Mt. Gox and the German government sunk the crypto market

07/10/2024 22:27

Binance Research revealed a report on the cryptocurrency market for June 2024

Binance Research revealed a report on the cryptocurrency market for June 2024.

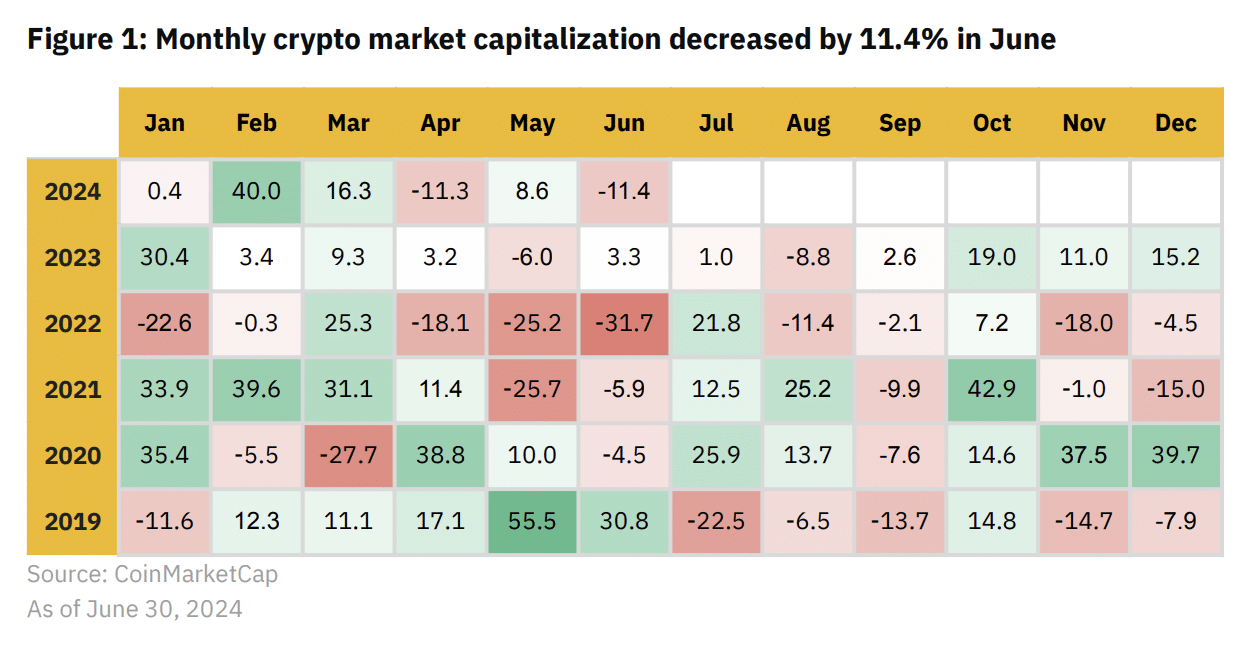

According to the latest research, market capitalization declined by 11.4% over the month. However, this trend is typical for June — over the past five years, the crypto market closed June with a positive indicator only twice.

In addition, nine out of ten assets by market capitalization ended the month in the red. According to experts, this decline was caused by news about payments to Mt. Gox and the U.S. and German governments’ movement of Bitcoins (BTC) to centralized exchanges.

Dive into the crypto market

Growth Leaders

One of the few tokens that has grown is Toncoin (TON). The asset grew by 17.5%, reaching a historical high of $8.24. Binance Research attributed this growth to the success of The Open League program and support of the ecosystem through grants. In addition, the number of active daily addresses on the network reached a record high of almost 578,000.

TON has also had notable success in attracting TVL inflows in sectors such as Telegram mini-apps and games, defi, NFTs, and memecoins.

“TON also continued its remarkable growth trajectory with a 109% month-on-month increase in TVL, hitting another all-time high of US$685.9M.”

Binance Research report

Airdrops

Additionally, the report mentions airdrops. In June, token distribution was carried out through various projects, including LayerZero, ZKsync, Blast, and Eigenlayer.

