TIA surges 42% in a week: Here’s why another 231% rally could be next

07/12/2024 00:00

TIA has surged by 41.72% in 7 days and 2.52% in 24 hrs. The recent surge has left traders eyeing 231% rally.

- TIA has surged by 41.72% in the last seven days and 2.52% in 24 hours.

- The surge has left traders eyeing a 231% rally

After a month-long decline, Celestia [TIA] has been soaring. Tia has recorded a 41.72% surge in the last seven days. However, the trading volume has declined by 46.10% during the previous 24 hours.

According to Coinmarketcap, TIA’s market cap has increased by 2.21% in 24 hours to $1.3 billion.

The recent surge has captured market attention, with crypto analysts betting big on TIA’s bull run while others show skepticism, arguing it’s short-lived. For instance, Decilizer shared his doubt, noting that,

“$TIA is not looking good in the current market conditions, approaching the next 5$ support amidst ongoing bearish trends. Expect a reversal shortly, with Celestia all set to lead alongside $PYTH in the upcoming cycle’s bull rally. Previously, we’ve seen a 720% profit rise on it”.

According to these analysts, the recent gains are small and cannot cover losses experienced over a long bearish trend. However, known crypto analyst Noodles believes TIA is set for a rally.

He argues that, the current surge will push prices by 231%, reaching $24. Another analyst believes Celestia will continue to grow as molecular blockchain continues to experience innovation.

