Mog Coin’s 70% hike – All the reasons why its price can double soon

07/13/2024 12:00

Mog Coin has a firmly bullish outlook from its momentum and volume indicators, but the high profits for holders might trigger a sell-off...

- Mog Coin maintained its bullish market structure even after the market-wide price crash last week

- Fibonacci extension levels underlined the possibility of another 55% and 91% move north

Mog Coin [MOG] was quick to recover from last week’s losses. The memecoin maintained its bullish price structure and gained by 71% in just over six days. However, it later fell, losing 15% of its value in the last 24 hours.

At press time, the memecoin was ranked 99th on CoinMarketCap and only had a market capitalization of $583 million. These figures are relatively small though so, some volatility is not uncommon.

Fibonacci levels laid out the next move for Mog Coin

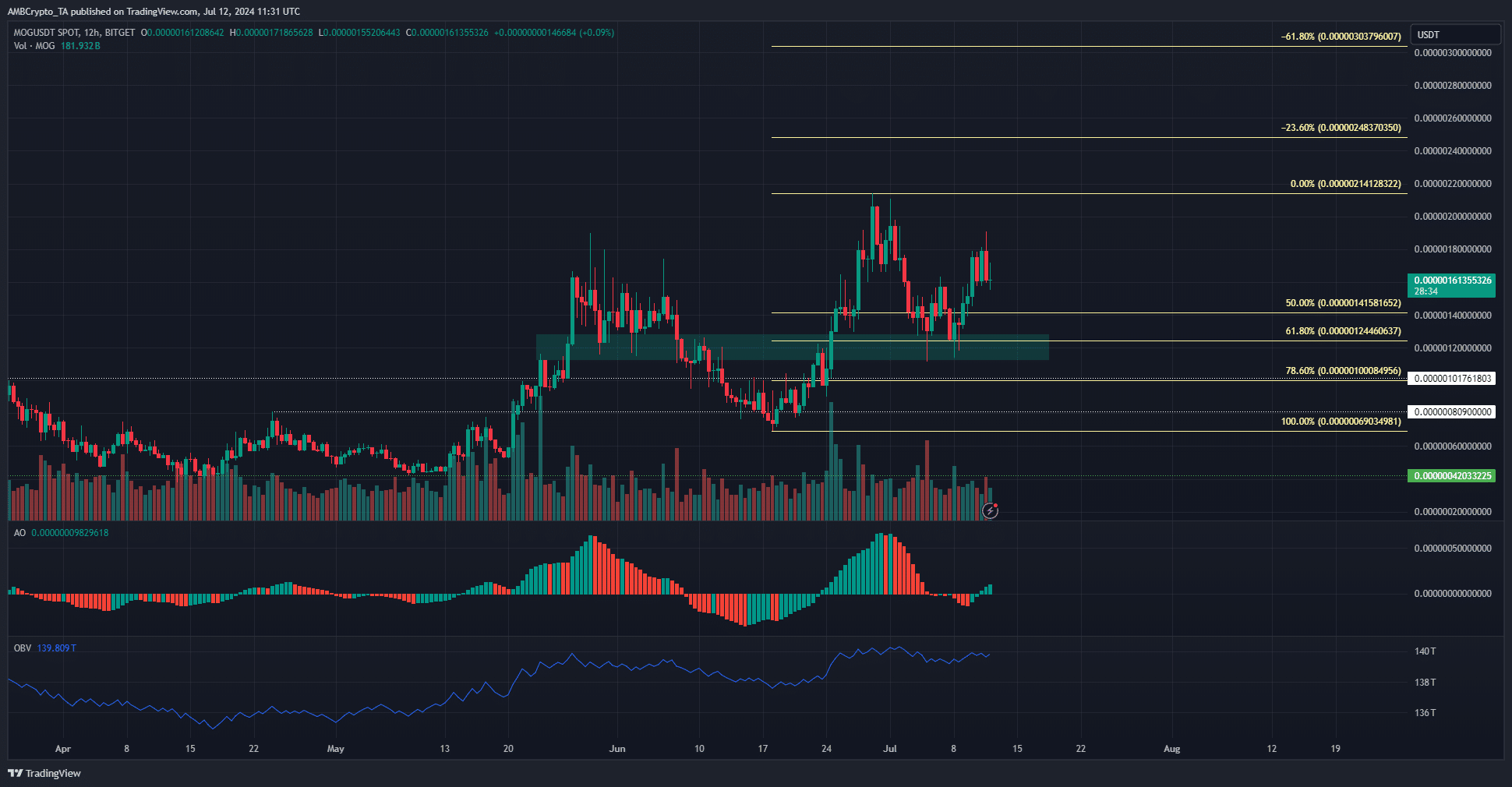

Based on the mid-June rally, a set of Fibonacci retracement and extension levels (pale yellow) were plotted. The defense of the $0.00000124 region (green) was a strong bullish sign. The buyers were able to reclaim an early June support level, which coincided with the 61.8% retracement.

The OBV has trended upwards consistently since May, reflecting steady buying pressure behind the memecoin. The Awesome Oscillator crossed over above neutral zero to indicate bullish momentum.

The $0.00000165-$0.00000175 zone has posed a hurdle to the buyers over the past two days, but MOG bulls would likely convert it into a support zone soon.

Increased network activity and holders sitting pretty

The network growth metric spiked on 7 July, showing 760 new addresses created on that day. A consistent uptrend in this metric would be a sign of increasing adoption and growth. Meanwhile, the 90-day MVRV had a reading of 41.87%.

Read Mog Coin’s [MOG] Price Prediction 2024-25

This showed that a good portion of the holders were in profit. MOG hit its all-time on 1 July, which explains their profits and also the bullish sentiment behind the token. It could also trigger a wave of selling from profit-taking activities, which traders must beware of.

Worth pointing out though that at press time, the mean dollar invested age was slowly rising – A sign of long-term holding.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.