Notcoin slips below $0.0156: A bearish sign for NOT’s price?

07/13/2024 08:00

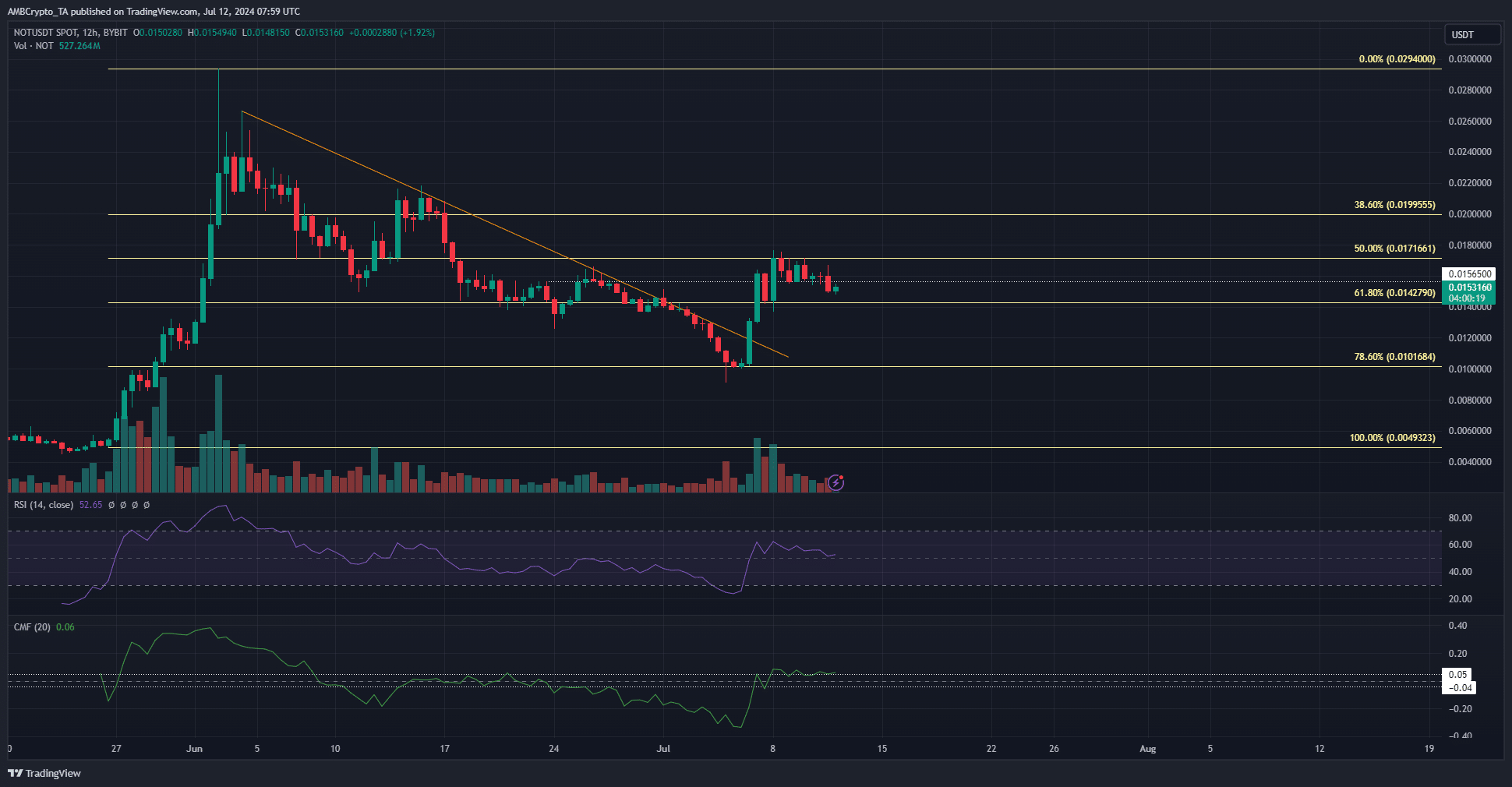

Notcoin has a bullish bias after breaking a trendline resistance and its bearish market structure, but market participants were not confident

- NOT breached the trendline resistance, resulting in a bullish market structure.

- The drop below $0.015 might continue if the buying pressure does not increase.

Notcoin [NOT] was successfully reversing its bearish fortunes recently, as bulls were dominant. But the momentum stalled over the past week, and the price did not reach the positive forecasts laid out for it.

The dwindling trading volume was a concern as it signaled ambivalence from market participants. Will the token continue to register gains, or was the rally just a brief respite during the downtrend?

NOT falls below $0.0156- is it beginning to slip once more?

After breaking the trendline resistance (orange) it was expected that NOT would continue higher and hold on to the $0.0156 level as support.

This level had been a stubborn resistance toward the end of June, but the bulls were not able to capture it wholly.

This might be because of the rapid pace of the recovery from the 78.6% Fibonacci level.

The bounce left a sizeable fair value gap, and the built-up liquidity around the $0.01-$0.012 region might pull prices down to it before a move higher.

The CMF was at +0.06 to signal buyer dominance, but the RSI reading of 52 was only slightly bullish.

Sentiment remained muted despite the structure break

The Open Interest jumped alongside the prices a week ago but has indicated bearish sentiment during the past few days. This was accompanied by a persistent downtrend in the spot CVD.

Is your portfolio green? Check out the NOT Profit Calculator

The long liquidations on the 11th of July when prices crept below $0.015 showed that this move downward was indeed searching for liquidations.

However, the evidence does not support a renewed bullish effort in the near term.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.