Prevailing market

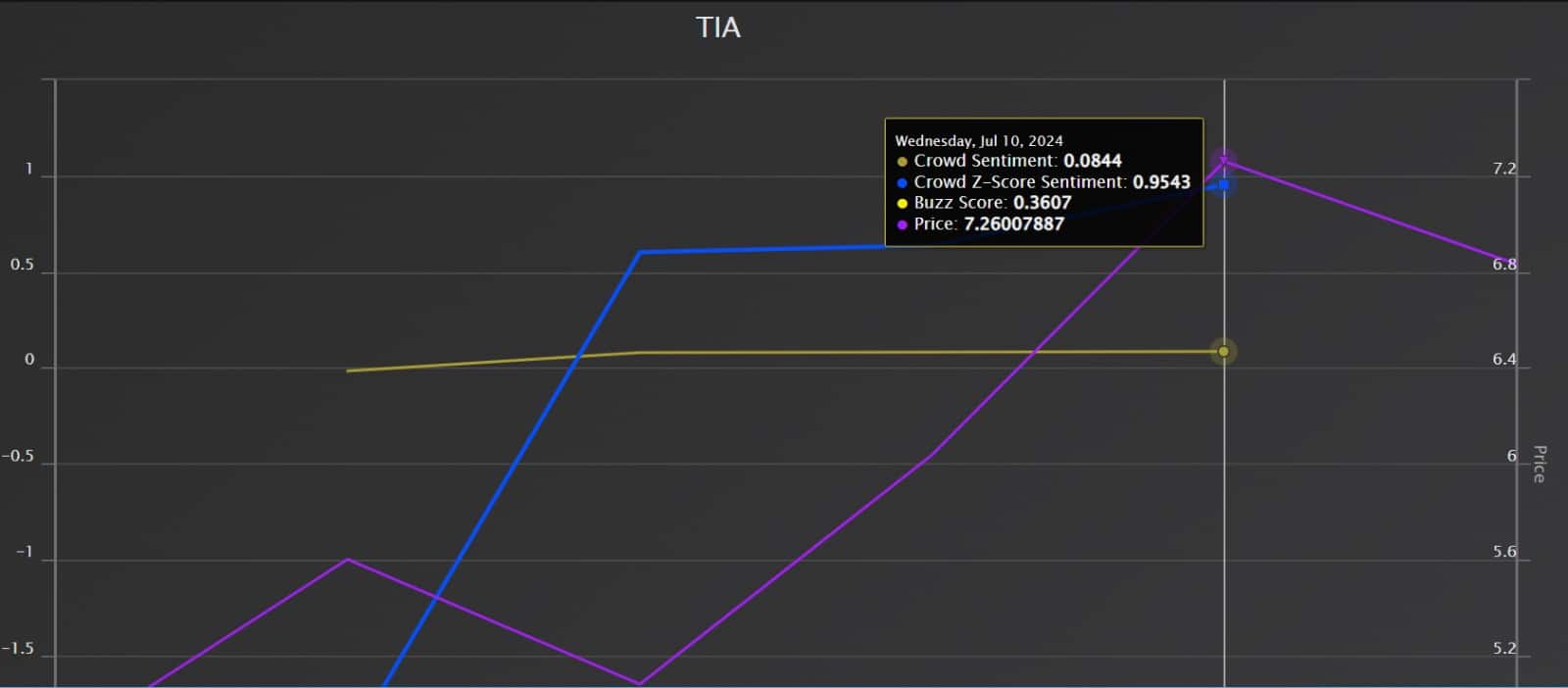

According to AMBCrypto’s analysis, TIA’s current market sentiment is largely positive. Based on market prophit’s data on sentiment, the crowd sentiment was 0.0844, while the crowd buzz score was 0.3607.

Also, the crowd z sentiment was 0.9543. Thus, this data suggests the market is very optimistic about Celestia’s future.

TIA price charts indicate…

Notably, AMBCrypto’s analysis indicates TIA market is acting bullish. The Aroon up line at 92.86% sits above the Aroon down line at 57.14. This indicates the recent market highs are more frequent than lows.

Thus, the market was experiencing upward momentum, a bullish signal.

Further, TIA reported an RSI of 53 and a based MA of 37.14. The RSI has been rising for the last 7 days, which indicates that the gains surpass the losses. This is growing bullish momentum, especially having outpaced RSI-based MA with 16.

Equally, the Chaikin money flow (CMF) was positive at 0.08. A positive CMF suggests the market is experiencing higher buying pressure. Thus, the demand is higher than the supply, which leads to a price surge.

