Japan’s MicroStrategy Metaplanet ‘buys the dip,’ invests 400M yen in Bitcoin

07/10/2024 00:00

Metaplanet, a publicly-listed investment and consulting firm based in Japan have purchased an additional 400 million Yen worth of Bitcoin.

- Metaplanet’s increased Bitcoin holdings mirror MicroStrategy’s successful institutional adoption strategy.

- Despite volatility, Metaplanet’s stock rises in sync with Bitcoin’s upward trajectory in 2024.

As Bitcoin [BTC] and the broader crypto market bled red for days, Metaplanet, a publicly-listed investment and consulting firm based in Japan, has decided to increase its BTC holdings.

This move underscores the strategy known as “buying the dip,” where investors purchase assets at reduced prices with the expectation of future value appreciation.

For those unfamiliar with the term, “buying the dip” reflects a belief in the asset’s long-term potential despite short-term market fluctuations.

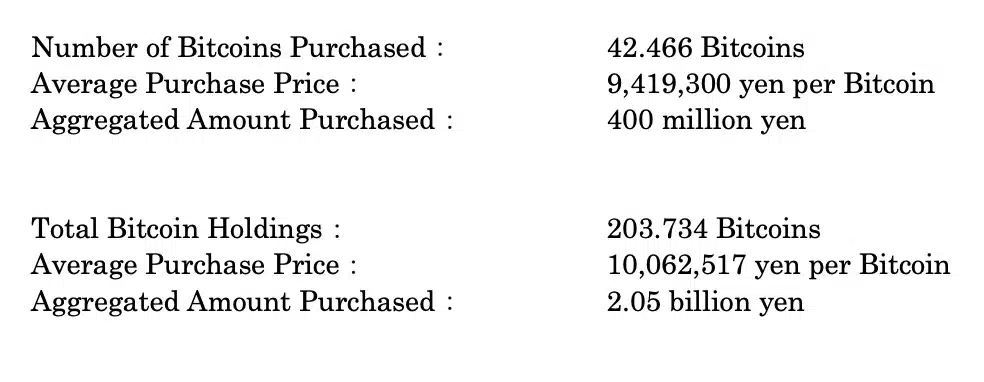

Metaplanet’s Bitcoin holdings

According to the statement released by Metaplanet Inc.,

“We hereby announce that we have purchased an additional 400 million Yen worth of Bitcoin.”

The statement further elaborated,

This move by Metaplanet aligns closely with Michael Saylor’s MicroStrategy BTC holdings. As of 20th June, Saylor emphasized,

“$MSTR hodls 226,331 $BTC acquired for ~$8.33B at average price of $36,798 per bitcoin.”

Following the steps of MicroStrategy

In fact, MicroStrategy’s BTC holdings have contributed to a 380% increase in MSTR stock price. According to CCData’s recent report titled ‘2024 H2 Outlook’,

“MicroStrategy led with a 380% rise in stock price, driven by its 214,000 Bitcoin holdings now worth $13.3bn, purchased at an average cost of $35,158. These holdings have earned the company approximately $6.54bn since 2020.”

Following in the footsteps of MicroStrategy, Metaplanet is often hailed as “Asia’s MicroStrategy,” highlighting the increasing adoption of BTC among institutions.

Needless to say, the launch of Bitcoin ETFs have been a catalyst that shifted the perspective of millions, including Wall Street, from viewing BTC as a threat to now seeing it as an opportunity.

Moreover, there has been a notable shift in political interest, particularly from former President Donald Trump, who once mocked cryptocurrencies, but now sees crypto and Bitcoin as potentially pivotal in winning upcoming elections.