For LayerZero, the protocol identified over 803,000 addresses as potential Sybil wallets. These addresses received only 15% of the original allocation, with the remaining 85% redistributed to 1.28 million eligible addresses.

“The LayerZero Foundation implemented a ‘Proof-of-Donation’ claiming mechanism, which received mixed reactions from the community.”

Binance Research report

The NFT sector continues to face difficult times

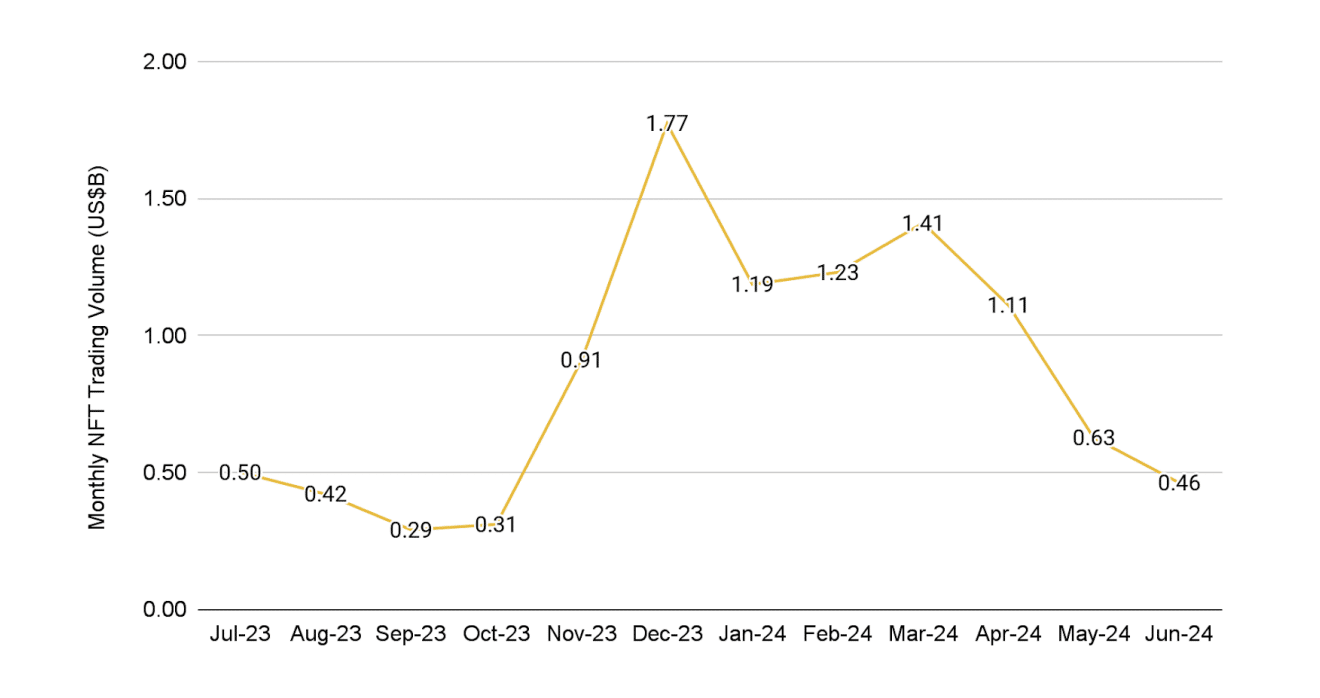

The NFT sector also showed no growth. Sales totaled $46 million, down 26.2% from May.

The leader in monthly sales volume was the DMarket NFT marketplace. DMarket, the in-game item platform on Mythos, led the way with the highest monthly sales with $18.9 million, followed by CryptoPunks with $16.1 million. Ordinals top collections, such as Bitcoin Puppets and NodeMonkes, experienced declines in sales, down 40.6% and 41%, respectively.

“Across the top chains, NFT sales volumes have decreased considerably. Bitcoin and Ethereum saw a 48.2% and 50.2% downturn, respectively, indicating the dwindling early hype over Bitcoin’s NFT.”