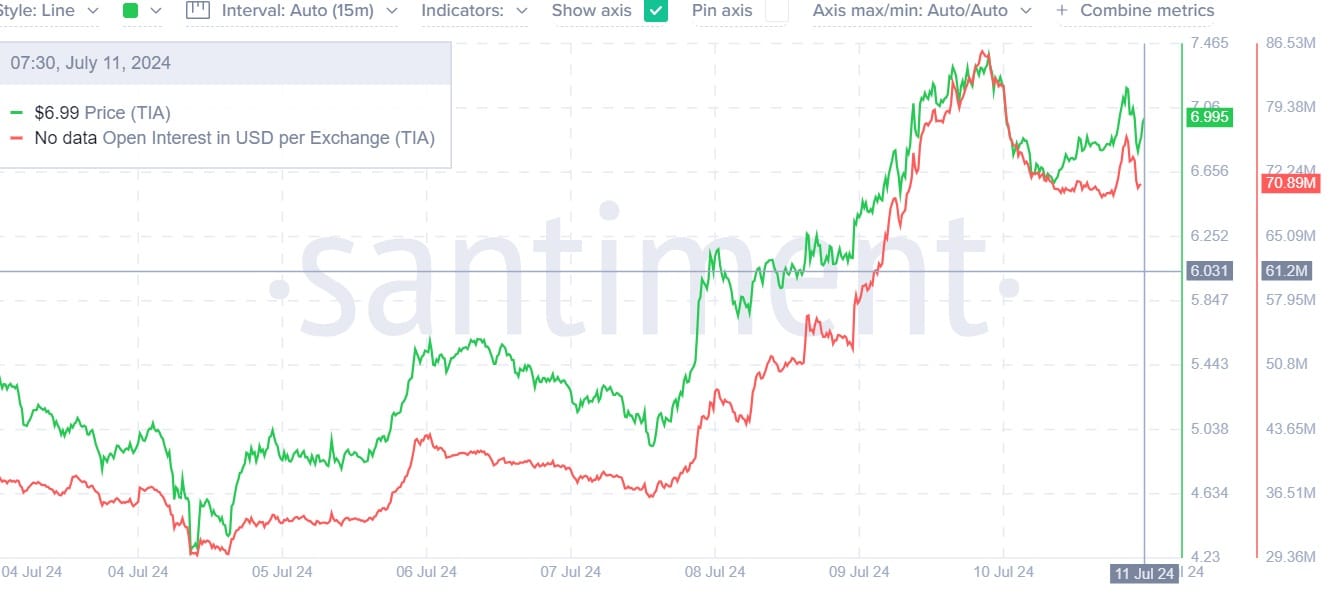

Looking further, analysis of Santiment data shows open interest per exchange has been rising for the last seven days.

Tia’s open interest per exchange has risen from a low of $29.36 million to a higher of $85.69 million. As of this writing, Open interest per exchange is at $70.89% despite losses on daily charts.

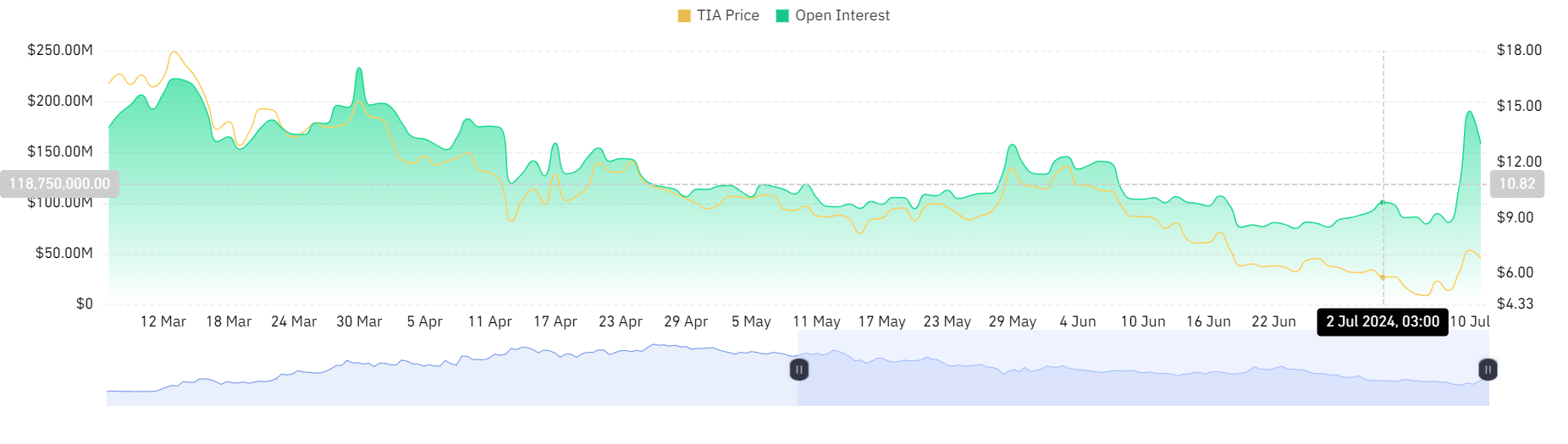

Finally, according to Coinglass, open interest has risen from $80.80 million on the 8th to $190.43 million. With the rise in open interest, investors are opening new positions while holding the existing ones.

This shows confidence in the altcoin’s direction and future potential.

Is your portfolio green? Check out the TIA Profit Calculator

Can Celestia surge to $24?

As of this writing, TIA is trading at $7.64 after a 2.52% surge in 24 hrs. With the upward momentum, if the bullish breakout holds, Tia will reach the resistance level of around $8.367 in the short term.

Equally, in a bullish short-term scenario, the prices will hit $11.4. Consequently, if the market experiences correction, the prices will decline by $6.069.