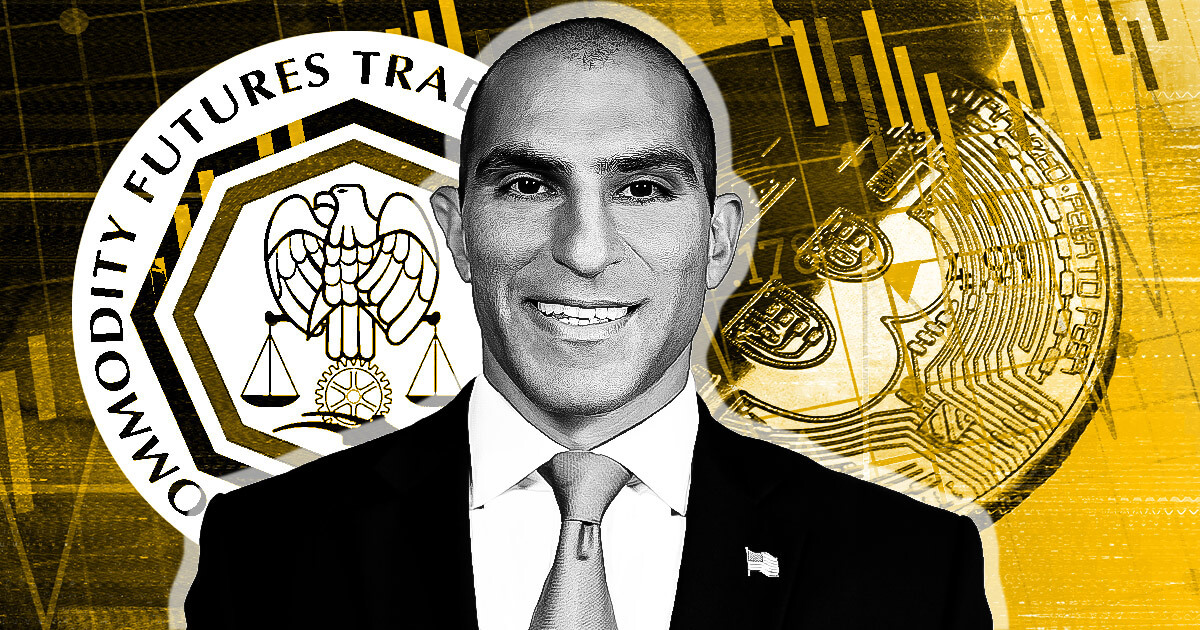

CFTC chair Rostin Behnam said the agency is open to serving as a primary regulator for crypto during a Senate Agriculture Committee hearing on digital commodities oversight.

The hearing, held on July 10, broadly concerned the CFTC’s request for more regulatory authority.

Senator Roger Marshall asked Behnam whether it would be “simpler” to make the CFTC a primary regulator for digital assets while leaving a small number of “offshoots” for the SEC to handle.

Behnam responded:

“I speak for myself, [we] would be happy to do that. I think we have the capacity to do that the expertise and the experience.”

However, Behnam said changes to definitions of securities and commodities would be necessary if the CFTC assumes primary authority.

Cooperation with SEC valuable

Earlier, Marshall asked Behnam whether he supports the SEC having the ability to decide which assets fall under the CFTC’s jurisdiction.

Behnam said he does not support the SEC making such decisions alone but added that the two agencies have worked together to define assets in grey areas for about 50 years.

Marshall also asked whether the CFTC is concerned it may face lawsuits over conflicting asset designations. Behnam said he “can’t say that it’s not going to happen,” but cooperation between the SEC and CFTC will help address novel legal questions.

Behnam acknowledged Marshall’s concerns that lawmakers could enable such lawsuits but stressed the need for a contract listing system that matches the CFTC’s existing powers and allows cooperation with the SEC. Behnam said:

“I think there’s a way to build a system of listing contracts that doesn’t prolong or delay the listing of contracts in a regulated market.”

Behnam said the CFTC wants to introduce tokens and contracts to regulated markets “as soon as possible” to reduce or eliminate investor risks.

Most

Behnam believes that a significant portion of the crypto market should fall under the CFTC’s purview as it cannot be classified as securities. During the hearing, Behnam said that more than 70% to 80% of the crypto market does not fall under the category of securities, leaving the area with no direct federal oversight.

He said the CFTC needs at least $30 million in the first year and at least $50 in the second year to establish a regulatory regime. The funding would go toward staffing, administration, and IT spending. User fees submitted by registrants would offset requested funds.

Behnam also affirmed Senator Cory Booker’s concerns around urgency, stating that if the CFTC does not gain authority, fraud and manipulation will continue to impact individuals across the US.