Trader’s Binance sell-off triggers BLUR’s 7% price decline – All the details

07/13/2024 13:00

BLUR token witnessed a 7% drop in its value following the actions of prominent trader - Machi Big Brother. The trader transferred all...

- Machi Big Brother’s massive BLUR transfer to Binance caused a sharp 7% price decline

- Blur’s active addresses surged and peaked at over 16,000 in late June, before dropping

BLUR token witnessed a 7% drop in its value following the actions of prominent trader – Machi Big Brother. The trader transferred all his tokens to Binance, prompting concerns among investors about a potential large-scale sell-off.

Major sell-off by Machi Big Brother

Spot On Chain reported that Machi Big Brother deposited 18.4 million tokens, worth approximately $3.13 million, into Binance. This move was perceived as a sign of impending sales by many, leading to a 7% drop in the crypto’s price over the last 24 hours. The average price of the tokens sold was $0.170 per token.

Machi Big Brother (@machibigbrother) has allegedly dumped all $BLUR at a $3.16M loss!

In the past 24 hours, he deposited all 18.4M $BLUR ($3.13M) to #Binance, causing the price to drop after each deposit!

Note that his other notable holdings are not doing well either!… pic.twitter.com/fF8jH81jT4

— Spot On Chain (@spotonchain) July 12, 2024

The large transaction by Machi Big Brother has raised concerns about the influence of significant traders on token markets. Investors are wary of further declines, reflecting a cautious sentiment in the community.

The transaction also shed light on Machi Big Brother’s other holdings, which are also experiencing losses. He holds 275 million Blast tokens, with an estimated loss of $1.5 million, and 8.8 million Friend tokens, with an estimated loss of $13.8 million.

At the time of writing, BLUR was trading at $0.162 with a 24-hour trading volume of $48,717,611. Despite the recent decline, however, BLUR has registered a 9.38% price hike over the past seven days. The market remains volatile, influenced by the activities of large traders and market sentiment.

Active addresses and whale transactions

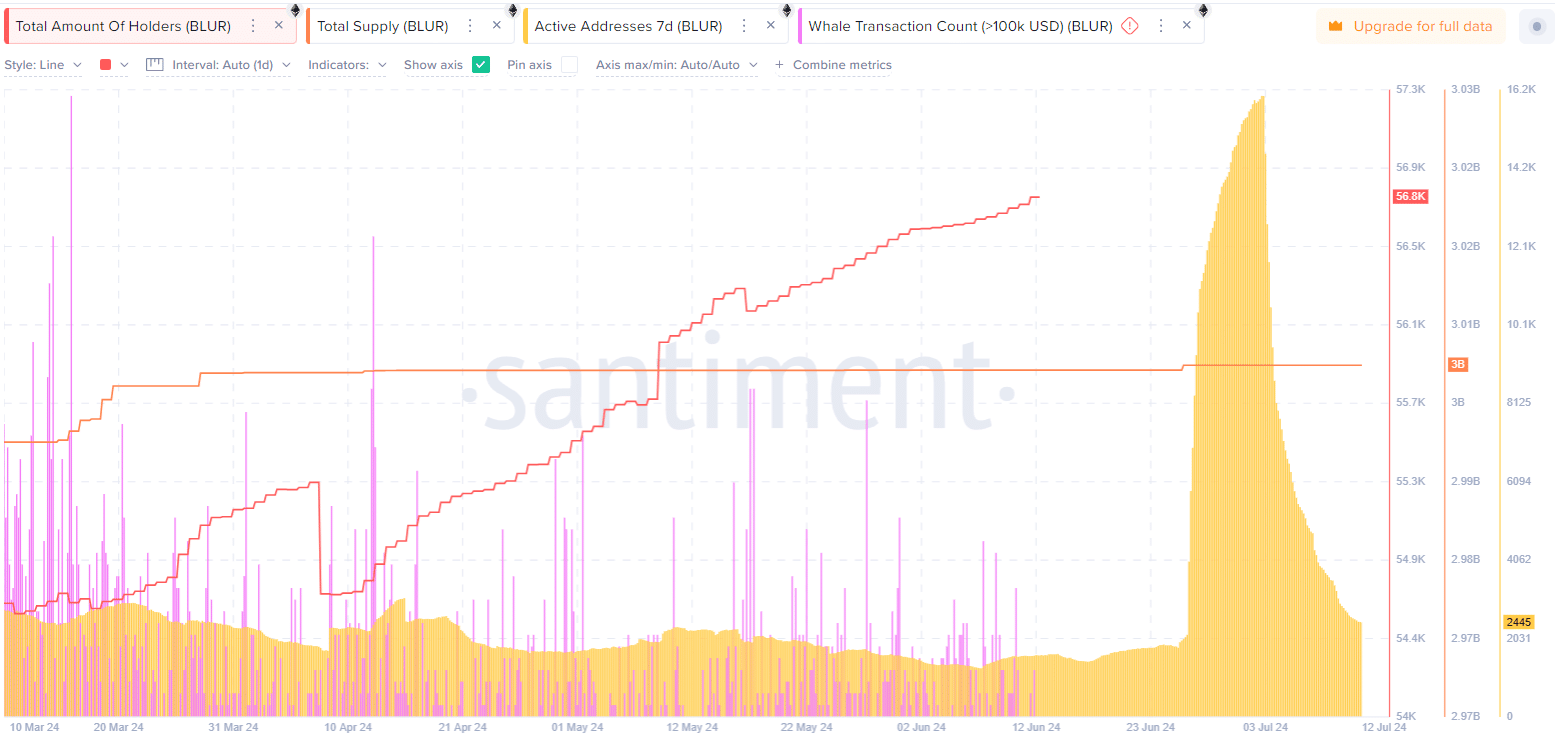

In fact, data from Santiment revealed a surge in active BLUR addresses starting in late June, peaking at over 16,000 addresses. However, it soon dropped to 2,445 by mid-July.

Whale transactions flashed intermittent spikes, particularly around mid-March and late May. This is usually a sign of short-term interest or specific events driving usage.

The total number of BLUR holders has steadily increased too, reaching 56,800 by mid-July.

Finally, despite the price fluctuations, the total supply of BLUR has remained constant at 3 billion since mid-March. This is a sign of growing interest and adoption among users, without inflationary changes in the token’s supply.