Binance Research report

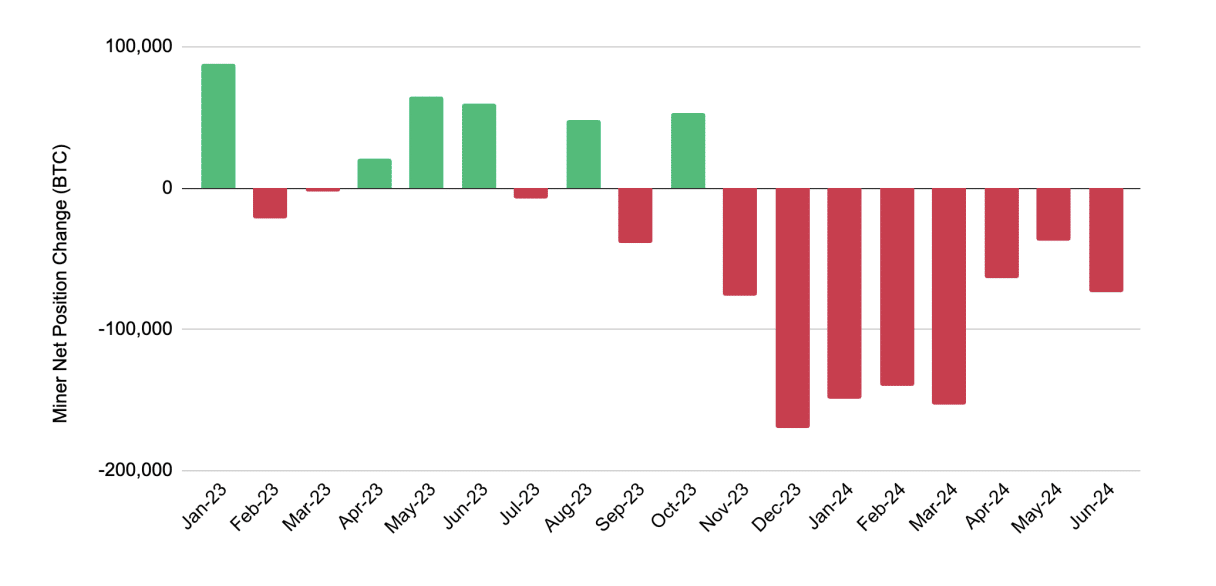

Miners are selling bitcoins

As for miners, they have been consistently selling BTC since November 2023. This is the most extended consecutive period of net sellers since 2017. As a result, BTC balances among miners reached their lowest level in the last 14 years. Analysts attribute this to halving.

“Given that the block reward represents most miners’ income, many miners have been forced to sell their holdings for survival.”

Binance Research report

What happened in the crypto market in May?

A month earlier, Binance Research revealed a report for May 2024. According to a previous analysis, the crypto market recovered in May and recorded a capitalization increase of 8.6%. At the same time, the crypto market closed in positive dynamics for the third time. Before this, negative dynamics were observed from 2021 to 2023.

In addition, all crypto assets from the top 10 in capitalization ended the month in positive territory. The leader among them was Solana (SOL), with 33.9% growth. Ethereum (ETH) is in second place, and Toncoin is in third place.

The NFT market also closed with a drawdown. Total sales were $0.63 billion, down 41% from April 2024.

