the coin will bounce back in the near term. In an X post, a crypto analyst pointed to the fact that the moves by Germany, Mt. Gox, and hacks have been there before. In most cases, such moves, including the FTX collapse, were short-lived.

#Jasmy fam, just a quick reminder that bull run is NOT over. Do not get shaken out n take advantage of this opportunity. I've seen these moves countless times since 2016. From China ban, MtGox, Hacks, n so on….but here we r #BTC 57k. #Crypto n $Jasmy is here to stay. Get it!!! pic.twitter.com/P9r5FB6KV8

— westcoast LA (@westcoast_la) July 9, 2024

In another tweet, Ki Young Ju, the founder of Cryptoquant noted that Bitcoin’s market cap can absolve this liquidity. He expects Bitcoin to bottom at between $47,000 and $48,000 and then resume the bullish trend, which will benefit Jasmy.

— Ki Young Ju (@ki_young_ju) July 8, 2024Great analysis from a macro perspective.

Despite potential liquidity dumps from the German govt and Mt. Gox creditors, #Bitcoin market can absorb it with an estimated -10.5% impact. Say $47-48K level.

Mt. Gox and govt BTC selling won't end this cycle. https://t.co/dOFdxmuvRn

The key JasmyCoin price to watch will be $0.019, which coincides with the 200-day moving average and the lower side of the hammer pattern that formed on Friday. A break below that level will likely indicate more downside.