No enforcement against Binance USD [BUSD]: SEC’s decision, unpacked

07/13/2024 00:00![No enforcement against Binance USD [BUSD]: SEC’s decision, unpacked](https://ambcrypto.com/wp-content/uploads/2024/07/BUSD-1-1000x600.webp)

The Binance USD has gotten what looks like regulatory clarity, according to the recent letter that was sent to Paxos.

- BUSD might be off the hook with recent developments.

- The SEC has paused enforcement against its issuer, recently.

In a recent announcement from Paxos, it was revealed that the U.S. Securities and Exchange Commission (SEC) has concluded its investigations into Binance USD [BUSD] without taking any further action.

However, while this resolution removes a major hurdle, the broader impact on BUSD remains to be seen as the market absorbs and reacts to this news.

SEC makes a U-turn on Binance USD

On the 11th of July, Paxos announced that it had received formal notification from the U.S. Securities and Exchange Commission (SEC).

The notification indicated that the agency would not recommend any enforcement action against the company regarding its issuance of Binance USD.

This decision came more than a year after Paxos received a Wells notice from the SEC, which initially directed the company to cease issuing the stablecoin from Binance.

How the SEC’s move impacted BUSD

This regulatory scrutiny had significantly impacted BUSD, which at the time was the third-largest stablecoin by market cap, valued at over $16 billion.

The SEC’s previous action had led to a substantial decrease in BUSD’s market cap, reflecting the market’s reaction to regulatory interventions.

The recent decision by the SEC marks a pivotal turn in the saga, but it is left to be seen if it could potentially stabilise the position of BUSD in the market.

The current state of the Binance USD

The recent notification from the U.S. Securities and Exchange Commission (SEC) clarifies that Binance USD is not considered a security.

This, at least for now, provides a measure of regulatory clarity for the stablecoin.

However, despite this positive development, the impact may be somewhat muted due to the significant decline in BUSD’s market presence.

According to data from CoinMarketCap, BUSD is no longer among the top 50 stablecoins. As of this writing, its market cap has dramatically reduced to approximately $69.5 million.

This decline in prominence and value can be traced back to actions taken in November 2023, when Binance announced it would delist the stablecoin and unpair it from other notable cryptocurrencies.

These moves significantly reduced BUSD’s demand and trading volume, adversely affecting its market position.

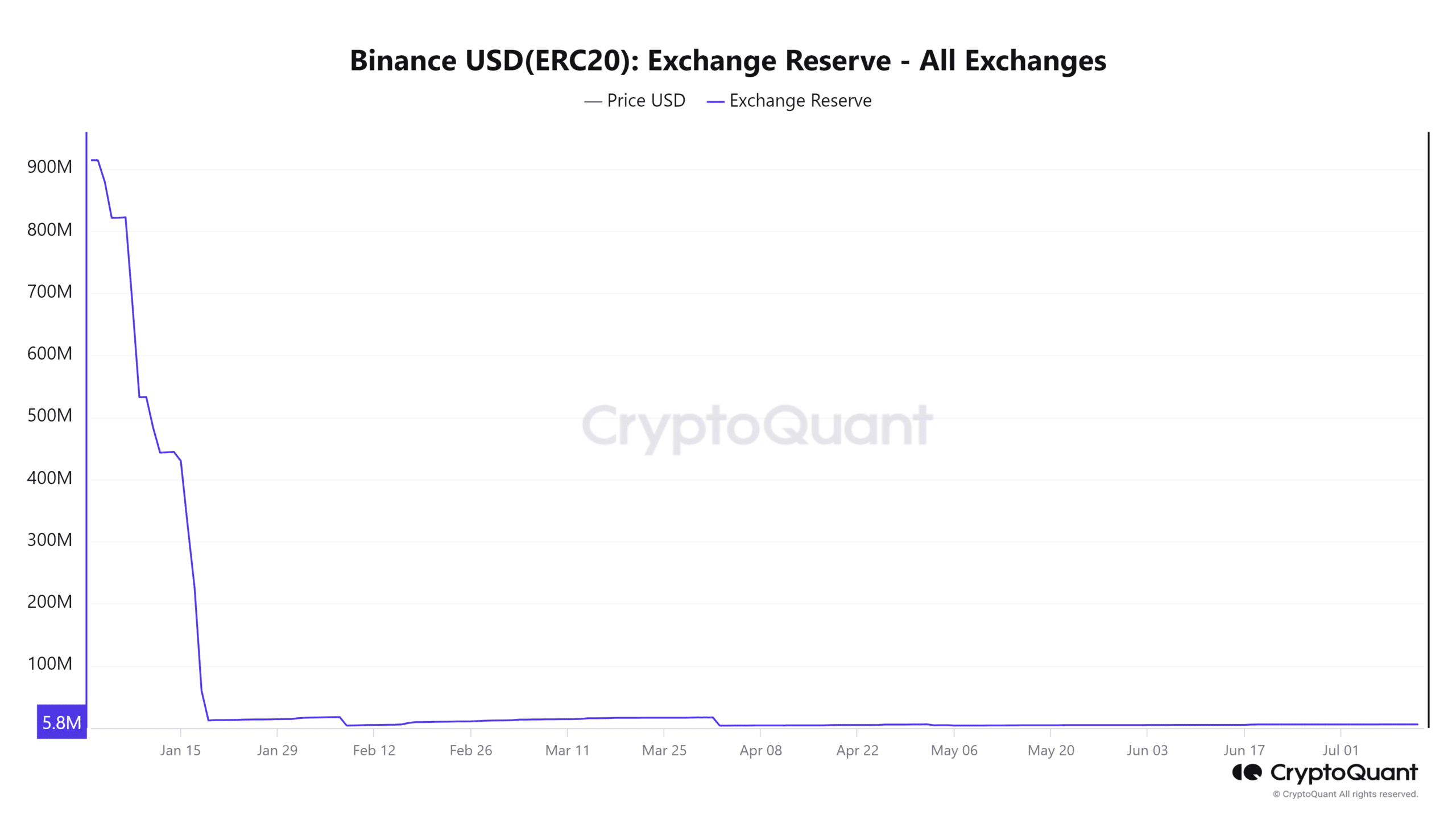

Exchange reserve remains flat

The exchange reserve levels for Binance USD (BUSD) have shown little to no variation over recent months. Also, the latest regulatory updates have yet to have a perceptible impact on this trend.

As of this writing, the exchange reserve for BUSD was approximately $5.8 million, a stark reduction from earlier in the year when it was over $900 million.

Trading volumes for BUSD remained low, with press time levels around $8 million. AMBCrypto’s analysis of recent trading activity indicated that there has been no significant change in volume over the last 24 hours.