The German government’s Bitcoin wallet received a small amount of Sats from a CoinJoin address amidst its significant selling activity.

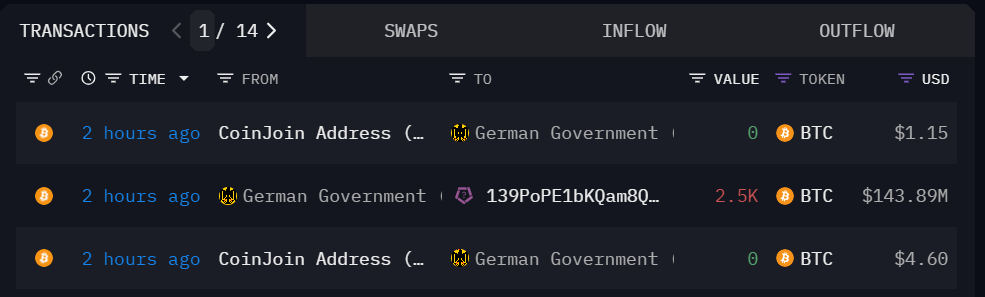

On-chain data from the crypto analytical platform Arkham Intelligence revealed that the German government wallets received less than $10 in three transactions from CoinJoin addresses today.

CoinJoin transactions combine multiple Bitcoin trades to obscure the flow of funds and enhance user privacy on-chain.

Recently, these transactions have been heavily scrutinized after the US government increased its pressure on privacy protocols. According to the authorities, malicious players like North Korea-backed Lazarus Group were using these tools for money laundering and other nefarious activities.

Due to this, several Bitcoin wallet providers, including Wasabi Wallet, discontinued the feature on their platforms.

Bitcoin selling continues

The German government has continued its trend of selling the flagship digital asset during the past day, according to on-chain data.

Arkham reported that the government sent 6306.9 BTC, estimated to be worth $362.12 million, to Kraken, Cumberland, and two unlabeled addresses likely belonging to an institutional deposit or over-the-counter service provider.

This recent activity has reduced the government’s Bitcoin holdings to 22,847 BTC, valued at $1.32 billion. Last month, Germany started its large-scale BTC sell-off, having initially held 50,000 BTC seized from a piracy website in January.

Meanwhile, the government’s unusual on-chain transactions have sparked varied reactions within the crypto community. On July 8, blockchain analytical firm SpotOnChain questioned the German authority’s decision to sell directly via centralized exchanges and the subsequent withdrawal of some of these BTC after the transfer to these platforms.

Despite these sales, experts note that the Bitcoin market remains unaffected. Ki Young Ju, CEO of CryptoQuant, stated:

“Government BTC selling is negligible compared to overall liquidity, and most Mt. Gox BTC holdings haven’t moved to creditors.”

CryptoSlate’s data shows that BTC’s price has been trending downwards, falling about 10% in the last seven days to $57,270 as of press time.