Crypto Speculation Index Slide Suggests Bitcoin Bull Market Reset

07/11/2024 20:19

Key gauge shows that the speculative forth prevalent during the first quarter has dissipated.

Key gauge shows that the speculative forth prevalent during the first quarter has dissipated.

Speculative washouts mean a healthier market and a potential for a renewed uptick in bitcoin.

Bull markets are observed to stall during periods of excessive optimism, only to resume after the speculative froth has been cleared.

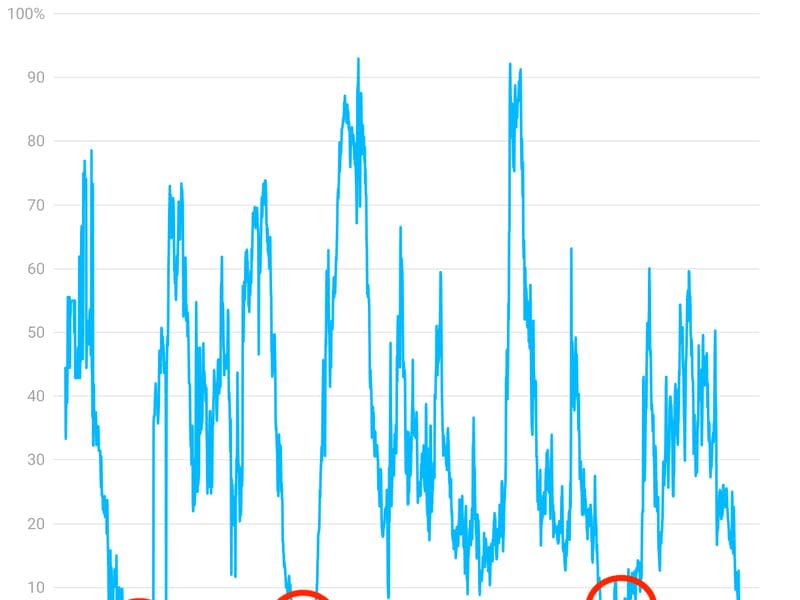

Capriole Investment's crypto speculation index shows that the speculative excesses prevalent during the first quarter have dissipated, indicating a potential for a renewed bullish price action in bitcoin {{BTC}}, the leading cryptocurrency by market value.

The speculation index, which measures the percentage of alternative cryptocurrencies (altcoins) with 90-day returns greater than bitcoin, has stabilized below 10%, down significantly from the January high of nearly 60%. Bitcoin, the leading cryptocurrency by market, hit new record highs above $70,000 in the first quarter and has since cooled to $58,000.

As of this writing, more than 14,800 altcoins exist, according to data source Coingecko. Most of these coins are illiquid and struggle to prove their use cases. Hence, altcoins are generally seen as speculative instruments, with volumes closely tied to Google Trends, an indicator of retail investor interest, and altcoin outperformance relative to BTC is seen as a sign of speculative mania.

Speculative washouts serve as corrective mechanisms, helping realign asset prices with fundamentals and tempering excessive speculation. Thus, they set the stage for a healthier environment in the long run.

That has been the case in the crypto market. Since 2019, a below-10% speculation index has coincided with the beginnings of sharp bitcoin rallies, as observed in the first half of 2019, late 2020, and the second half of 2023.