What to expect in July

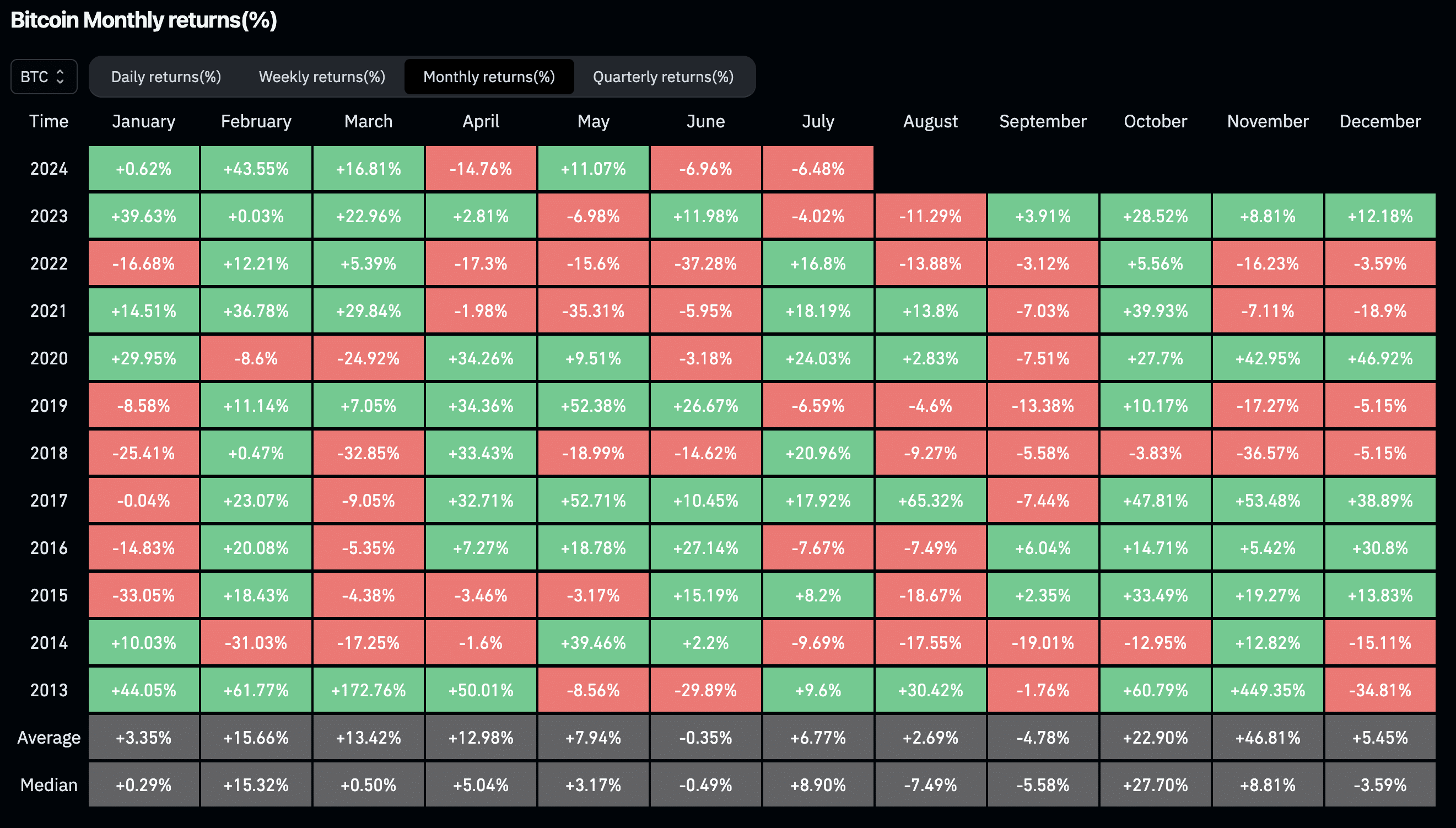

Bitcoin ended June down 7%. This is the second month in 2024 that BTC ended with a decline in value. In April, losses amounted to almost 15%; in other months, BTC showed growth with dynamics from 1% to 44%.

According to historical data from Coinglass, the crypto market typically shows growth in July, with an average growth rate of 7.3%. The analysis since 2013 showed seven successful months with growth of up to 24%, while only five months were unprofitable with a decline of at least 10%.

Two significant events are planned for the second month of summer, which are being followed by the entire crypto market — payments of cryptocurrency to clients of Mt. Gox, which they have been waiting for ten years, is the event that causes unrest in the community due to the possible impact of sales on the price.

The crypto community is also anticipating the possible launch of spot Ethereum ETFs. Their approval could become a strong driver for growth in the crypto market. On July 8, several companies issuing spot Ethereum-ETFs sent updated applications on Form S-1 to the SEC.