Celestia's TIA Token Surges 25%, Leaves Crypto Traders in Disbelief

07/10/2024 17:04

Funding rates in perpetual futures tied to TIA are most negative since January, indicating a bias for shorts or bearish bets.

TIA surges 25% in one week, hinting at a positive turnaround following a five-month downtrend.

Traders continue to short TIA perpetual futures, negative funding rates suggest.

TIA's rally may have legs, according to one observer.

Data availability blockchain network Celestia's native cryptocurrency TIA has jumped 25% to $7.30 this week, registering the best performance among the top 100 digital assets by market value.

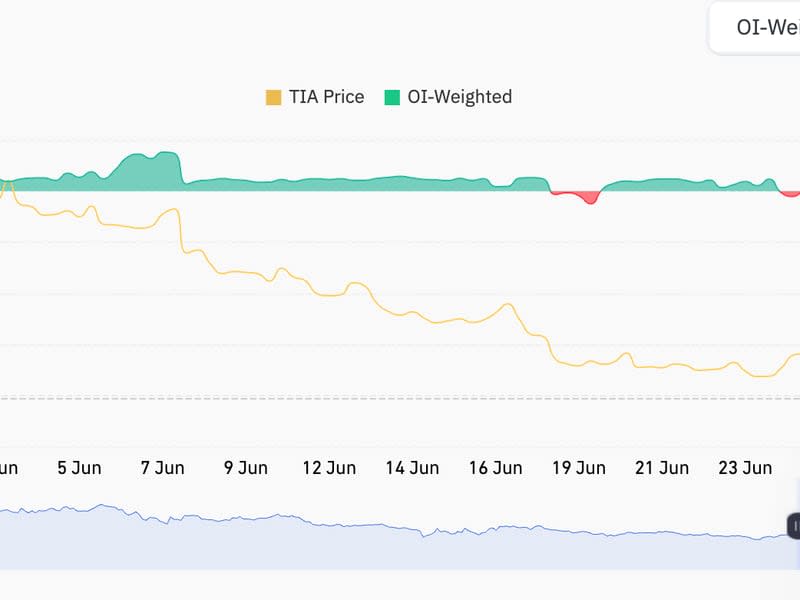

Traders seem skeptical about the ongoing price surge and are taking bearish bets by shorting perpetual futures tied to the cryptocurrency, according to funding rates tracked by CoinGlass.

Average funding rates across exchanges flipped negative over the weekend and have dropped to -0.1231% since then, reaching levels last seen in January. In other words, bias for bearish bets is most pronounced in six months.

Calculated and collected from traders every eight hours, funding rates represent the cost of holding bullish or bearish bets. A negative rate implies that traders with short positions, betting on a price drop, are paying a funding fee to longs. It occurs when there is a high demand for short positions relative to long positions.

The bias for shorts amid a price rally looks like a classic case of recency bias, whereby trades are placing more weight on the TIA's price crash in recent months than other vital developments. TIA's latest bounce comes after a five-month downtrend that saw prices slide 80% from $21 to less than $5. As such, it's not particularly surprising to see traders sell the bounce.

However, traders could be overlooking modular blockchain Celestia's role as a data availability layer for layer 2 networks like the booming permissionless liquidity layer for Web3 trading, Orderly Network, which means the price bounce could be sustainable.

"The need for a data availability layer here makes sense after realizing that safe/permissionless liquidity is by far one of the biggest hurdles in making onchain perps markets usable. So having a middle layer that can provide shared liquidity to any exchange seems like an obvious solution moving forward," psuedonymous analyst DeFi^2 explained on X.

"As an actual core piece of infrastructure for cases like this, Celestia has a lot of the right factors coming together this week for a strong market bottom to be put in, including the Modular Summit taking place this week with Celestia at the center of it," DeFi^2 added.

Celestia, a modular blockchain, separates consensus from execution, boosting scalability. It acts like a storage system for data used by rollups and layer 2 networks, helping them become faster and handle more transactions.

Orderly Network, a permissionless liquidity layer and infrastructure provider for Web3 trading built on top of the Near blockchain, uses Celestia for data availability. On July 5, Orderly Network's cumulative trading volume reached a record $6.2 billion, with cumulative net fees exceeding $6.6 million while accounting for 40% of the total data posted on the Celestia network, the network told CoinDesk in an email.

Besides, the bias for short positions could catalyze further price rise. The funding fee that traders holding shorts are currently paying will become a burden if prices remain resilient, eventually forcing them to square off their bearish bets. That, in turn, could bump up prices in what is a known as a short squeeze rally.