Binance whale knocks the altcoin down further: Will BNB ever recover?

07/10/2024 09:00

A whale moved a large quantity of BNB within the last 24 hours. Will BNB's price plumet going forward in the future?

- A whale moved a large amount of BNB over the last 24 hours.

- As a result, social sentiment around the token fell significantly.

Binance Coin [BNB] was one of the many tokens that was impacted by the recent market drawdown. A whale, seemingly affected by this sudden volatility, withdrew BNB tokens worth $103 million on the 8th of July.

Did this movement impact BNB’s trajectory?

What’s going on with BNB

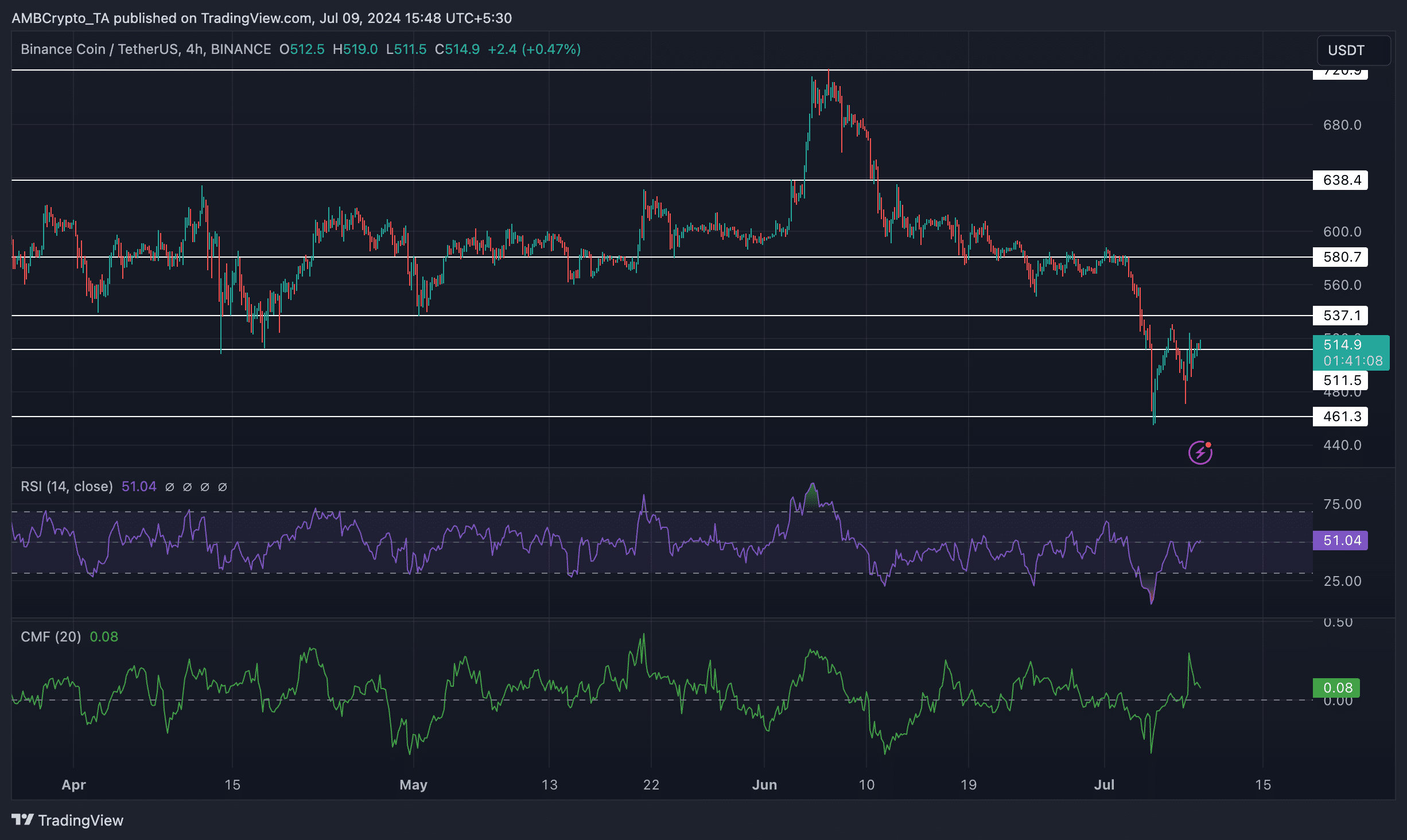

Since the 7th of July, the price of BNB had declined materially. During this period, the price of BNB exhibited multiple lower lows and lower highs, indicative of a bearish trend.