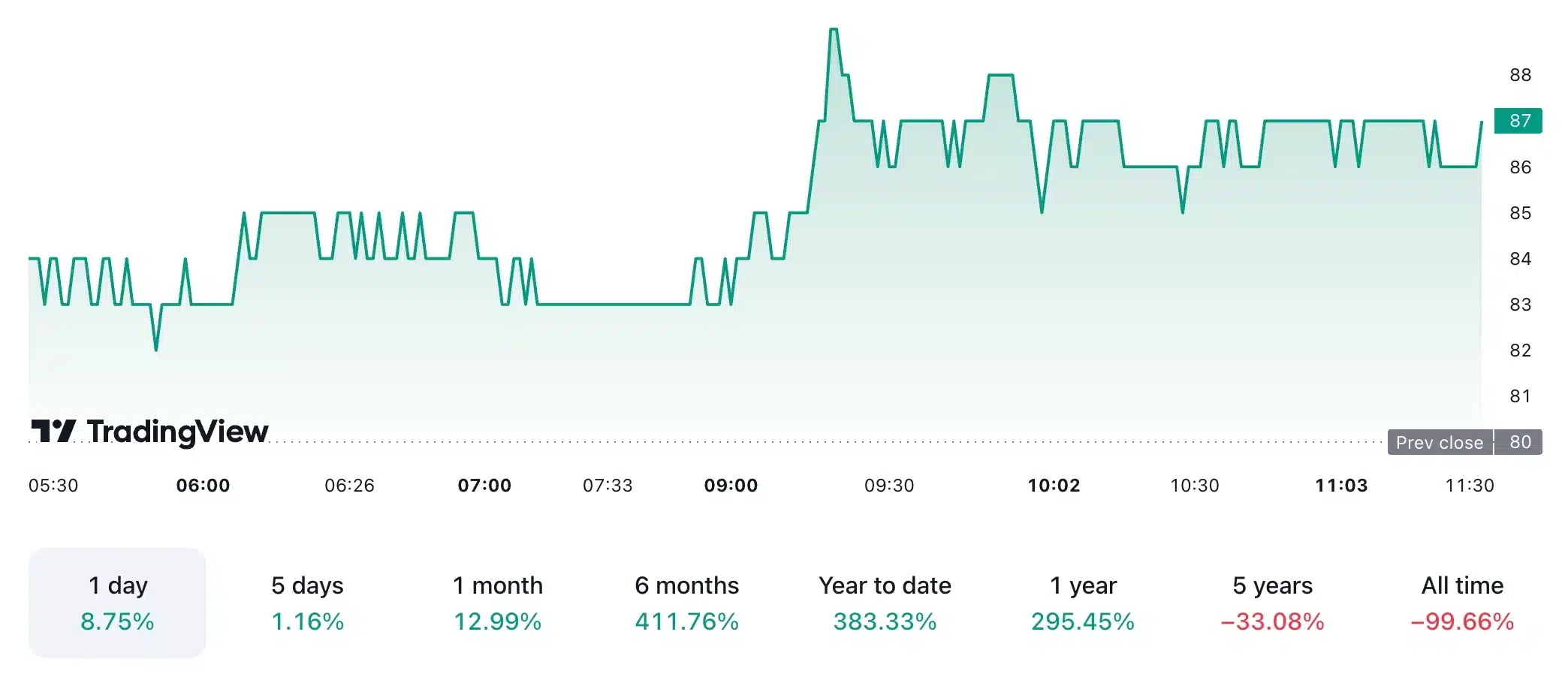

Impact of Bitcoin on Metaplanet’s stock price

However, similar to the recent downturn in Bitcoin, there has been a direct negative impact on Metaplanet’s stock price.

After reaching a peak of 107 yen on 11th June, Metaplanet stock declined by 25% as BTC dropped from around $70,000 to below $60,000.

However, as of the latest update, the stock was trading at 87 yen, reflecting an 8.75% increase in the past 24 hours, with the stock’s year-to-date price rising by 383.33%.

Meanwhile, Bitcoin was trading at $57,705 at press time, having seen a 2.29% increase in the past 24 hours, and boasting a year-to-date gain of 36.55%.