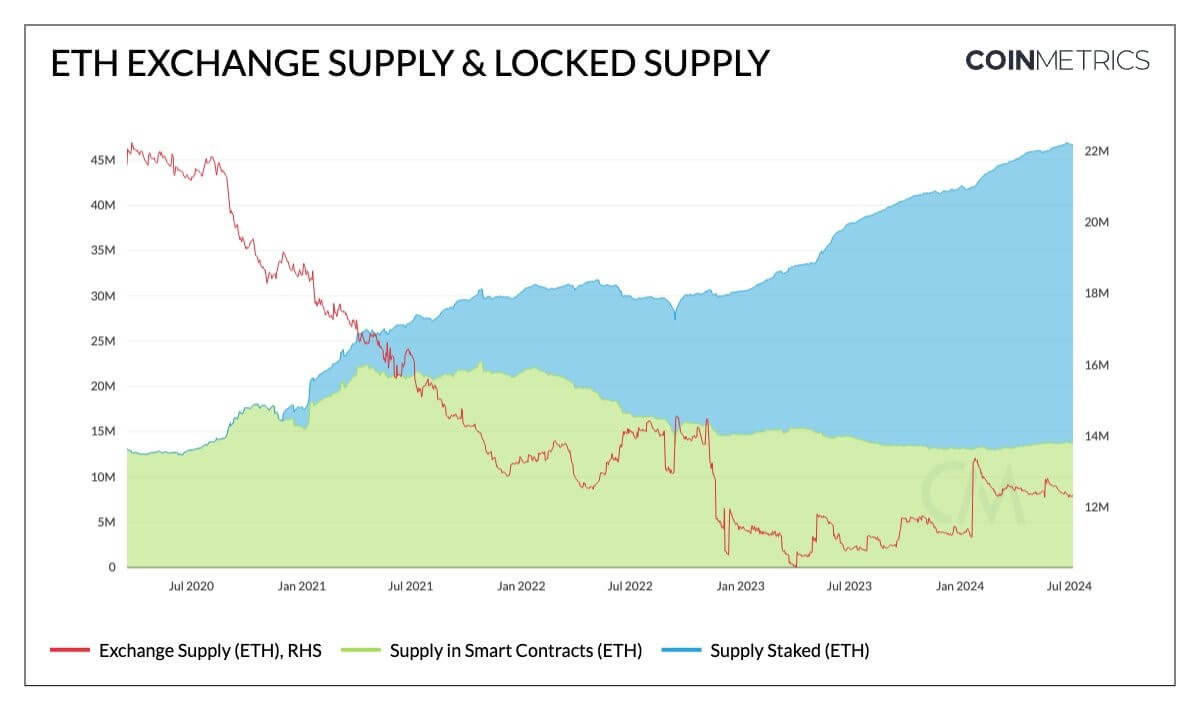

Approximately 40% of Ethereum supply is locked as the market anticipates the final approval for ETH spot-based exchange-traded funds (ETFs).

A breakdown of this “locked supply” shows that over 33 million ETH is staked on the network, representing around 28% of Ethereum’s total supply, according to Dune Analytics data.

Proof-of-stake networks like Ethereum require users to “lock up” their digital assets to support its security and operations, and in return, they earn rewards.

Additionally, 12% of the supply is locked in smart contracts and bridges, which are seeing high adoption lately. For example, A.J. Warner, Chief Strategy Officer at Offchain Labs, noted that ETH in the Arbitrum One bridge has consistently increased over the past three years.

Market observers believe this substantial ETH lockup and the impending ETF approval will boost ETH prices. Tom Dunleavy, Managing Partner at MV Capital, pointed out that the approval of spot Ether ETFs will significantly impact the market. He stated:

“The spot ETH ETF flows are going to rapidly move this market.”

ETF approval

Meanwhile, anticipation continues to grow surrounding the final approvals for a spot Ethereum ETF in the United States.

On July 9, Bitwise’s Chief Commercial Officer, Katherine Dowling, said the ETFs are nearing approval, pointing out that the Securities and Exchange Commission (SEC) was addressing only a few remaining issues.

Dowling suggested the products might be approved over the summer, a sentiment echoed by Bloomberg ETF analyst James Seyffart.

Seyffart speculated that approval could come by the end of the month despite his low confidence in exact launch date predictions. He said:

“I have fairly low confidence in those launch date predictions at this point. There’s no deadline & SEC’s Corp Fin is taking its time here (I don’t blame them). But these changes were very minimal and [i don’t know] why the ETFs wouldn’t be ready to go within a couple of weeks.”

Meanwhile, crypto bettors on Polymarket expect the products to launch before the end of the month, with an 87% chance of being listed for trading by July 26.