The token fluctuated between the $461.3 mark and the $537.1 levels. For BNB to surge beyond these levels and break the current bearish trend, it would need significant bullish movement.

The RSI (Relative Strength Index) for BNB was 51.04 at the time of writing, indicating that the bullish momentum around the BNB token had surged.

However, the CMF (Chaikin Money Flow) had declined significantly, indicating that the money flowing into BNB had declined. So, the sideways movement might continue for sometime before a breakout.

Looking at the socials

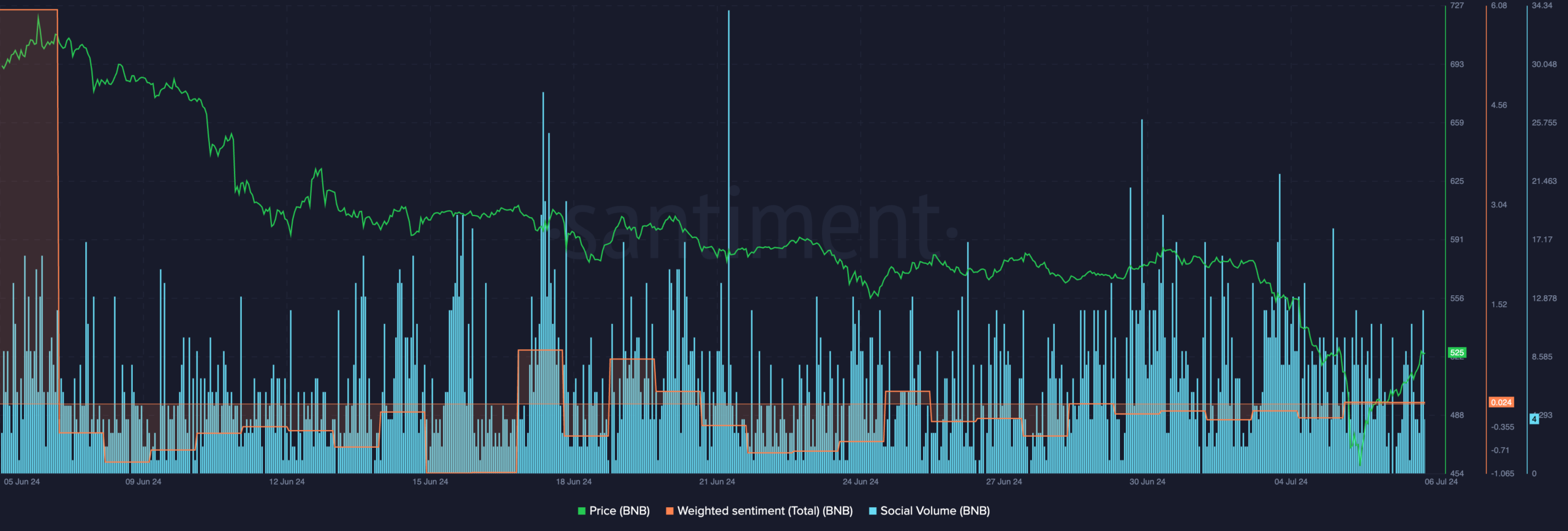

AMBCrypto’s analysis of Santiment’s data revealed that Social Volume around BNB had remained high over the last few days, indicating that the popularity of the BNB token had remained unchanged.

However, Weighted Sentiment also fell materially, indicating that the number of negative comments around the BNB token had surged. This could hinder BNB’s potential to grow further.

Realistic or not, here’s BNB’s market cap in BTC’s terms

At press time, BNB was trading at $515.60 and its price had grown by 0.34% in the last 24 hours. The volume at which BNB was trading at had declined by 12.53% in the last 24 hours.

If such massive movements continue, BNB will continue to suffer, dropping its price to levels that traders might find impossible to scramble up from.